According to the report data, in 2023, the total scale of the china supply chain planning and APS solution market (excluding hardware revenue) reached 1.76 billion RMB, with an annual growth rate of 29.2%, still the fastest growing market among core industrial software.

According to a report released by IDC, the size, growth rate, major players, market trends, and technological developments of the china supply chain planning and APS market in 2023 were studied in detail. The report data shows that in 2023, the total scale of the china supply chain planning and APS solution market (excluding hardware revenue) reached 1.76 billion RMB, with an annual growth rate of 29.2%, still the fastest growing market among core industrial software.

The main factors maintaining a high growth rate are the continuous release of demand for supply chain planning in the china market, continuous improvement in market supply capacity, and the low penetration rate and market base as prerequisites. IDC predicts that this market will continue to maintain a high growth rate in the coming years, but the market structure has not yet solidified and is in the early stage of competition.

The research target of this report is the supply chain planning and APS solution market in 2023. In this market, the product forms of global manufacturers in the supply chain planning and APS are relatively clear. For example, Blue Yonder's Luminate Planning, SAP's IBP (Integrated Business Planning) are supply chain planning solutions; SAP PP/DS (Production Planning and Detailed Scheduling), Siemens Opcenter APS, Asprova APS focus on the production and manufacturing level APS solutions.

The research target of this report is the supply chain planning and APS solution market in 2023. In this market, the product forms of global manufacturers in the supply chain planning and APS are relatively clear. For example, Blue Yonder's Luminate Planning, SAP's IBP (Integrated Business Planning) are supply chain planning solutions; SAP PP/DS (Production Planning and Detailed Scheduling), Siemens Opcenter APS, Asprova APS focus on the production and manufacturing level APS solutions.

Local manufacturers in the china market like Hand Enterprise Solutions, Sunswell, and ShanShu Technology provide integrated solutions including supply chain planning and APS, with companies like Kingdee and Lansfar focusing on the supply chain planning layer, and Mei Yunzhi Data focusing on the production and manufacturing level APS. The planning of the supply chain layer and the manufacturing layer overlap and are closely related, the product boundaries are gradually becoming blurred, and the trend of integrated overall solutions is emerging. Based on this current situation and trend, this research targets the overall solution market including these two parts.

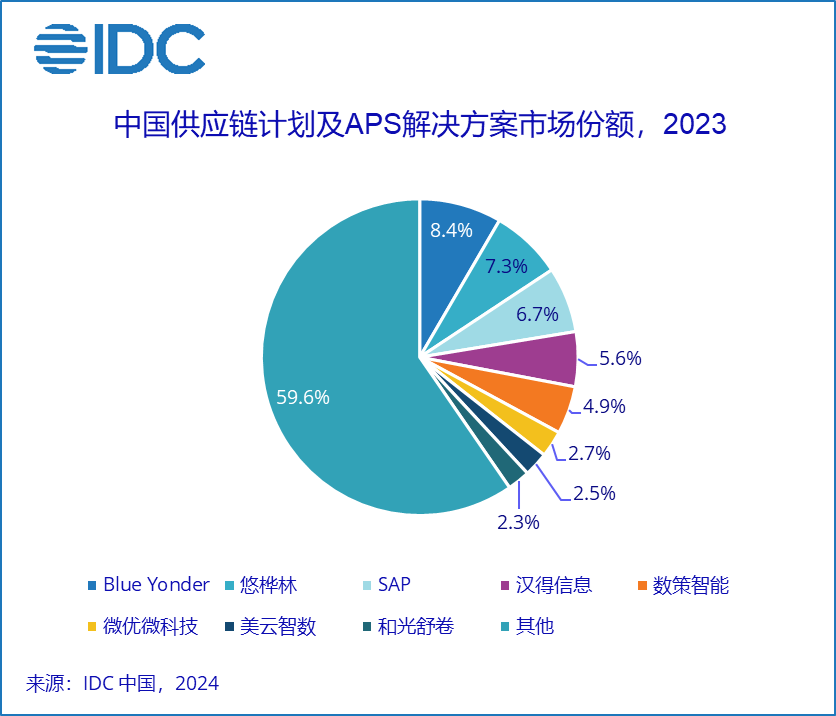

In terms of the competitive landscape, Blue Yonder, Sunswell, and SAP ranked top three in the china supply chain planning and APS solution market in 2023. Blue Yonder maintained its good reputation in the china market and the deep accumulation of high-tech electronics industry solutions, ranking first with an 8.4% market share; Sunswell, with explorations and accumulations in multiple industries such as new energy, home appliances, food and beverage, equipment manufacturing, complete vehicles and parts, ranked second with a 7.3% market share, rising one place from last year; SAP, with the widest customer base, provides end-to-end integrated solutions from enterprise resource management to supply chain planning, ranked third with a 6.7% market share.

Hand Enterprise Solutions (300170.SZ), Datastory Intelligence, Weiyewei Technology, Mei Yunzhi Data, and Heguang Shujuan ranked fourth to eighth. Other typical service providers such as Dassault Systemes, ShanShu Technology, Siemens, Kingdee (00268), Lansfar, Gudou, o9, Yongkai, Fourth Paradigm (06682), Innovation Qizhi (02121), Shangjian, Bugong, and QINGZHI YOUDA have performed well in their respective fields.

The IDC report points out that the main market changes in 2023 include cloud vendors reshaping the industrial software ecosystem, stricter IPOs, financing difficulties, and merger and acquisition opportunities. The IDC report advises technology service providers to focus on issues of scarce consultants, solid delivery of each project, and trends such as extending towards high-value supply chain plans.

IDC's report indicates that in 2023, major market changes include cloud vendors reshaping industrial software ecosystems, tighter IPOs, and financing difficulties. Opportunities are arising. IDC advises in the report that technology service providers should pay particular attention to issues of scarce consultants, deliver solid results for each project, and extend towards high-value supply chain planning initiatives.

本报告研究对象是2023年供应链计划及APS解决方案市场。该市场中,全球厂商供应链计划和APS两层的产品形态相对清晰,例如,Blue Yonder的Luminate Planning、SAP的IBP(Integrated Business Planning)为供应链计划解决方案;SAP PP/DS(Production Planning and Detailed Scheduling)、西门子Opcenter APS、Asprova APS则是聚焦生产制造层面的APS解决方案。

本报告研究对象是2023年供应链计划及APS解决方案市场。该市场中,全球厂商供应链计划和APS两层的产品形态相对清晰,例如,Blue Yonder的Luminate Planning、SAP的IBP(Integrated Business Planning)为供应链计划解决方案;SAP PP/DS(Production Planning and Detailed Scheduling)、西门子Opcenter APS、Asprova APS则是聚焦生产制造层面的APS解决方案。