Author: Guotai Junan social service team

Capital markets are voting with their feet to respond to the pneumonia epidemic.

From January 20 to 21, the A-share catering and tourism sector fell sharply for two consecutive days, falling more than 6%, making it one of the worst performing sectors in the two cities. And the airport and aviation sectors related to travel are also in the doldrums, and the market is expecting an unprecedented crisis in the tourism industry.

But at the same time, past experience tells us that pandemics are emergencies. Although they will have an impact on market sentiment in the short term, they will not change the investment logic of the capital market in the long run.

The key is, for the first to bear the brunt of the tourism industry, how big the impact will be?

The major epidemic has a wide impact on the tourism industry, and the impact on performance and stock prices lasts about one year.It is suggested to focus on the relevant targets with "home" as the core demand, and industries such as takeout and online education to replace or benefit from social and clustering needs. In the long run, we should maintain optimism and confidence in China's public health level and infectious disease control ability. under the influence of short-term emotions, we suggest to pay attention to the long-term layout opportunities brought about by the overfall of the leader, and recommend the target:Meituan comments-W (03690.HK) $.

Review of SARS epidemic situationYesThe real impact of tourism

Of all the tourism crisis events, infectious diseases have the greatest impact on the industry.

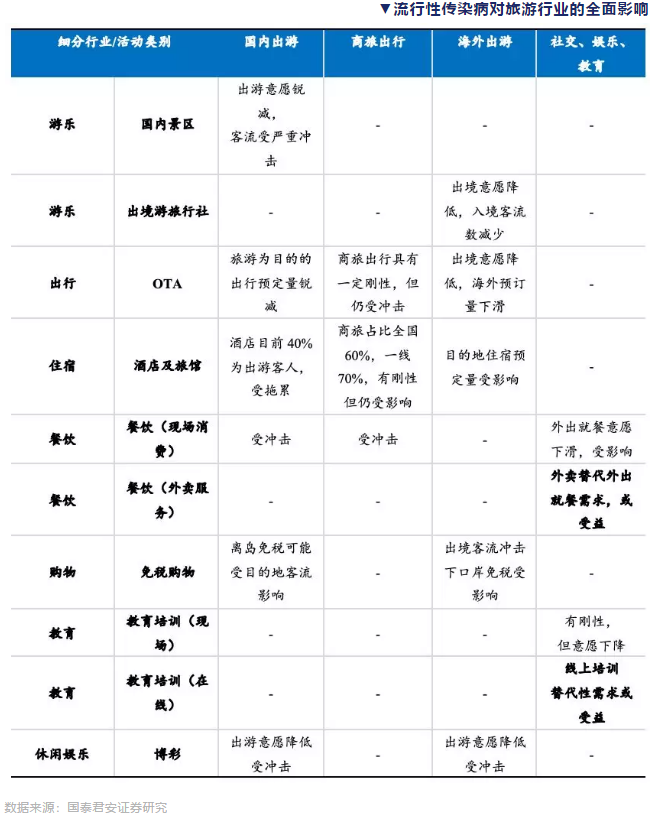

① tourism is an environmentally sensitive industry. Infectious diseases impact all social and crowd-gathering activities. The SARS epidemic in 2003 has an impact on all segments of the plate.

② domestic Tour and Scenic spot: in 2003, the growth rate of domestic tourist flow dropped sharply from 13pct to-0.9% compared with the same period last year, while the growth rate of travel agency operating income decreased by 28pct, and people's fear could surpass the tourist flow in areas where the epidemic affected few cases.

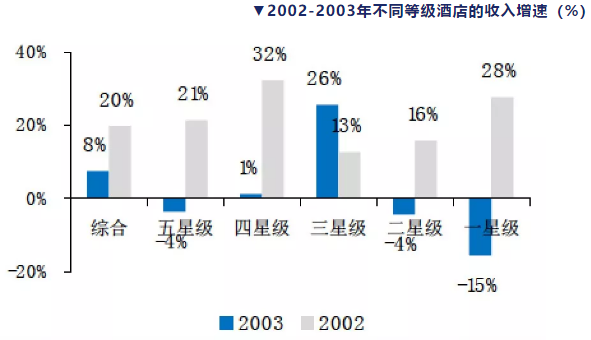

③ hotel and accommodation industry: during the SARS period, the national star hotel rental rate was-4pct, the growth rate decreased 6pct compared with 2002, in which the five-star hotel decreased by as much as 10pct and the four-star hotel decreased by 5.65pct. It had a greater impact on the income of low-star hotels: the income growth rate of star-rated hotels was only 8%, with a rapid decline of 12pct, including an one-star growth rate of 43pct and a two-star decline of 20pct

Data source: China Hotel Industry Association, Guotai Junan Securities Research

Data source: China Hotel Industry Association, Guotai Junan Securities Research

④ inbound and outbound travel: frequent travel warnings, cliff decline of travel intention, and average passenger flow loss of 20%.

The impact of Infectious Diseases on TourismHow long will it take to fix it?

The influence of SARS lasted for one year, the obvious recovery lagged and the epidemic situation calmed down for 2-3 quarters, during which the supply-side passive reform.

The peak of the influence of ① SARS was from March to June 2003, and the whole process was affected for about one year. On August 18, 2003, the last case of SARS recovered and discharged from hospital.

However, after the ② epidemic subsided, people were still afraid of traveling, and the willingness to travel remained low in 2-3 quarters. Passenger flow rebounded in the second half of 2003, but there was no expected blowout growth.

One year after the ③ event window, the impact was basically eliminated, and the operating data grew high under the low base of the industry.

To some extent, the ④ epidemic has cleared out the enterprises with weak anti-risk ability: the hotel has too many high-star clear rooms, too many large-scale properties, low-star clear properties with weak anti-risk ability, and too few rooms.

The influence of Infectious Diseases on Capital Market

The impact of the epidemic on performance and stock prices went beyond the window period of the epidemic, and the stock price experienced a window of 2-3 rounds.

The willingness to travel remained low during the ① epidemic and within half a year after the end of the epidemic, which dragged down 2003Q2-Q4 's revenue performance. Scenic spots and hotels were the hardest hit areas: 2003Q2 return net profit CYTS (- 113%), Emeishan (- 72%), Guilin Tourism (- 121%), Jinjiang Hotel (- 159%), Lingnan Holdings (- 173%).

② shares have experienced three rounds of declines:

The first round of killing valuationFor SARS, from April 2003 to August 2003, the overall valuation of the sector fell from 60x to 50x, with a valuation adjustment of-17%.

Double kill in the second round of valuation-- at this stage, the epidemic has just subsided, and the willingness to travel is still generally low, and it is at the stage of China report and three quarterly reports, and the impact of the epidemic on performance in the first half of the year has landed. At this time valuation performance double kill, plate valuation fell from 50x to 35x, a decline of 30%.

Kill the valuation again in the third roundDue to the less-than-expected recovery in the tourism industry in the first half of 2004, the blowout expected by the market did not occur, and it was more a rebound from a low base, so the sustainability and stamina of the performance recovery of listed companies was not strong, leading to the third round of valuation adjustment.

From the perspective of the performance of the industry segment, the hotels and scenic spots whose performance is most affected are also reflected in the decline in stock prices. From November 2002 to December 2004, the cumulative relative income of listed companies in scenic spots was the lowest-45.18%, while that of the hotel industry was-42.10%, ranking among the top two declines. Catering (- 41.59%) and aviation (- 30.25%) were also greatly affected.

Edit / Iris