Whales with a lot of money to spend have taken a noticeably bearish stance on ARM Holdings.

Looking at options history for ARM Holdings (NASDAQ:ARM) we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 7 are puts, for a total amount of $302,995 and 10, calls, for a total amount of $478,313.

From the overall spotted trades, 7 are puts, for a total amount of $302,995 and 10, calls, for a total amount of $478,313.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $87.5 to $215.0 for ARM Holdings over the last 3 months.

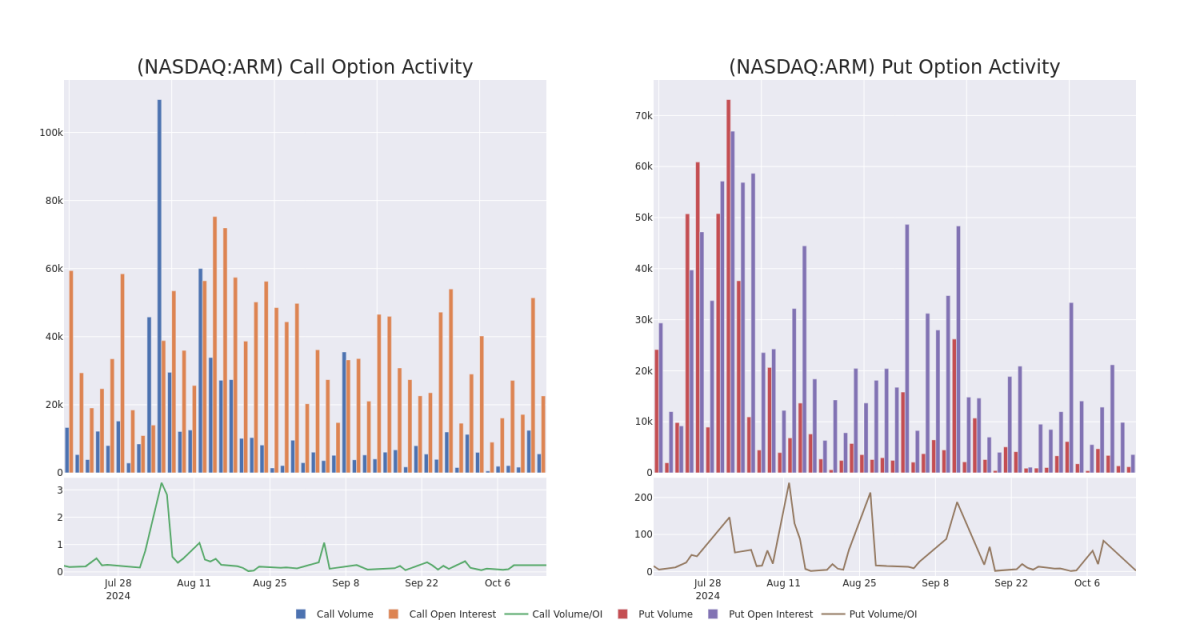

Volume & Open Interest Trends

In terms of liquidity and interest, the mean open interest for ARM Holdings options trades today is 2378.64 with a total volume of 6,753.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for ARM Holdings's big money trades within a strike price range of $87.5 to $215.0 over the last 30 days.

ARM Holdings Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ARM | PUT | SWEEP | BEARISH | 11/15/24 | $20.0 | $19.9 | $20.0 | $170.00 | $75.8K | 507 | 63 |

| ARM | CALL | TRADE | BULLISH | 01/17/25 | $36.0 | $35.4 | $36.0 | $135.00 | $72.0K | 1.1K | 0 |

| ARM | CALL | SWEEP | NEUTRAL | 10/25/24 | $1.5 | $1.34 | $1.5 | $175.00 | $60.0K | 1.7K | 404 |

| ARM | CALL | SWEEP | BULLISH | 10/18/24 | $1.38 | $1.01 | $1.38 | $170.00 | $56.5K | 13.4K | 1.2K |

| ARM | CALL | SWEEP | BULLISH | 10/18/24 | $1.37 | $1.02 | $1.37 | $170.00 | $50.8K | 13.4K | 2.0K |

About ARM Holdings

Arm Holdings is the IP owner and developer of the ARM architecture (ARM stands for Acorn RISC Machine), which is used in 99% of the world's smartphone CPU cores, and it also has high market share in other battery-powered devices like wearables, tablets, or sensors. Arm licenses its architecture for a fee, offering different types of licenses depending on the flexibility the customer needs. Customers like Apple or Qualcomm buy architectural licenses, which allows them to modify the architecture and add or delete instructions to tailor the chips to their specific needs. Other clients directly buy off-the-shelf designs from Arm. Off-the-shelf and architectural customers pay a royalty fee per chip shipped.

Having examined the options trading patterns of ARM Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

ARM Holdings's Current Market Status

- With a volume of 392,215, the price of ARM is down -1.28% at $159.75.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 22 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ARM Holdings with Benzinga Pro for real-time alerts.