Abstract: since the discovery of pneumonia cases infected by novel coronavirus, a total of 198 cases have been reported in Wuhan. At present, some cases or suspected cases have been found in Beijing, Guangdong, Zhejiang and other places, and several cases have been found outside China.

We reviewed China's economic performance before and after SARS in 2003: the impact of SARS on the economy in 2003 was mainly concentrated in the second quarter, and passenger transport, tourism, accommodation, catering, retail and other industries were greatly affected in the short term. the impact on investment and foreign trade is not obvious; the emergence of SARS did not interrupt the upward trend of the economy at that time. The macro policy tilted to the industries greatly affected by SARS, and maintained an expansionary macro policy environment, and the faster rate of monetary expansion at that time was not adjusted until the upward trend of economic growth fully recovered at the end of the third quarter. Looking forward, the development of this new epidemic is uncertain and needs to be closely monitored.

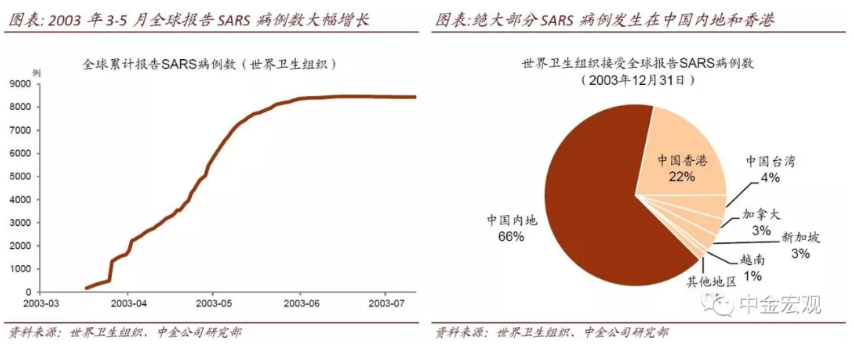

During the SARS period in 2003, more than 8000 cases of severe acute respiratory syndrome (SARS) were reported worldwide, with the vast majority of cases occurring in mainland China and Hong Kong.On November 16, 2002, the first known case of SARS occurred in Foshan, Guangdong. Since February 2003, more cases have been found around the world. On March 12, the World Health Organization issued a global alert for cases of atypical pneumonia. From March to May 2003, the number of SARS cases reported worldwide increased significantly, and the epidemic was gradually brought under control after June. By the end of 2003, 8096 SARS cases had been reported worldwide, including 5327 cases in mainland China and 1755 cases in Hong Kong, China.

China's economy was most affected by SARS in the second quarter of 2003, but SARS did not change the upward trend at that time.The GDP growth rate in the four quarters of 2003 was 11.1%, 9.1%, 10% and 10% respectively. The GDP growth rate in the second quarter was 1.5 percentage points lower than the average growth rate in the previous two quarters.

► SARS did not change the upward trend of China's economy at that time.From 2001 to 2005, China's real GDP grew by 8.3%, 9.1%, 10%, 10.1% and 11.4% respectively, accelerating year by year.

► Because of its small economy, Hong Kong is more affected by SARS.. Hong Kong's GDP fell 0.6% in the second quarter of 2003 compared with the same period last year, 4.5 percentage points lower than the average growth rate in the previous two quarters.

► Transportation, accommodation, catering, tourism and other industries have been greatly affected.In the second quarter of 2003, the added value of transportation, warehousing and postal services increased by 2.3% year-on-year, 5.4 percentage points lower than the average growth rate of the previous two quarters, while the accommodation and catering industry grew 7.4% year-on-year, 6.6 percentage points lower than the average growth rate of the previous two quarters. In May 2003, the number of inbound tourists in mainland China fell 31% from the same period last year, foreign exchange earnings from tourism dropped 59% from the same period last year, and domestic passenger traffic dropped 42% from the same period last year. In May 2003, the growth rate of retail sales of consumer goods slowed to 3.6% compared with the same period last year, significantly lower than the 9.1% growth rate for the whole year.

► Industrial production is less affected, and there is no obvious fluctuation in the growth rate of investment and import and export.Industrial production increased by 14.9% and 13.7% in April and May 2003 compared with the same period last year, down from 16.9% in March and June. The growth rate of import and export and fixed asset investment itself fluctuated greatly, and there was no significant decline around May 2003.

In 2003, the macro policy was tilted to the industries greatly affected by SARS, and remained loose as a whole.

► Fiscal policy has reduced some taxes and fees for industries seriously affected by the SARS epidemic.From May 1, 2003, income from civil aviation passenger transport, tourism and railway passenger transport will be exempted from business tax, urban maintenance and construction tax and additional education fees; some government funds will be waived or waived for catering, hotel, tourism, entertainment, civil aviation, road passenger transport, waterway passenger transport, taxi and other industries.[7][8][9]. The growth rate of fiscal revenue slowed down in the second half of 2003.

► The credit policy is appropriately skewed towards the industries and regions that are greatly affected by the SARS epidemic.In May 2003, the central bank issued an opinion.[10]It is required to effectively guarantee the reasonable supply of credit funds needed for the prevention and treatment of atypical pneumonia, and to implement appropriate credit tilts for industries and regions that are greatly affected by the epidemic of atypical pneumonia. but at the same time, it is also proposed to maintain a moderate growth of the total amount of money and credit to prevent substantial fluctuations in money and credit.

► Monetary expansion maintained a relatively rapid pace, and the central bank did not raise the reserve ratio until the economic rise was reconfirmed.In 2003, domestic money and credit grew rapidly. In the first half of the year, M2 increased by 20.8% over the same period last year, and loans increased by 23.1% over the same period last year. In 2003, the real estate market overheated to a certain extent. in the first half of the year, the sales area of commercial housing increased by 38% compared with the same period last year, and sales increased by 45% over the same period last year. At the same time, foreign exchange funds continued to flow in. When the overheating trend was reconfirmed at the end of the third quarter, the central bank raised the reserve requirement ratio from 6% to 7% on September 21st.

The emergence of novel coronavirus's pneumonia epidemic may increase the uncertainty of domestic economy and policy.After the experience of fighting against SARS in 2003, the Chinese government has further improved its ability to prevent, control and manage epidemic diseases. After years of development, information technology is conducive to disease prevention, control and management, but a significant increase in transport capacity may increase the speed of the spread of epidemic diseases. We believe that if the new epidemic can be brought under control in the short term, it will not have much impact on the macro-economy. However, it may still be in the early stage of the epidemic, there is great uncertainty about how to develop, and we need to continue to pay close attention to the changes of the epidemic.

Edit / emily