The Canadian banking sector plays an essential role in the Canadian economy, enabling families to buy homes and save for retirement, and helping small businesses grow. According to the Canadian Bankers Association, this sector employs nearly 300,000 Canadians and contributes approximately $30 billion in salaries and benefits annually.

Additionally, the six largest Canadian banks paid around $15 billion in taxes to the government in 2023, underscoring their economic significance. Collectively, the Canadian banking sector accounts for about 3.5% of the country's gross domestic product (GDP).

Among these giants, the Bank of Nova Scotia (TSX:BNS) and Canadian Imperial Bank of Commerce (TSX:CM) are two dividend-paying stocks worth examining. So, which is a better investment right now? Let's dive deeper into both.

Bank of Nova Scotia has growth potential while paying steady dividends

Bank of Nova Scotia is a diversified financial institution, offering a wide array of services in personal and commercial banking, wealth management, investment banking, and capital markets. Notably, its international operations extend primarily into Central and South America, positioning the bank for growth in emerging markets.

Bank of Nova Scotia is a diversified financial institution, offering a wide array of services in personal and commercial banking, wealth management, investment banking, and capital markets. Notably, its international operations extend primarily into Central and South America, positioning the bank for growth in emerging markets.

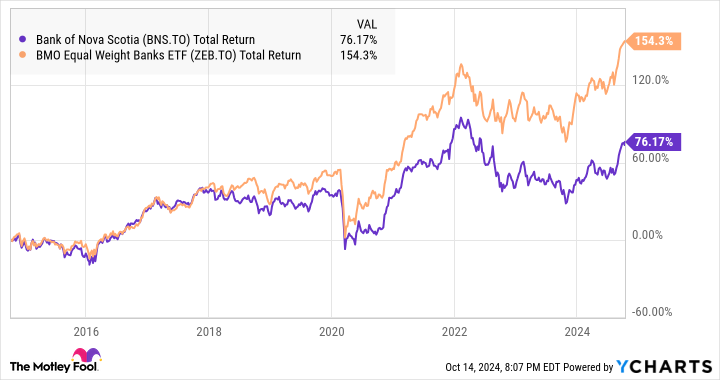

BNS and ZEB 10-year Total Return Level data by YCharts

Over the past decade, Bank of Nova Scotia has reported a compound annual growth rate (CAGR) of 9.4% in revenue per share. However, this solid revenue growth has not translated into similar earnings growth with diluted earnings per share having only increased at a modest CAGR of 1.2% during the period. This stagnation in earnings may explain why BNS shares have lagged behind the broader Canadian banking sector, as measured by the BMO Equal Weight Banks Index ETF.

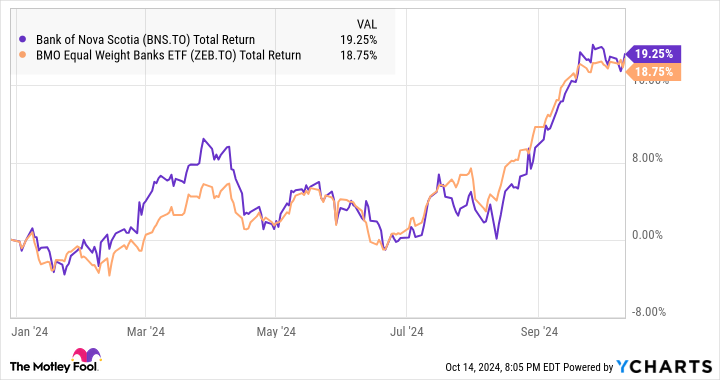

Yet, year to date, Bank of Nova Scotia's total returns were on par with the sector, as shown in the graph below. Investors are likely drawn to BNS for its attractive dividend yield, as interest rates have started coming down. The bank has demonstrated a commitment to its shareholders by increasing its dividend at a CAGR of about 5.8% over the last decade.

BNS and ZEB year to date Total Return Level data by YCharts

At $72.18 per share at writing, BNS stock offers a generous dividend yield of nearly 5.9%. This combination of a solid yield and a history of dividend increases makes Bank of Nova Scotia an appealing choice for income-focused investors.

CIBC consistently performs

Canadian Imperial Bank of Commerce is the fifth-largest bank in Canada, known for its robust operations in retail and business banking, wealth management, and capital markets. Unlike BNS, CIBC has shown a stronger performance trajectory over the years.

ZEB and CIBC 10-year Total Return Level data by YCharts

CIBC has achieved a remarkable 11% CAGR in revenue per share over the past decade, translating into a diluted earnings per share growth rate of 2.3%. Additionally, CIBC has increased its dividend at a CAGR of 6.1%.

Priced at $83.88 per share at writing, CIBC stock provides a dividend yield of approximately 4.3%. Importantly, the Big Six Canadian bank stock has outperformed the banking sector both year to date and over the past decade, making it a standout option for investors seeking growth along with steady income.

Foolish investor takeaway

When comparing these two banking giants, it's clear that CIBC has outperformed BNS in terms of returns and consistent growth. For investors looking for more consistent gains, waiting for a market pullback could present an opportunity to buy CIBC at a more attractive price. However, for those willing to take a risk for potential turnaround gains, BNS may be the better bet for higher total returns over the next three to five years.