On October 15, Cui Dongshu released an analysis of the market structure of passenger vehicle price segments.

According to the report from the Intellectual Finance APP, on October 15, Cui Dongshu released an analysis of the market structure of passenger vehicle price segments. According to data from the China Passenger Car Association, the sales structure trend of price segments in the national passenger vehicle market has been continuously increasing in recent years. The proportion of high-end car sales has significantly increased, while the proportion of mid-to-low-price car sales has decreased. This is driven by consumption upgrade and also due to the consumption upgrade of the replacement group. With the implementation of the national subsidy policy for scrapped and updated vehicles, the new energy market below 0.1 million yuan in the third quarter of 2024 has strengthened, the trend of pure electric vehicles in the 0.05 million yuan class has improved, and the growth of plug-in hybrid vehicles in the 0.1 million yuan class has been rapid, further diverting market share from gasoline vehicles.

1. The lower the price of passenger vehicles, the more expensive they get.

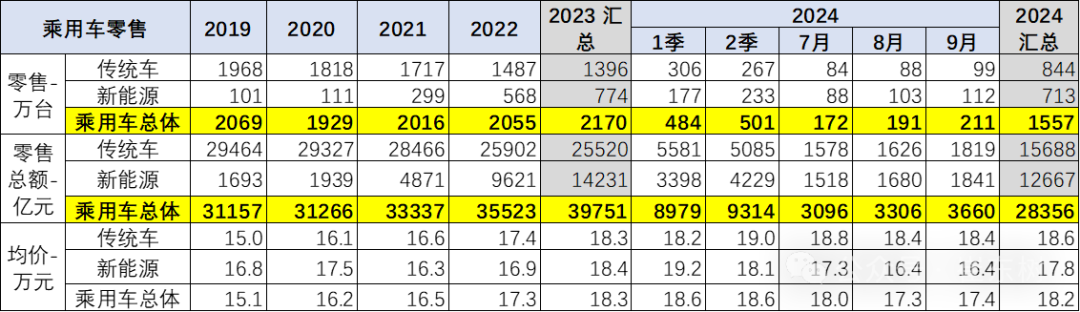

The main influence on price changes is the impact of structural changes. In recent years, the price of the automotive market has shown a continuous upward trend, which was 0.151 million yuan in 2019, 0.162 million yuan in 2020, an average of 0.182 million yuan cumulatively for this year, and 0.174 million yuan in September.

The main influence on price changes is the impact of structural changes. In recent years, the price of the automotive market has shown a continuous upward trend, which was 0.151 million yuan in 2019, 0.162 million yuan in 2020, an average of 0.182 million yuan cumulatively for this year, and 0.174 million yuan in September.

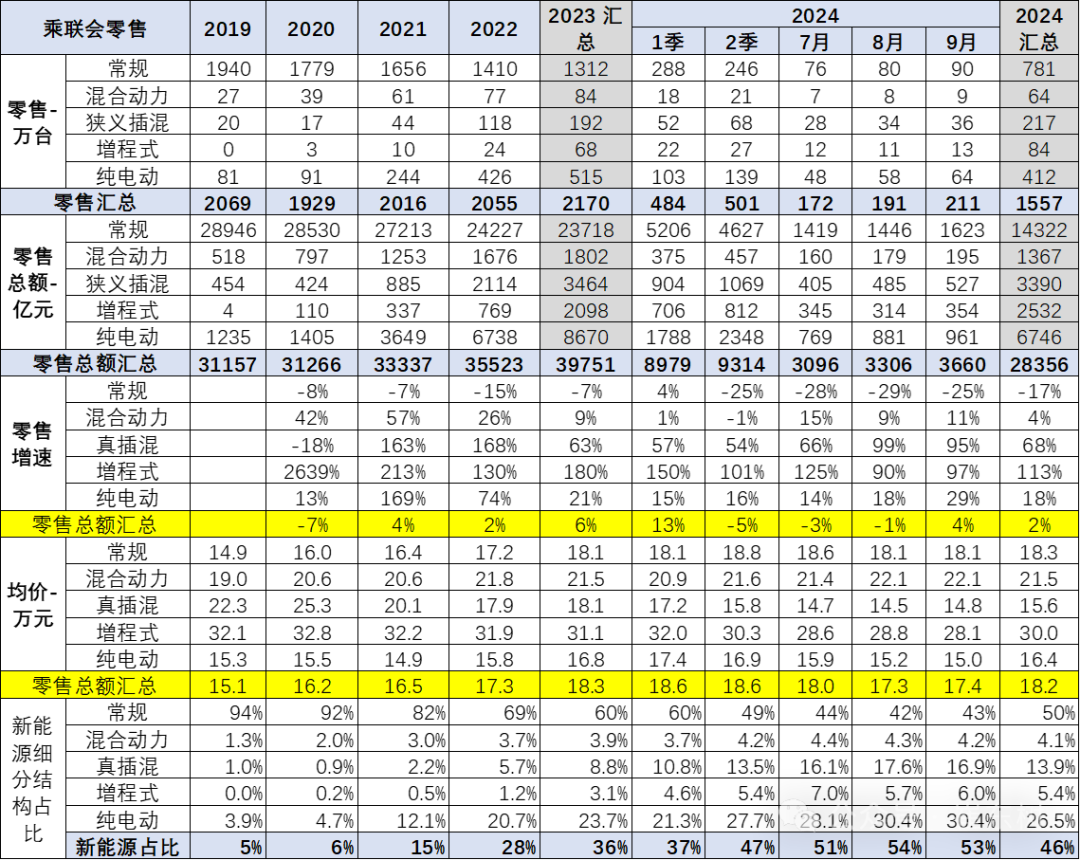

The increase in the proportion of entry-level electric vehicles and plug-in hybrids in September led to a decrease in the average price. The structural reason for the average price decrease in September is that hybrid and extended-range vehicles have higher prices, but their proportion has decreased, leading to structural driving. Additionally, the average sales price of existing gasoline vehicles has also decreased in September. Moreover, the premiumization of gasoline vehicles has significantly driven price increases.

2. Market sales structure of passenger vehicles by price segment

According to the retail data of the China Passenger Car Association, the trend of the price structure of the national urban market is continuously rising, with a significant increase in the sales of high-end new energy vehicle models and a decrease in the sales of mid-to-low-priced vehicle models.

The proportion of models priced below 0.05 million yuan continued to rise from 2021 to 2022 compared to 2020, mainly due to the sales contribution of micro electric vehicles. However, it has been declining since 2023, rising again after the third quarter of 2024, with sales of models priced below 0.05 million yuan in September 2024 accounting for 4.1%, an increase of 1.6 percentage points from 2023. The decline in sales of traditional models priced between 0.05 and 0.15 million, offset by the growth of new energy vehicles, still shows an overall downward trend.

The market share of models priced above 0.15 million yuan continues to rise, with rapid growth. The 0.2-0.3 million yuan models accounted for 17% of domestic retail sales in 2023, increasing to 19% in September this year. In recent years, the proportion of various segments of models priced above 0.3 million yuan has continued to increase, with the retail sales share of 0.3-0.4 million yuan models at 10% in 2023, dropping to 9% in September. For models priced above 0.4 million, the domestic retail share was 5% in 2023, dropping to 3% this year, reflecting the obvious trend of the high-end development brought by the increase in new energy passenger vehicles, but the trend of decline in traditional luxury cars is more severe.

3. Passenger vehicle sales structure by level

Recently, the highest penetration rate of electric vehicles is in small cars, with a 100% penetration rate of microcars in September, and A0 compact cars exceeding 75%, with fast growth in A-grade new energy vehicles.

The penetration rate of B-class and C-class vehicles has increased significantly, reflecting the significant advantages of high-end electrification.

The increase in the penetration rate of new energy in high-end vehicles mainly reflects the trend of autonomous improvement.

4. The structure of new energy vehicles in passenger vehicles

Domestic retail sales of pure electric new energy vehicles continue to grow rapidly, plug-in hybrids have performed well in the past three years, and the range continues to grow slightly. The sales of traditional passenger vehicles are under continuous downward pressure.

In 2023, the proportion of new energy vehicles reached a strong ratio of 36%, with the penetration rate of new energy vehicles in September 2024 reaching 53%, and the future contribution of new energy vehicles is expected to continue to increase slightly.

5. Price and sales structure of various types of power in 2024

Currently, the price range of 0.05-0.15 million yuan for passenger vehicles is a characteristic of the core block orders market, mainly due to the higher proportion of traditional rbob gasoline vehicles. There is a significant difference between traditional vehicles and electric vehicles, with a relatively concentrated structure in the mid-range for plug-in hybrids.

6. In September 2024, the sales structure of internal power in various price segments.

In the price segment market, power distribution is relatively uneven. Pure electric vehicles perform the strongest in the under-0.05 million yuan market, while extended-range electric vehicles show the strongest distribution pattern in the high-end market price range, and hybrid vehicles have a relatively strong performance in the 0.2-0.3 million yuan range.

Traditional fuel vehicles have shown relatively strong performance in the range of 0.1-0.15 million yuan, forming a differentiated distribution. Especially, the distribution of hybrid vehicles is relatively narrow, with products mainly in the mid-to-high price range. At the beginning of the year, the low-end market contracted severely, which also had a greater impact on the low-end market due to weaker consumption.

7. Conventional fuel passenger vehicle structure.

The high-end product structure of traditional fuel vehicles is more obvious, mainly the high growth of models priced above 0.15 million yuan, which is a direct reflection of consumption upgrade. Recently, the declining speed of fuel vehicles priced below 0.1 million yuan has slowed down. Under the high growth of pure electric vehicles, fuel vehicles have shown a sharp decline.

8. Changes in the product structure of pure electric vehicles - significant growth in the high-end segment.

With the decrease in costs and product improvement, the decline of electric vehicles priced below 0.05 million is faster. Electric vehicles priced between 0.15-0.3 million yuan perform well, among which Tesla (TSLA.US) still ranks above 0.2 million to prevent significant structural fluctuations.

Driven by scrap renewal policies, the recent growth of new energy vehicles priced below 0.1 million is significant. The proportion of electric vehicles priced between 0.1-0.15 million yuan is decreasing, with some electric vehicles serving as the main force in rental and online ride-hailing services, and the trend in the A-class electric vehicle market has not been strong in the past two years. With the decrease in lithium carbonate prices, the micro electric vehicle market is recovering.

9. Changes in the product structure of plug-in hybrid vehicles - significant increase in the mid-to-high-end segment.

The increase in sales volume of plug-in hybrid models is mainly in the low price range. After the maturity of independent plug-in hybrid technology, it has gained a significant market share in the mid to low price range. In 2024, there will be an explosive growth of plug-in hybrids priced at 0.1 million yuan, driving the strength of plug-in hybrids.

10. Changes in the product structure of extended-range vehicles - strong performance in the high-end segment.

As a branch of pure electric vehicles, range-extended electric vehicles have been included in plug-in hybrids. In recent years, the performance has continued to be strong, both in the high-end and 150,000 yuan level products.

The recent growth of range-extended electric vehicles has significantly slowed down, with a sharp decrease in the proportion of high-end models.

11. Changes in market share of hybrid electric vehicles - high-end segment.

The market share of hybrid vehicles is also continuously increasing, with improvement in supply in 2024 leading to a gradual increase in market share. Market demand under policy drive is shifting towards plug-in hybrids. The performance of joint venture hybrid vehicles is average.

12. Changes in market share of various automakers' products.

In 2024, self-owned brands performed very well, with new energy making comprehensive efforts, both pure electric and narrowly defined plug-in hybrid performances are very good. Overall, the advantage of new energy lies in the outstanding high-end hybrid technology brought by independent innovation, while the structural fluctuations of new forces are larger, with good performance in range extension, gradual strengthening of the pure electric market, and jointly diverting the gasoline vehicle market. In September, self-owned gasoline vehicles accounted for only 32% of self-owned vehicles.

影响价格变化的主要是结构变化的影响。近几年的车市价格呈现持续上升的态势,2019年是15.1万元,2020年是16.2万元,今年累计平均是18.2万元,9月是17.4万元。

影响价格变化的主要是结构变化的影响。近几年的车市价格呈现持续上升的态势,2019年是15.1万元,2020年是16.2万元,今年累计平均是18.2万元,9月是17.4万元。