Recently, the European futures prices have shown strong upward momentum. Market analysis suggests that the price support and implementation status of major airlines need to be closely monitored. Please see the details below.

Recently, the European line futures prices have been strong, with the European line 2412 contract rising over 40% from the low point of 1816 after National Day, quoting 2932.3 points at 10:15 on October 21st.

Spot end

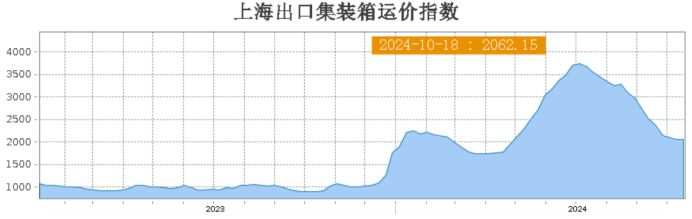

On October 18, the SCFI index released by the Shanghai Shipping Exchange was 2062.15 points, a weekly decline of 0.42. On October 14, the SCFIS index released by the Shanghai Shipping Exchange was 2391.04 points, with a weekly decline of 10.2%. This indicates that the supply and demand situation for European shipping lines remains relatively loose in the near term.

However, through the shipping market tracking tool - FBX container freight index (try it now), we found that the spot prices in Europe have risen slightly. This indicates that the recent announcements of rate increases by major shipping companies may boost market sentiment and impact spot prices.

However, through the shipping market tracking tool - FBX container freight index (try it now), we found that the spot prices in Europe have risen slightly. This indicates that the recent announcements of rate increases by major shipping companies may boost market sentiment and impact spot prices.

Shenyin Wanguo Futures stated that the current key point in European container trade is whether the rate increases by shipping companies in early November can be successfully implemented. With most major shipping companies initiating rate increases in November, it is currently impossible to disprove that these rate increases will not be implemented as scheduled. The market is volatile between 2500-2900 points. The rate increase actions of major shipping companies in November are relatively consistent. Currently, the center of the three major alliances' large container quotations in early November is around $4500, with the 12-month contract largely reflecting the increase in shipping rates in early November. Compared to the situation in 2023, the possibility of the $4500 large container rate landing, which represents an increase of about 50% from the end of October, is not high. However, it will help stabilize the downward trend in rates since the third quarter, and it is expected that the market will lean towards volatility. Attention should be paid to the shipping companies' capacity adjustments in November and the booking situation at the beginning of November.

Additionally, we can also continuously monitor spot prices for the European shipping market through the shipping market tracking tools -Platts' major shipping routes freight index and Drewry's freight index (click the link to experience).

News:

The recent changes in the geopolitical conflicts in the Middle East are unpredictable, and the escalation of these conflicts may impact the capacity supply of Europe-bound shipping lines. Therefore, we need to continue monitoring the conflict situation in the Middle East, especially last weekend, where we discovered through the shipping market monitoring tool - news flashes and major events (click the link to experience) that the geopolitical conflicts in the Middle East may further intensify.

Market view

Green Da Hua Futures stated that on the supply side, the empty sailings measures continued to increase at the beginning of November. Calculated by the departure time of the first port in East China, the capacity for weeks 45-46 dropped to 0.21 million TEU, significantly lower than the 0.28 million TEU at the end of October. Carriers intend to reduce capacity supply by suspending sailings and reducing speed. On the demand side, the European economy is still not optimistic, and cargo volume has not shown a significant increase yet. However, the rate cut in Europe may temporarily boost the market. As of now, most major carriers have announced increases in November rates on the European routes, increasing the likelihood of implementation. Based on the price increases by major carriers in November, Maersk's quote corresponds to around 3000 on the SCFIS index, COSCO SHP SG near 2800, and Block Orders around 3200. Currently, most carriers have already traded the announced rate increases for November, but COSCO SHP SG has a larger increase and has not been traded yet on the market.Support level.Raising to 3200 is a strong resistance level. If it proves difficult to implement subsequent rate increases, there may be a significant decline.

Guotou Futures mentioned that this rate increase is accompanied by a considerable scale of sailings suspensions, further slowing down potential late-arriving vessels to create additional empty sailings, similar to the proactive sailings suspension of the 2M Alliance Lion route. The proactive sailings suspensions and speed reductions demonstrate the carriers' relatively firm determination, and it is expected that the rate increases will achieve good implementation in the early stages. However, the drivers behind the rate support in the off-peak season mostly stem from carriers' proactive sailings suspensions. Apart from the unconventional years of 2020-2021, the declines in November cargo volume compared to October in previous years ranged from 3% to 6%, but the current November weekly average capacity on the supply side is significantly higher than that of October. Considering the costs of sailings suspension, continuous sailings suspension on the supply side may not be realistic. It is expected that the November rates will follow the usual pattern, with a substantial decline after a rapid surge following the implementation of the rate increases.

但通过

但通过