1. Cathay Technology intends to acquire a 5% stake in its wholly-owned subsidiary, Cathay Grid; 2. Dongguan Dingtong Technology's net profit in the third quarter increased by 262.57% year-on-year; 3. Micro Electric Physiology's net profit in the first three quarters increased by 262.22% year-on-year; 4. Autel Technology: Net profit in the first three quarters increased by 103.08% year-on-year.

The Science and Technology Innovation Board Daily News on October 21st includes: Cathay Technology intends to acquire a 5% stake in its wholly-owned subsidiary, Cathay Grid; Dongguan Dingtong Technology's net profit in the third quarter increased by 262.57% year-on-year; Micro Electric Physiology's net profit in the first three quarters increased by 262.22% year-on-year; Autel Technology: Net profit in the first three quarters increased by 103.08% year-on-year.

Focus on hot topics

Briefs:

Briefs:

Guangdong: vigorously promote the research and development of key equipment such as etching machines for optical chips and domestic substitution.

The General Office of the People's Government of Guangdong Province issued the "Guangdong Province Accelerating the Innovation and Development Action Plan for the Optical Chip Industry (2024-2030)". It mentions promoting the R&D and manufacturing of key equipment for optical chips. Vigorously promote the R&D and localization of key equipment for optical chips such as etching machines, bonding machines, epitaxial growth equipment, and optical vector parameter network testers. Implement policies for updating and renovating industrial equipment to accelerate the upgrading of key equipment for optical chips.

Shandong invites bids for 0.022 million aircraft to build a "Low-Altitude Skynet". Insiders: Expected to be delivered in batches to seize resources in advance.

Subsidiary of Shandong Hi-Speed, Shandong Hi-Speed Urban and Rural Development Group Co., Ltd., recently issued a notice soliciting cooperation partners for the "Low-Altitude Skynet" product and technology. Insiders close to the company revealed to Caixin reporters that the company plans to bid for 0.022 million aircraft, which are expected to be delivered in batches. The main application scenarios include low-altitude logistics, gradually building the provincial "Low-Altitude Skynet". This move is mainly to leverage ground resources such as Shandong Hi-Speed expressway network, and occupy a position in related low-altitude airspace areas.

In-depth analysis:

Semiconductor Manufacturing International Corporation's stock price exceeded 100 yuan, with the number of "hundred-yuan stocks" in the semiconductor industry increasing to 17. Which step has industrial recovery taken?

Guangdong strives to become a "pioneer in light pursuit" and aims at a billion-level optoelectronic chip industry cluster, vigorously supporting the research and development of photolithography, etching machines, etc.

National Bureau of Statistics: More than 100 trusted data spaces will be established by 2028.

Science and Technology Innovation Board Companies

Cathay Biotech Inc.: Planning to purchase the controlling rights of Sichuan Yichong, with stocks suspended from trading.

Cathay Biotech Inc. announcement: The company is planning to purchase the controlling rights of Sichuan Yichong Technology Co., Ltd. by issuing shares, issuing targeted convertible corporate bonds, and paying cash, while also planning to raise matching funds. According to preliminary calculations, this transaction is expected to constitute a significant asset restructuring and a related party transaction. Prior to this transaction, the company and the counterparty have no associated relationship. This transaction will not result in a change of the actual controller of the company. The company's stocks will be suspended from trading starting from October 22, 2024, and the suspension period is expected not to exceed 5 trading days.

Jinghua Micro: The company does not have any significant information that should be disclosed but has not been disclosed.

Jinghua Micro announced that the company's stocks had consecutive days of trading on October 17, 18, and 21, 2024, with cumulative deviations in closing prices exceeding 30%, indicating abnormal stock trading. After the company's self-inspection and verification with the controlling shareholder and actual controller, as of the disclosure date of the announcement, there is no significant information that should have been disclosed but has not been disclosed.

Dongguan Dingtong Precision Metal Co.,Ltd.: Net income in the third quarter increased by 262.57% year on year.

Dongguan Dingtong Precision Metal Co.,Ltd. released the third quarter report for 2024. During the reporting period, the company achieved revenue of 0.251 billion yuan, a year-on-year increase of 58.15%; the net income attributable to shareholders of the listed company was 29.0382 million yuan, a year-on-year increase of 262.57%.

Microelectronics: Net income in the first three quarters increased by 262.22% year on year.

Microelectronics released the third quarter report of 2024, achieving revenue of 0.291 billion yuan in the first three quarters, a year-on-year increase of 23.21%; net income attributable to shareholders of the listed company was 41.7267 million yuan, a year-on-year increase of 262.22%. In the third quarter, revenue reached 92.5015 million yuan, a year-on-year decrease of 1.54%; net income attributable to shareholders of the listed company was 24.714 million yuan, a year-on-year increase of 163.92%.

Autel Intelligent Technology Corp., Ltd.: The net income in the first three quarters increased by 103.08% year-on-year.

Autel Intelligent Technology Corp., Ltd. released the third quarter report for 2024, achieving revenue of 2.804 billion yuan in the first three quarters, a year-on-year increase of 28.07%; the net income attributable to the shareholders of the listed company was 0.541 billion yuan, a year-on-year increase of 103.08%. Among them, the revenue in the third quarter was 0.962 billion yuan, a year-on-year increase of 29.72%; the net income attributable to the shareholders of the listed company was 0.155 billion yuan, a year-on-year increase of 99.61%.

Brightgene Bio-Medical Technology Co., Ltd.: Shareholder Huilian II plans to reduce its shareholding by no more than 2.9615% of the company's stocks.

LiYuan Technology announced that shareholder Huilian No.2 plans to reduce its holdings of up to 4.5 million shares of the company's stock, accounting for 2.9615% of the total share capital of the company.

Brightgene Bio-Medical Technology: BGM0504 injection for weight loss indications has obtained the Phase III clinical trial ethics approval.

Brightgene Bio-Medical Technology announced that its wholly-owned subsidiary, Borui New Creation, has independently developed the Phase III clinical research plan for BGM0504 injection for weight loss indications, which has been approved by the Ethics Review Committee of the leading hospital, Peking University People's Hospital, and obtained the "Ethical Review Approval Document of Peking University People's Hospital Ethics Review Committee".

Kain Technology: intends to acquire 5% equity of controlling subsidiary Kain Ge Ling.

Kaiyin Technology announced that the company plans to use 9.9571 million yuan in cash to acquire 5% of the equity of Kaiyin Ge Ling held by shareholder Tang Jian, a minority shareholder of the holding subsidiary. After the completion of this transaction, the company's shareholding proportion of Kaiyin Ge Ling will increase from 76% to 81%.

Wide Info: Proposed to repurchase shares with an amount of -30 million yuan.

Wide Info announcement, the company plans to use its own funds to repurchase shares through centralized bidding trading, with a total amount of not less than 20 million yuan and not more than 30 million yuan. The repurchase price will not exceed 19.05 yuan per share. The repurchased shares are intended to be used for employee stock ownership plans or stock-based incentives at a suitable future time.

cathay biotech inc. intends to repurchase company shares worth 10 million to 20 million yuan.

Cathay Biotech Inc. announced that the company plans to repurchase shares with an amount ranging from 10 million to 20 million yuan for employee shareholding plans or stock-based incentives, with a repurchase price not exceeding 67 yuan per share (inclusive).

Qingyun Technology: Shareholders owning more than 5% and their concerted action parties plan to reduce their shareholding.

Qingyun Technology announced that the company recently received a notification letter from shareholders Jiaxing Lance, Tianjin Lance, indicating their plans to reduce a total of no more than 955,824 shares through centralized bidding and block trading, accounting for no more than 2.00% of the total share capital. Among these, the plan is to reduce no more than 477,912 shares through centralized bidding, i.e., no more than 1.00% of the total share capital; and to reduce no more than 477,912 shares through block trading, i.e., no more than 1.00% of the total share capital. Jiaxing Lance and Tianjin Lance collectively hold 4,515,594 shares of the company, representing 9.45% of the total share capital. This reduction plan will not have a significant impact on the company's governance structure and ongoing operations.

Linkage Software: Several shareholders plan to jointly reduce their company shares by no more than 3.1%.

Linkage Software announced that shareholders Huada Qifu, holding 4.28% of the shares, Daying Zhihui, holding 4.7%, and Huafu Zhihui, holding 4.21%, due to their own funding needs, plan to reduce company shares by no more than 1%, 0.59%, and 1.51% respectively, totaling no more than 3.1%.

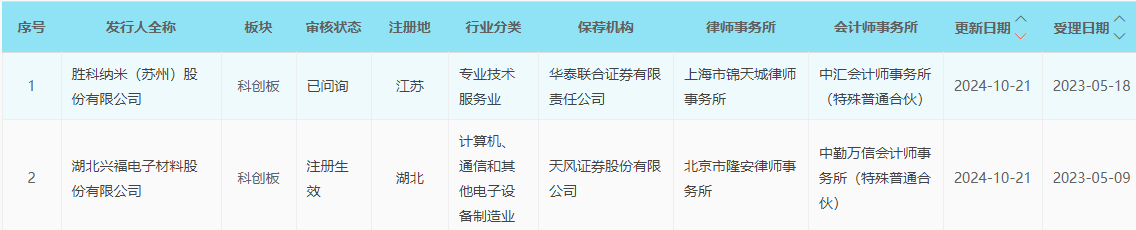

【Review Status】

Updates on the review status of 2 companies planning to list on the STAR Market.

As of the time of publication, a total of 944 companies have had their applications for listing on the STAR Market accepted. Today, 2 companies have updated their review status, including Xingfu Electronics' registration becoming effective, and Shengke Nano responding to the second round of inquiries.

Venture Capital Wind Vane

GLVentures led a round A financing of tens of millions of yuan for Taijing Technology.

Nanjing Taijing Technology Co., Ltd. recently announced the completion of tens of millions of yuan in round A financing, led by GLVentures, with follow-up investments from Shenzhen Small and Medium-sized Enterprise Venture Capital, and Shenzhen Honghui Investment. Existing shareholder Panlin Capital continues to support, with Lenglu Capital serving as the exclusive financial advisor for this round. The raised funds will be mainly used for the mass production and promotion of self-developed terahertz sensors, modules, and instruments.

Sipeng Technology completed a pre-A round financing of hundreds of millions of yuan.

Sipeng Technology, a new synthetic biology high-tech company, announced the completion of hundreds of millions of yuan in Pre-A round financing, with this round's investors being Guotou Chuanghe and Rugao City Technology Investment Group Co., Ltd. The financing funds will be used for advanced manufacturing of bio-based products and to create a negative carbon intelligent manufacturing platform for high-performance bio-based materials. Sipeng Technology's product pipeline covers negative carbon new materials, polymer monomers, and various high-value compounds. Previously, Sipeng Technology has completed two rounds of angel financing.

Xuanjing Biology completed over hundred million yuan in angel + round financing.

Suzhou Xuanjing Biotechnology Co., Ltd. (Xuanjing Biology) announced the completion of over hundred million yuan in angel + round financing. This round of financing was jointly participated by Shanghai Science and Technology Investment, Beijing Centergate Technologies Development Takeoff Fund, InnoPinnacle Fund, Tri-Innovation Investment, and Jinsha River Joint Capital. The financing funds will be used for Xuanjing Biology's continuous investment in the innovative research and industrialization of nucleic acid drugs. Xuanjing Biology is a company focusing on the research and industrialization of innovative nucleic acid drugs, covering the entire process of small nucleic acid drug development. Previously, Xuanjing Biology had completed angel round financing.