Semiconductor equipment giants led the decline last week, underperforming the entire US chip sector; Gabelli predicts this divergence will persist long term.

The two core forces of the global chip industry—$ASML Holding (ASML.US)$with$Taiwan Semiconductor (TSM.US)$The latest round of earnings reports from chip companies in this top-tier global industry chain, valued at a staggering $530 billion, shows that the gap between the stock prices and actual performance of chip companies riding the unprecedented wave of AI frenzy and those that have missed out on this AI boom is widening. It highlights the market's tendency to place bets with real money on listed chip companies linked to AI, rather than those heavily tied to business outside the AI domain. Based on the preliminary data from this earnings season, this discrepancy in stock prices and performance may soon widen from a crack to an abyss.

"If there is no artificial intelligence, the entire chip market will be very challenging," said Christophe Fouquet, CEO of Dutch lithography equipment manufacturer ASML, during last week's earnings conference call. The company unexpectedly missed its Q3 performance last week, mainly due to the continued softness in all chip demand except for artificial intelligence, resulting in a downward revision of its full-year 2025 sales expectations, and ASML's Q3 orders significantly fell short of market expectations due to the sluggish demand in non-AI areas.

ASML from the Netherlands is the world's largest-scale manufacturer of lithography systems, and the lithography equipment produced by ASML plays a crucial role in the chip manufacturing process. ASML is the sole supplier of the most advanced extreme ultraviolet (EUV) lithography machines currently used by TAIWAN SEMICONDUCTOR, SAMSUNG, and INTEL to manufacture the most cutting-edge process chips.

ASML from the Netherlands is the world's largest-scale manufacturer of lithography systems, and the lithography equipment produced by ASML plays a crucial role in the chip manufacturing process. ASML is the sole supplier of the most advanced extreme ultraviolet (EUV) lithography machines currently used by TAIWAN SEMICONDUCTOR, SAMSUNG, and INTEL to manufacture the most cutting-edge process chips.

If chips are the "pearl" of modern human industry, lithography machines are the essential tools for producing this "pearl". More importantly, ASML is the global sole supplier of EUV lithography equipment needed for the most advanced process chips in the world, such as 3nm, 5nm, and 7nm chips. The company's performance outlook adjustment reflects that the demand level of the entire chip industry is still in a weak recovery phase, at least in the current period it has not achieved the demand "boom cycle" of the chip industry.

The chip industry is experiencing a "two-tiered" situation: a surge in AI-related demand while non-AI areas remain in a "sluggish moment".

ASML's latest earnings announcement has sparked new concerns about the health of the chip industry. Despite the unprecedented AI boom, strong demand for chips closely related to AI, especially data center AI chips, US tech giants continue to invest heavily in AI GPUs, data center Ethernet chips, and other artificial intelligence infrastructure to expand or build new data centers. However, the entire chip industry is still significantly affected by weak demand in key markets such as personal computers, smartphones, and electric vehicles.

In addition, this lithography giant has long been caught in the escalating geopolitical tensions between China and the USA, which may further cut off more ASML lithography machines from entering the Chinese chip market, thereby continuing to impact ASML's performance. The Chinese market is still the world's largest market for semiconductor equipment such as lithography machines.

From the perspective of rational investors, ASML's blow to the global chip stocks' stock price performance does not mean that the global wave of artificial intelligence layout is retreating or cooling down, and ASML's performance shows a continuous surge in demand for AI chips. However, this exploding financial report does reveal the latest dynamics of the global chip industry, namely: the AI boom is still ongoing, especially the demand for all types of AI chips focusing on B-end data centers remains very high. However, areas not related to AI, such as electric cars, industrial sectors, IoT devices, and chips for a wide range of consumer electronics, are still in a state of weak demand or even significant decline in demand.

However, last Thursday, TSMC, the chip manufacturing giant known as the 'King of Global Chip Manufacturing,' significantly raised its revenue expectations for 2024 and emphasized the extremely strong demand for AI, greatly alleviating market concerns about the overall chip industry demand, and boosting market optimism for AI chip demand to a great extent. $Apple (AAPL.US)$ The company and the supreme ruler of AI chips$NVIDIA (NVDA.US)$All are Taiwan Semiconductor's core chip foundry customers. Taiwan Semiconductor's CEO C.C. Wei stated at the earnings conference that industry growth is driven by strong factors related to artificial intelligence, and overall chip demand has become "stable" and showing signs of improvement.

Taiwan Semiconductor's latest performance significantly reinforces the viewpoint that the AI craze is still going strong, with a highly explosive demand for AI chips. Regarding the market demand for AI chips, the head of Taiwan Semiconductor, Wei Zhejia, stated during the earnings conference that the outlook for AI chip demand is very optimistic, emphasizing that the demand from Taiwan Semiconductor's customers for CoWoS advanced packaging far outstrips the company's supply.

"The company will fully address customers' demand for CoWoS advanced packaging capacity. Even if the capacity doubles this year and continues to double next year, it will still be far from enough," Wei Zhejia stated during the earnings conference. The capacity for CoWoS advanced packaging is crucial for a broader range of AI chips like Nvidia's Blackwell AI GPU. Nearly all AI innovators collaborate with Taiwan Semiconductor, confirming the real existence of AI-related demand, and I believe this is just the beginning.

Taiwan Semiconductor's management expects the company's full-year revenue to grow by nearly 30%, exceeding the general expectation of analysts of 20%-25%, and the company's own expectation in the previous quarter. The management also anticipates that this year, Taiwan Semiconductor's data center artificial intelligence server chips (including Nvidia's AI GPU, AI ASIC, and other broadly defined AI chips) related revenue will more than double.$Broadcom (AVGO.US)$Taiwan Semiconductor's management expects the company's full-year revenue to grow by nearly 30%, exceeding the general expectation of analysts of 20%-25%, and the company's own expectation in the previous quarter. The management also anticipates that this year, Taiwan Semiconductor's data center artificial intelligence server chips (including Nvidia's AI GPU, AI ASIC, and other broadly defined AI chips) related revenue will more than double.

The release of financial reports by ASML and Taiwan Semiconductor successively heralds the start of a new round of global chip company earnings season, and the performance of these two major core giants in the chip industry collectively demonstrates: the global wave of AI spending is unstoppable, and the stock logic closely related to AI chips can be described as extremely hardcore. The soaring stock prices of AI chip leaders such as NVIDIA may far from stopping. Especially in the data center AI chip sector where the market share of the AI chip giant NVIDIA reaches 80% to 90%, the stock price may continuously reach new historical highs, breaking through the widely expected $150 mark by Wall Street analysts may only be a matter of time.

In the US stock market, there is a huge divergence in the trend of chip stocks.

Known as the "global semiconductor stock indicator"$PHLX Semiconductor Index (.SOX.US)$Last week, due to the unexpectedly poor performance of ASML, the stock plummeted. After ASML dramatically released a significantly lower-than-expected financial report on Tuesday, it rarelLy fell by 5.3%, then rebounded strongly after TSMC announced its performance on Thursday. However, in the entire US stock market, the core force driving the repeated highs of US stocks - the semiconductor sector, has seen huge divergences in the stock movements.

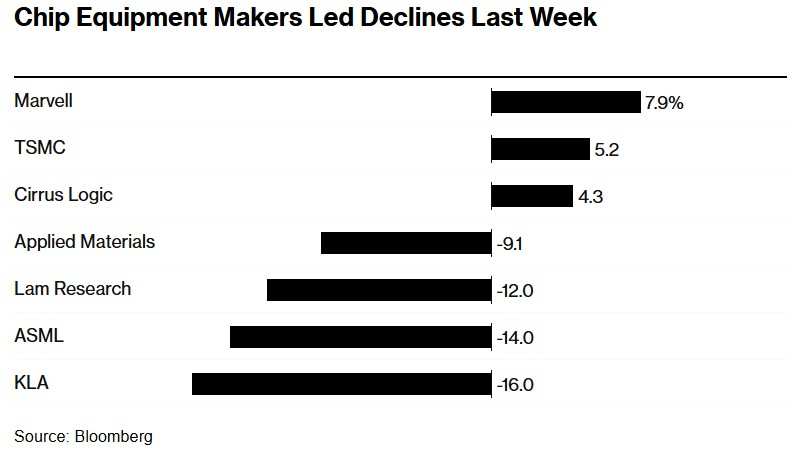

Among them, semiconductor equipment companies significantly underperformed compared to the PHLX Semiconductor Index. ASML,$KLA Corp (KLAC.US)$and Lam Research ( $Lam Research (LRCX.US)$ Rarely seen, semiconductor equipment giants such as()are included in the 'leading decliners list', while chip companies closely associated with AI such as Taiwan Semiconductor, Nvidia, and Broadcom have seen significant stock price increases.

Semiconductor equipment companies led the decline in the U.S. chip sector last week

Semiconductor equipment companies provide chip manufacturing equipment, focusing on core chip manufacturing processes such as lithography, etching, thin film deposition, multilayer interconnection, and thermal management. Therefore, compared to chip companies benefiting significantly from the global AI frenzy like TSMC, Nvidia, AMD, and Broadcom, which are directly involved in AI-related chip demand, asset-heavy semiconductor equipment companies still heavily rely on overall chip industry demand rather than just AI-related chip demand. If areas like PCs, smartphones, and other end-side AI large models become popular globally, it may drive the entire chip industry into prosperity, but this scenario is not yet showing clear signs. ASML's latest financial results highlight the overall sluggish trend in the chip industry demand, causing collective weakening of these companies' stock prices.

"We expect this divergence to continue, as assuming that all of this is demand driven by AI is entirely correct." Ryuta Makino, a senior analyst at Gabelli Funds, said that he expects this significant divergence path to persist at least until 2025.

The financial data of chip companies are often seen as a barometer of the global economy, as chips are crucial for the manufacturing of a wide range of electronic products from high-performance servers in data centers to smartphones, electric cars, and dishwashers. Companies providing semiconductor equipment for manufacturing these chips are at the forefront of the industry.

Before chip manufacturers like TSMC and Samsung start chip production, time is needed to build, install, and test large chip production machines. Therefore, semiconductor equipment companies like ASML and KLA Corp have an unusually long-term view of customer demand. Currently, they are issuing warning signals for all chip areas except AI. For example, due to continuous increase in customer inventory, the demand for chips in electric cars and industrial ends is still declining, and the demand for chip in the general sense of personal computers and smartphones remains sluggish since 2022 as AI PC and AI smartphone demand have not expanded significantly.

Additionally, Intel, which holds an important position in the chip manufacturing field, is cutting costs and delaying the construction of new chip factories because the company is struggling to address significant declines in sales and increased losses. This month, another chip giant, Samsung, even directly apologized to investors, stating that the company's foundry business progress and the delay in HBM storage chip shipments have disappointed investors.

Investors will closely monitor this week$Texas Instruments (TXN.US)$The company's financial report, the company will release its financial report after the close of the US Eastern Time on Tuesday, and its analog chip products are widely used by a diverse customer base. Texas Instruments can be said to have the widest customer base and the largest product range among chip manufacturers, so the company's performance and performance outlook data can be used as one of the forecasting indicators for various industry demands. Texas Instruments is the world's largest analog chip manufacturer, its products perform simple but crucial functions, such as converting power sources to different voltages in electronic devices. In addition, Texas Instruments' analog chips have played an essential role in various key function modules and systems in electric autos in recent years, including power management, battery management, sensor interfaces, audio and video processing, and motor control.

Overall, ASML, KLA Corp, and other semiconductor equipment companies seem to face a more challenging path than expected, although KLA Corp and many other semiconductor equipment companies' stocks hit record highs earlier this year. Some Wall Street traders have not chosen to wait for the signal of the entire chip industry demand recovery, but have already started selling shares of companies like ASML and other semiconductor equipment companies.$Applied Materials (AMAT.US)$some semiconductor equipment companies' stocks hit record highs earlier this year. Some Wall Street traders have not chosen to wait for the signal of the entire chip industry demand recovery, but have already started selling shares of companies like ASML and other semiconductor equipment companies.

ASML has just experienced its worst week since early September, with its US stock price dropping significantly by 14%. The stock price of the largest semiconductor equipment company in the United States, Applied Materials, fell by 9.1%, while the declines of KLA Corp and Lam Research exceeded 12%.

"We are clearly more cautious on other semiconductor equipment names." Analyst CJ Muse from Cantor Fitzgerald wrote in a research report. "We once believed that longer-time participants like ASML would perform potentially better. Clearly, our assumption was wrong." Following ASML's announcement of significantly lower-than-expected performance, the analyst stated that the stock prices of semiconductor equipment companies are expected to further decline.

Artificial intelligence spending continues to surge, and NVIDIA may long dominate the title of the 'biggest winner in the AI boom.'

For Taiwan Semiconductor, Nvidia, Broadcom, as well as AMD,$Micron Technology (MU.US)$for the "hot AI chip stocks" that have continued to attract funds since 2023, the situation of their stock prices is completely different, as these companies may continue to benefit from the continuous massive spending by large tech companies in artificial intelligence development.

Wall Street statistics show,$Microsoft (MSFT.US)$Google's parent company, Alphabet,$Amazon (AMZN.US)$companies as well as Facebook's parent company, Meta, had capital expenditures exceeding $50 billion in the second quarter, with most of it used to purchase datacenter AI chips, such as Nvidia's H100/H200/Blackwell series AI GPUs and Broadcom's AI ASIC. Some tech giants have publicly stated that they plan to invest larger amounts of funds in the next few quarters to acquire AI GPUs, data center Ethernet chips, and other artificial intelligence infrastructure to expand or build new data centers.

According to the well-known technology industry chain analyst Guo Mingchi from TF International Securities, the latest industry chain order information for the NVIDIA Blackwell GB200 chip indicates that Microsoft is currently the largest GB200 customer in the world, with Q4 orders surging 3-4 times, exceeding the total orders of all other cloud service providers.

Guo Mingchi stated in a recent report that the production capacity expansion of the Blackwell AI GPU is expected to start in early Q4 of this year. At that time, the shipment volume in Q4 will be between 150,000 to 200,000 units. It is projected that the shipment volume in Q1 2025 will significantly increase by 200% to 250%, reaching 500,000 to 550,000 units. This means that NVIDIA may achieve its sales target of one million AI server systems in just a few quarters. NVIDIA founder and CEO Huang Renxun recently revealed in an interview that the Blackwell architecture AI GPU is in full production and the demand is extremely "crazy".

According to the latest forecast data from the Wall Street financial giant Citigroup, by 2025, the datacenter-related capital expenditures of the four largest technology giants in the United States are expected to increase by at least 40% year-on-year, and these massive capital expenditures are basically linked to generative artificial intelligence, meaning that the computational demands of AI applications like ChatGPT remain significant. Citigroup states that this implies that the giants are expected to further expand their datacenter spending beyond the already strong spending levels of 2024, and the institution expects this trend to continue to provide very significant positive catalysts for the AI GPU undoubted dominator Nvidia as well as datacenter interconnect (DCI) technology providers' stock prices.

In research reports, Citigroup refers to the four major technology giants globally as the cloud computing giants Amazon, Google, Microsoft, along with social media's Facebook and Instagram parent company. Citigroup expects that in this latest research report, by 2025, the capital expenditure of these four major technology giants' data centers will increase by 40% to 50% year-on-year. The significant increase in technology giants' expenditure on data centers is expected to drive Nvidia, which holds a dominant position in the global artificial intelligence field.$Arista Networks (ANET.US)$and other data center networking technology giants continue to be favored by international funds for their stock prices.

Citigroup's analyst team stated in the latest research report that NVIDIA's absolute leading position in total cost of ownership (TCO) and return on investment (ROI) in the field of AI infrastructure servers, NVIDIA whole machine servers, and other hardware systems is highlighted as a core concern for data center operators. They emphasize the higher-level performance of running various applications (including AI training/inference applications) on NVIDIA's hardware and CUDA parallel acceleration software platform. The Citigroup analyst team also emphasizes that the adoption of artificial intelligence (AI) is still in the early to mid-term stages, especially with the growing demand for AI applications driven by the hot AI application "AI agents" in the enterprise sector, leading to a strong demand for computational resources, stimulating a significant expansion and establishment of data centers by tech giants.

Solita Marcelli, Chief Investment Officer for UBS Global Wealth Management, Americas, stated that it is expected that by 2025, the total sales of chip companies closely related to artificial intelligence will jump from $168 billion this year to $245 billion. Marcelli recommends that clients increase their positions in AI-related chip manufacturers after ASML announces their earnings.

"We continue to see strong growth prospects for AI chips and closely monitor management's guidance on future demand," she wrote in a research report last week.

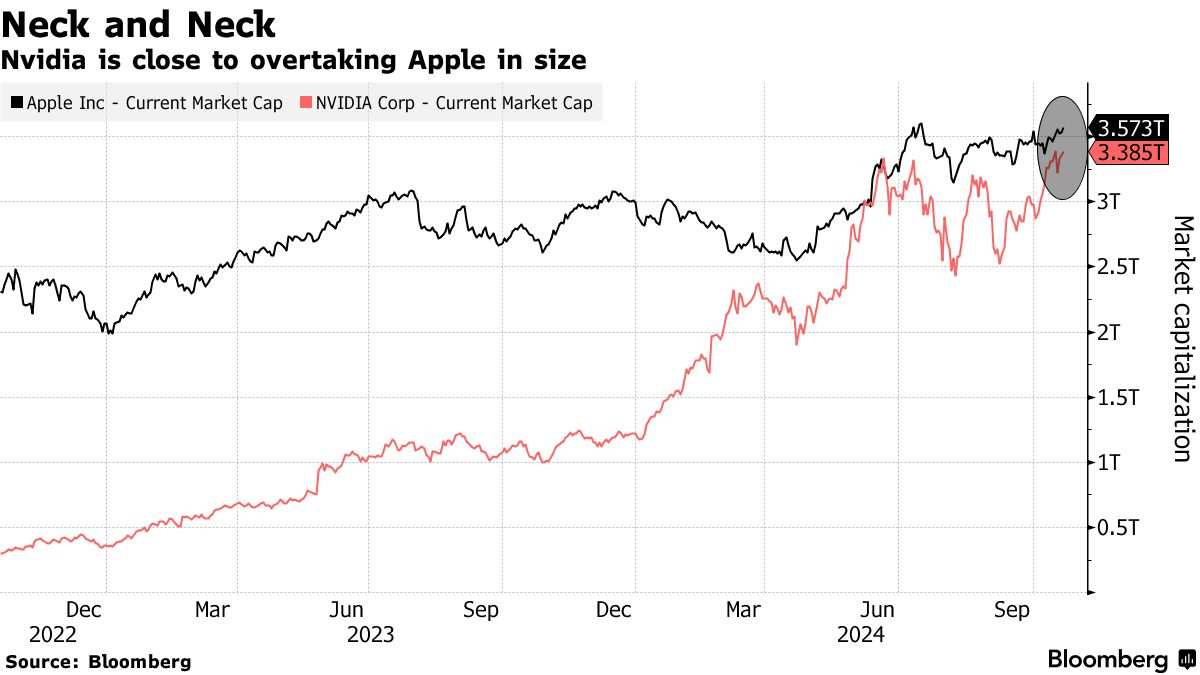

In the view of Wall Street analysts, the major beneficiaries of all data center expenditures are NVIDIA, which continues to dominate the broader AI chip market. After CEO Huang Renxun assured that their new Blackwell chip is in full production and saw strong customer demand, the stock hit an all-time high last week, surpassing the previous high in June. NVIDIA's stock price has risen by over 175% in 2024, currently with a market cap of nearly $3.4 trillion, just a step away from surpassing Apple once again to become the "world's most valuable company".

According to TipRanks' data compilation, 42 Wall Street analysts have an average target price expectation for Nvidia within 12 months at $153.86, implying a potential upside of nearly 10%. The Wall Street banking giant Bank of America recently reiterated a 'buy' rating on Nvidia, significantly raising the target price from $165 to $190, higher than the generally accepted target price on Wall Street. The Bank of America analysis team also raised Nvidia's earnings per share expectations for the fiscal year 2025 from $2.81 to $2.87; for fiscal year 2026 from $3.90 to $4.47; and for fiscal year 2027 from $4.72 to $5.67.

In the view of Wall Street analysts, other chip companies that can benefit from the AI spending boom include Taiwan Semiconductor, Broadcom, Arm, Micron Technology, and AMD, especially as AMD is attempting to weaken Nvidia's absolute control over the AI chip market.

AMD's heavyweight MI300X AI accelerator has significant advantages in memory bandwidth and capacity compared to Nvidia's Hopper architecture AI GPU, especially suitable for AI parallel computing-intensive workload demands in generative AI model training and inference tasks. Recently, some analysts believe that if AMD continues to improve the competitive AMD ROCm software ecosystem against Nvidia's CUDA and accelerates its support for mainstream AI developer environments, it may further erode Nvidia's share of the AI GPU market in data centers.

However, even for 'hot AI chip stocks,' it seems they cannot avoid the negative impact of sluggish non-AI demand. For example, Broadcom, whose customized AI chips and Ethernet chips are mainly used in major data centers globally, saw its stock price plummet last month due to disappointing performance in a portion of its non-AI-related business, and the latest Broadcom performance forecasts suggest that the growth rate of its non-AI business is much slower than the market's recovery expectations.

"Ultimately, it will certainly provide value scenarios for non-AI chip companies, especially when economic strength signals a moment of demand recovery," said Tim Ghriskey, Senior Investment Portfolio Strategist at Ingalls & Snyder. "However, this is a timing issue. Artificial intelligence will be the market's focus in the long term."

Editor/Rocky

来自荷兰的阿斯麦是全球最大规模光刻系统制造商,阿斯麦所生产的光刻设备在制造芯片的过程中可谓起着最重要作用。阿斯麦是台积电、三星以及英特尔用于制造最高端制程芯片的目前最先进极紫外(EUV)光刻机的唯一供应商。

来自荷兰的阿斯麦是全球最大规模光刻系统制造商,阿斯麦所生产的光刻设备在制造芯片的过程中可谓起着最重要作用。阿斯麦是台积电、三星以及英特尔用于制造最高端制程芯片的目前最先进极紫外(EUV)光刻机的唯一供应商。