Deep-pocketed investors have adopted a bearish approach towards Danaher (NYSE:DHR), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DHR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 24 extraordinary options activities for Danaher. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 41% leaning bullish and 50% bearish. Among these notable options, 22 are puts, totaling $1,018,942, and 2 are calls, amounting to $107,750.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $262.5 to $330.0 for Danaher over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $262.5 to $330.0 for Danaher over the last 3 months.

Volume & Open Interest Development

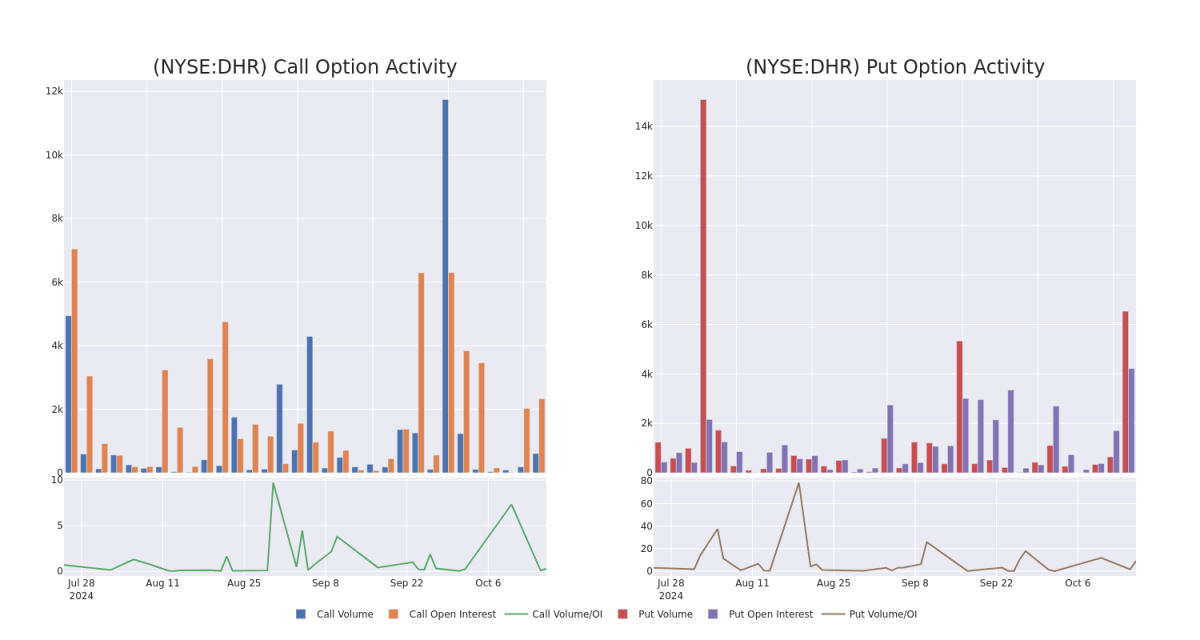

In today's trading context, the average open interest for options of Danaher stands at 817.88, with a total volume reaching 7,139.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Danaher, situated within the strike price corridor from $262.5 to $330.0, throughout the last 30 days.

Danaher Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | PUT | TRADE | BULLISH | 10/18/24 | $1.55 | $1.15 | $1.25 | $262.50 | $87.5K | 234 | 1.0K |

| DHR | PUT | SWEEP | BULLISH | 10/18/24 | $6.2 | $5.7 | $5.7 | $270.00 | $70.1K | 1.7K | 684 |

| DHR | PUT | SWEEP | BEARISH | 10/18/24 | $4.5 | $3.8 | $4.4 | $270.00 | $59.8K | 1.7K | 496 |

| DHR | CALL | TRADE | BULLISH | 10/18/24 | $1.4 | $0.95 | $1.4 | $275.00 | $56.0K | 2.0K | 562 |

| DHR | PUT | SWEEP | BEARISH | 11/15/24 | $16.1 | $15.7 | $16.1 | $280.00 | $53.0K | 429 | 0 |

About Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

In light of the recent options history for Danaher, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Danaher

- With a trading volume of 908,531, the price of DHR is down by -2.15%, reaching $266.83.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 6 days from now.

What Analysts Are Saying About Danaher

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $296.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Stephens & Co. lowers its rating to Overweight with a new price target of $315.* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Danaher, which currently sits at a price target of $278.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.