January 17, a new round of drug price reduction kicked off, in the second batch of volume procurement bidding site, the competition is extremely fierce.

On the same day, 122 enterprises launched quotations around 33 varieties of drugs, resulting in the proposed winning results, which will be officially released three days after the announcement.Patients across the country will use this batch of selected drugs in April.。

According to media reports, judging from the current drop in varieties, the overall decline in this round of collection is initially expected to be greater than the previous two. In order to retain the Chinese market, some original drug research companies even reduced their prices by 90%. There was an outcry after the hypoglycemic drug acarbose of Bayer, an original drug research company, quoted a shockingly low price.

On the retail side, the shock wave of drug collection has unstoppably hit the retail drugstores.The four major listed chain pharmacies have successively expressed their position to follow up the centralized drug procurement policy organized by the state.

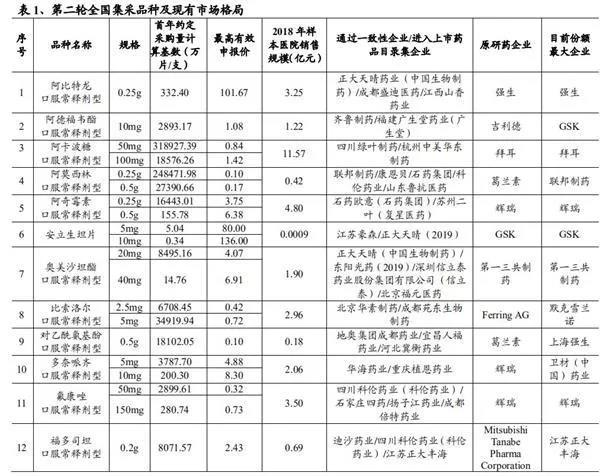

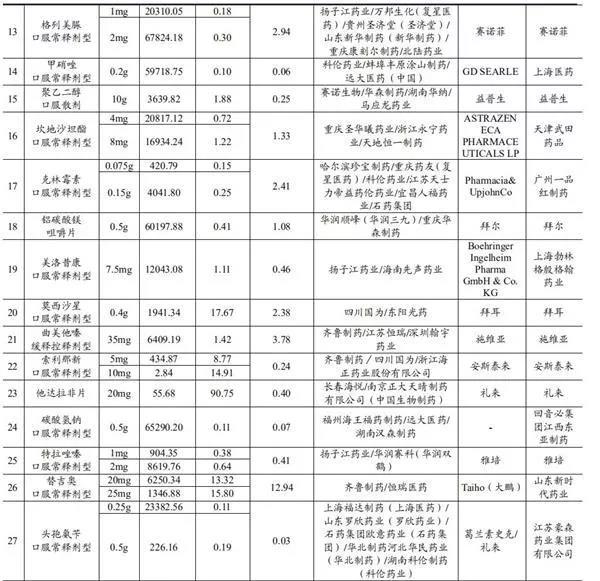

33 drugs are collected in this round.

According to e company, on December 29, Shanghai Sunshine Pharmaceutical Purchasing Network issued a document to carry out the second batch of centralized procurement and use of drugs organized by the state, which means that the second batch of collection has been officially launched. This time, the document published the second batch of national catalogue of varieties, with a total of 33 varieties.Acarbose, amoxicillin, Anlisengtan tablets, glimepiride and so on are impressively listed.

According to Mine.com, the total sales of the above 33 varieties (common names + dosage forms) exceeded 35 billion yuan in 2018 in China's urban public hospitals, county-level public hospitals, urban community centers and township health centers, of which 8 were more than 1 billion.

Price fight, a maximum price reduction of 90%

The second round of nationwide volume procurement began at 8 a.m. on Friday, after nearly five hours of fierce competition.

According to the preliminary statistics from the results from the scene, among the 33 varieties involved in the second batch of national drug procurement,There are 18 varieties of original research pharmaceutical companies directly out of this purchase.Among them, Sanofi, the original research manufacturer of glimepiride, and Xi'an Janssen, the original research manufacturer of Abelon, directly chose to abandon the bid in today's centralized procurement bidding.

It is worth mentioning that Bayer Pharmaceutical's hypoglycemic drug acarbose shocked its peers and caused an outcry at the scene.

It is understood that in the second batch of volume procurement bidding, acarbose bidding companies include East China Pharmaceutical subsidiaries, East China, Green Leaf Pharmaceuticals and Bayer, the three quotations are 13.96,9.6 and 5.42 yuan respectively, the specifications are 50mg/30 tablets.

Bayer quoted 5.42 yuan per box, a decrease of more than 90%.. The price of the single piece is 0.1807 yuan, which is nearly 80% lower than the required valid bid price of 0.8353. According to public data, the median price of Bayer's acarbose tablets 50mg was 2.14 yuan / tablet, and that of 100mg was 3.53 yuan / tablet.

It is worth noting that acarbose is one of the most concerned varieties in this collection.Acarbose is a hypoglycemic drug that diabetic patients need to take for a long time. It has a broad market and is a battleground for military personnel.。

According to the sales data of chemical oral hypoglycemic drugs in sample hospitals in China in 2018, acarbose and metformin accounted for more than 50% of the market share of chemical oral hypoglycemic drugs. Among them, acarbose ranked first (33%) and metformin ranked second (18%). Metformin, which has also attracted a lot of attention, did not enter the collection catalogue.

East China medicine flash collapse

In fact, after Friday's price fight, several families are happy and several are sad. China, the United States and East China were badly knocked out. It is worth noting that acarbose is one of the core products of East China Medicine. When the news broke on Friday morning, East China Pharmaceutical shares flashed and closed by the daily limit.From the K chart, share prices also hit a new low in recent months.

Source: wind

According to the company research report released by Huaxin Securities in June 2019, the producers of acarbose in the domestic market are Bayer Pharmaceutical, East China Pharmaceutical and Sichuan Luye. Bayer Pharmaceutical, the original research manufacturer of acarbose, has always occupied the largest share of the Chinese market, followed by East China Pharmaceutical, which basically occupies the rest of the market, while Sichuan Luye has a market share of less than 4%. In recent years, Bayer Pharmaceuticals' market share of Baitangping has shown a downward trend, while the market share of East China Pharmaceutical has shown a steady increase, and the proportion of import substitution has gradually increased.

2 billion yuan market may be lost

According to the "East China Medicine: announcement on the first Acarbose tablets to pass generic Drug consistency Evaluation" released by the company on November 28, 2018.Sales revenue reached 2 billion yuan in 2017.

The failure of the pharmaceutical procurement bid means that the door of acarbose to take the health insurance channel is closed to East China Pharmaceutical, and its market share is bound to decline significantly in the future.

According to the East China Pharmaceutical Financial report, the company's revenue exceeded 30 billion yuan in 2018, and although the manufacturing industry accounted for about 25% of the company's revenue, the gross profit accounted for 80%.If the current market share of acarbose is lost, it may have a greater impact on the company's net profit.

The organization concentrated to escape.

From the after-market list on January 17, a number of institutional seats fled sharply, but at the same time, the buying funds were equally determined, buying the first five seats totaling 321 million yuan and selling the first five seats totaling 280 million yuan.

From the perspective of shareholders' shareholding in East China Pharmaceutical's three-quarter report, social security, insurance funds and funds all hold large shares, but some institutions have significantly reduced their positions compared with the second quarter.

The average price of 25 selected drugs purchased by "4-7" fell by 52% on average.

In December 2018, the pilot results of "4-7" procurement of drugs with centralized volume organized by the state were produced.25 drugs were selected, an average decrease of 52% compared with the minimum purchase price of the same kind of drugs in pilot cities in 2017.。

Since March 2019, the "4-7" region has successively implemented the successful results of volume procurement. Since December 2019, other provinces across the country have also begun to implement the results of centralized procurement expansion, and the reform effect has benefited patients across the country. According to the calculation of the agreed purchase volume, the 25 varieties selected in the centralized procurement of drugs organized by the first batch of state organizations are expected to save 25.3 billion yuan.

The price reduction in the new round of collection may be greater.

Shi Lichen, general manager of Beijing Dingchen Management Consulting Co., Ltd., said earlier.The new round of volume procurement compared with the previous round, the price reduction may be greater.The reasons are: first, the negotiation ability of the country's negotiators has been further improved after the last round; second, compared with the first batch of volume procurement rules, the rules have changed, mainly reflected in the expansion from the exclusive winning bid to six winning biddings. the more enterprises are shortlisted, the greater the drop in drug prices, and the price reduction of some winning drugs may exceed the first round.

Reviewing the first batch of collection, the 47th pilot project began in December 2018, and then in September 2019, the collection results of 25 provinces and cities were announced. Drug price reduction was the immediate goal, leading to a reshuffle of the market pattern.

In the secondary market, after the first batch of volume procurement results were announced in December 2018The pharmaceutical sector as a whole fell sharply, with a number of stocks falling by about 25%.However, after the national expansion results of volume procurement in 2019 were announced, the time and extent of the impact on the pharmaceutical sector were significantly shorter and less than that of last year.

Zhongtai Securities believes that purchasing with volume should be treated rationally. Volume procurement policy will be a long-term trend for generic drugs, in terms of long-term trend.Generic profit margins return to a reasonable level of 10% to 20%.The sales cost has dropped sharply, and the development of the industry has entered a virtuous circle. Generic drug price reduction, differentiation for enterprises, capable enterprises, have production capacity, low cost, API preparation integration of enterprises are expected to win in this competition, although the decline in revenue, but a substantial increase in sales, profits are limited, for some prepared enterprises may even be good.For enterprises with small production capacity, single variety and limited capacity in the past, they may be greatly affected.

Drugstore "New parity era"

On the retail side, the shock wave of drug collection has unstoppably hit the retail drugstores.The four major listed chain pharmacies have successively expressed their position to follow up the centralized drug procurement policy organized by the state.

According to the Huaxia Times, on January 14, Yixintang released a message on its official WeChat account: "resolutely implement the implementation of the 'winning bid price' for purchasing varieties with volume!" "announced at its strongholdMore than 3800 stores in Yunnan Province implement the national collection price.The winning variety is of the same quality and price as the hospital, and the wholly-owned subsidiaries of other provinces are actively negotiating.

Yifeng Pharmacy said on December 18 last year thatWhere a consumer buys a drug of the same specification that is lower than the retail price in his or her store within 2 kilometers, the consumer will return the minimum selling unit of the drug to 3 times the price difference.. On December 20, the people's big pharmacy also promised to "refund three times the price difference" in the official WeChat account, and 5000 + stores across the country were "at the same price as the hospital." On January 10, Da Shenlin said that since January 1, 2020, more than 4000 stores have responded to the national collection policy and reduced the prices of corresponding varieties.

In fact, since the implementation of "4-7" volume procurement,In addition to listed chain pharmacies, leading chain enterprises such as Shu Yu civilian Pharmacy and Yikang Pharmaceutical have followed up to reduce prices.。

From a regional point of view, Shandong Province took the lead in issuing a notice on May 15, 2019, and implemented from July 1, to bring chain drugstores into the collection system, requiring that the total purchase of medical insurance drugs in chain drugstores should not be less than 60% of the original use in principle.

On May 24, 2019, Zhejiang Pharmaceutical equipment Purchasing platform made it clear that six provincial pharmaceutical chain drugstore groups, including Yinte Yinian, East China Pharmacy and State-controlled Pharmacy, can open procurement authority in the provincial pharmaceutical equipment purchasing platform. Five months later, the Zhejiang Provincial Medical Insurance Bureau issued a notice requiring that "the selling price of drugs in designated pharmacies should be appropriately increased on the basis of the payment standard of health insurance in public hospitals."

On June 26, 2019, Shanghai Sunshine Pharmaceutical Purchasing Network informed that from July 2019, the municipal pharmacy will carry out the work of "public bargaining of drugs in restricted pharmacies".

The big four listed drugstores took the initiative at the end of 2019.

Wang Qin, vice president of the people's Great Pharmacy, said publicly in December last year that [the price reduction] is indeed greater than we thought. As a chain enterprise, we should face it bravely and bring new opportunities at the same time, so we should comply with the trend.

Related data displayThe pharmaceutical retail industry has experienced a continuous decline in industry-wide sales for the first time since April 2019.

The organization suggests that we should pay attention to the quality leaders of the subdivided industries.

CITIC pointed out that although the trend of returning to a reasonable level of profits in the generic drug industry will not change in the medium to long term, the market has fully expected the risk of price reduction brought about by volume procurement.The subsequent impact on the plate is expected to gradually weaken.

As more and more varieties are included in volume procurement, the competitive core of generic drug enterprises in the future will come from two aspects: research and development and cost control. Sales capacity will be gradually weakened, and sales expenses are expected to be greatly reduced. The medical insurance funds saved by volume purchase provide sufficient payment space for innovative drugs, and marching into the field of innovative drugs will become an important path for generic drug enterprises to transform.However, from a technical and financial point of view, only the leading enterprises are expected to successfully achieve the transformation.

Founder Securities Zhou Xiaogang released a research report saying that volume procurement has become National Healthcare Security Administration's leading procurement idea for generic drugs and some high-value consumables. It is expected that from 2020, innovative devices, a similar innovative drug with more significant clinical value, are expected to rise formally.It is suggested that the targets of innovative drugs or innovative instruments with large market space and expected price reduction of similar varieties should be selected.. Specific target: it is recommended to focus on Lepu Medical, Lizhu Group, Beida Pharmaceutical and Hesco.

Shanghai Securities believes that with the expansion of volume procurement coverage, the profit margins of generic drug companies continue to be compressed, and the industry concentration will be further improved, benefiting leading enterprises with cost advantages and rich varieties. In the long run, the volume purchase of drugs and consumables will continue to drive the cage exchange of the health insurance fund.

In the process,On the one hand, the leading enterprises of generic drugs and medical consumables with scale cost effect and technological advantages can survive in the process of rapid market concentration.On the other hand, the policy will force enterprises with R & D capabilities to innovate and transform, promote the development of domestic innovative pharmaceutical equipment industry chain, and the performance of pharmaceutical listed companies may continue to differentiate.

It is recommended to lay out the sub-field leaders and industry leaders with high magnificence, including innovative pharmaceutical companies with rich product lines, strong R & D capabilities and high-quality disease tracks, as well as CRO, CMO, CDMO and other service providers.

Great Wall Securities believes that volume procurement is one of the most direct and effective ways to reduce drug prices and health insurance expenditure, plays an important role in coordinating the further promotion of health care reform, and continues to affect the development of the pharmaceutical industry. Intensive disclosure of performance announcements in the annual reportIt is suggested that we should pay attention to the high quality targets with beautiful performance and reasonable valuation.Mainly focus on three main investment lines:

The first is the innovation and industrial chain that benefit from the policy.The policy encourages R & D and innovation, especially under the background of the continuous decline in the prices of existing varieties, the market value of innovative varieties is enhanced, which is good for innovative enterprises and the industrial chain. Enterprises with large R & D investment and advanced variety progress will continue to be favored by the market. With reference to the market performance of overseas innovative enterprises, the progress of each R & D stage will lead to an increase in market value. Investment, M & A, introduction and the formation of pipeline echelon through independent research and development are equally important, which will enhance the core competitiveness and market value of enterprises.

The second is valuation repair + high-quality raw materials industry.Volume procurement intensifies market competition, and the ability of cost control in the future will gradually become an important factor in determining the competitiveness of preparation enterprises, especially generic drug enterprises. Although product price reduction has led to a decline in the profitability of production enterprises, however, it is highly likely that the selected enterprises will be able to exchange price for quantity, increase their market share and support their continuous innovation and transformation. At the same time, the decline in the price of selected varieties to reduce the burden of patients, help to open the grass-roots market space, good to drive the release of high-quality raw and auxiliary materials, and improve the status of the API industry chain.

Third, the upgrading of consumption leads to the increase of optional consumption.With the improvement of residents' quality of life, medical needs are also changing. at present, China is dominated by basic medical insurance, under the background of its basic insurance, there are a large number of unmet needs in vaccines, medical devices, third-party testing, dentistry and other optional consumption areas. Overseas, such as Germany and the United States, have developed a mature commercial insurance system, and the domestic commercial insurance system is still in its infancy. The upgrading of consumption brings great potential for the development of optional consumption. Including Hengrui Medicine, Jinyu Medicine, Kyushu Tong, Minohua, Aoxiang Pharmaceutical Co., Ltd., Hypri, Zhaoyan New Drug, Kailaiying, Kapu Biological, Kangtai Biological, Zhifei Biological, Zhenghai Biological, North China Pharmaceutical, Tongrentang and so on.

Edit / Edward