During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the financials sector.

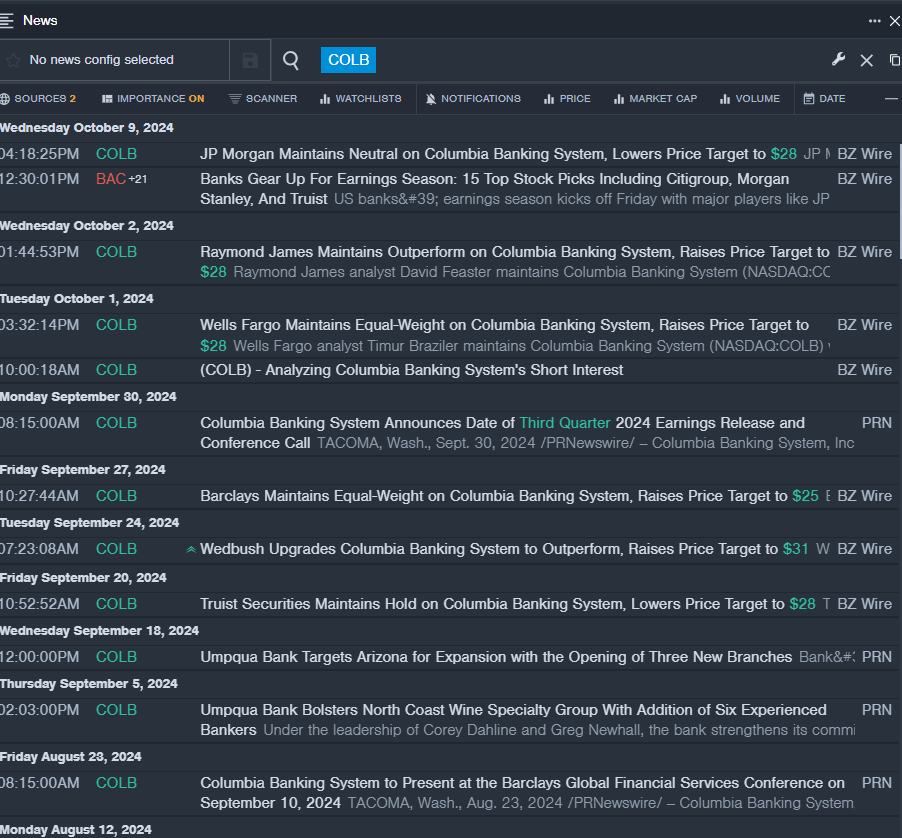

Columbia Banking System, Inc. (NASDAQ:COLB)

- Dividend Yield: 5.19%

- JP Morgan analyst Steven Alexopoulos maintained a Neutral rating and cut the price target from $29 to $28 on Oct. 9. This analyst has an accuracy rate of 71%.

- Raymond James analyst David Feaster maintained an Outperform rating and raised the price target from $26 to $28 on Oct. 2. This analyst has an accuracy rate of 68%

- Recent News: Columbia Banking System, will release third quarter financial results on Thursday, Oct. 24, before market open.

- Benzinga Pro's real-time newsfeed alerted to latest COLB news.

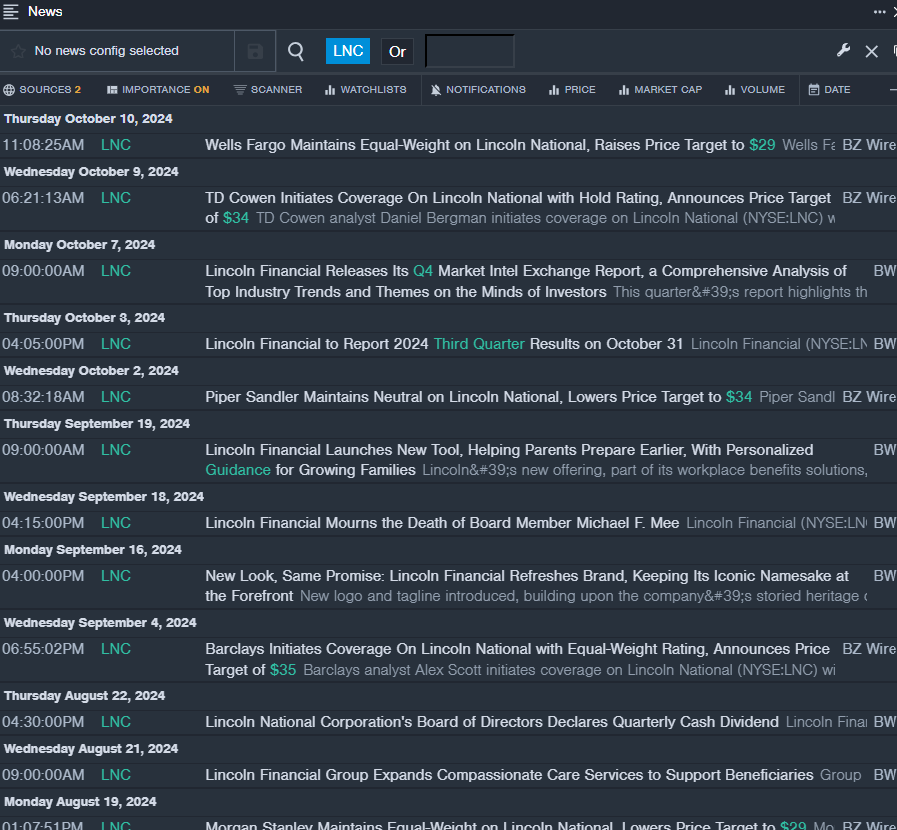

Lincoln National Corporation (NYSE:LNC)

- Dividend Yield: 5.35%

- Wells Fargo analyst Elyse Greenspan maintained an Equal-Weight rating and raised the price target from $28 to $29 on Oct. 10. This analyst has an accuracy rate of 68%.

- TD Cowen analyst Daniel Bergman initiated coverage on the stock with a Hold rating with a price target of $34 on Oct. 9. This analyst has an accuracy rate of 66%.

- Recent News: Lincoln Financial is expected to report third quarter results on Oct. 31.

- Benzinga Pro's real-time newsfeed alerted to latest LNC news.

Main Street Capital Corporation (NYSE:MAIN)

- Dividend Yield: 7.86%

- Morgan Stanley analyst Devin McDermott upgraded the stock from Underweight to Equal-Weight with a price target of $24 on Sept. 16. This analyst has an accuracy rate of 80%.

- Barclays analyst Theresa Chen maintained an Equal-Weight rating and boosted the price target from $21 to $22 on Sept. 13. This analyst has an accuracy rate of 78%.

- Recent News: On Oct. 15, Main Street reported preliminary estimate of third-quarter net investment income of 99 cents to $1.01 per share.

- Benzinga Pro's charting tool helped identify the trend in MAIN stock.

Read More:

Read More:

- AbbVie Is Doing 'Very Well' But Jim Cramer's Favorite? Abbott Laboratories