Source: Wall Street See

Author: Gao Zhimou

Consumer spending remains robust, moderate crediting conditions eased, coupled with anticipated inflation relief and declining interest rates, all provide support for the usa economy to avoid a hard landing.

Recently, there has been a heated debate in the global capital markets about whether the US economy will have a "soft landing" or a "hard landing". However, the latest bank performance reports point to a new possibility: the US economy may not land at all.

The so-called non-landing usually refers to the economy not experiencing the expected slowdown or recession after high growth, but continuing to maintain strong growth momentum, while inflation levels remain uncontrolled, leading to a situation where the Federal Reserve has virtually no room for interest rate cuts. Stocks benefit from strong economic performance on one hand, while also facing suppression from rising risk-free interest rates, showing an overall fluctuating trend.

The so-called non-landing usually refers to the economy not experiencing the expected slowdown or recession after high growth, but continuing to maintain strong growth momentum, while inflation levels remain uncontrolled, leading to a situation where the Federal Reserve has virtually no room for interest rate cuts. Stocks benefit from strong economic performance on one hand, while also facing suppression from rising risk-free interest rates, showing an overall fluctuating trend.

$JPMorgan (JPM.US)$ and $Wells Fargo & Co (WFC.US)$ The report indicates that credit card spending growth is slowing down, with an increase in credit card overdue payments. For example, JPMorgan's credit card service sales volume (excluding business credit cards) increased by nearly 7% year-on-year, lower than the almost 8% increase in the second quarter, and the first quarter increase exceeded 9%.

At first glance, this seems to suggest that economic activity is slowing down. However, JPMorgan's CFO Jeremy Barnum believes it is more a result of the normalization of post-pandemic consumption patterns rather than a sign of economic recession. He added that while travel and entertainment spending has decreased, retail consumption remains robust, indicating that consumer confidence has not wavered.

In particular, Barnum explained that after the difficult period of the pandemic, there has been a 'significant shift' in travel and entertainment spending, 'because people have done a lot of travelling, they have booked cruises they have never booked before, everyone is going out to eat more frequently, and so on. This situation has now returned to normal.'

In general, a decrease in such expenses may indicate a shift from discretionary spending to necessary consumer goods, such as rbob gasoline or groceries, daily necessities. This usually indicates that consumers are preparing for a worse economic environment.

However, JPMorgan's consumer data does not show this situation. For example, the bank has not seen signs of weak retail consumption. Furthermore, Barnum stated:

"Therefore, overall, we believe that consumer spending patterns are robust, which aligns with the statement that consumer fundamentals are solid, and also aligns with the central forecast scenario of the current economic 'soft landing'."

Similarly, bank executives believe that the increase in some credit card overdue payments can be traced back to loans issued during the special period between 2021 and 2022.

At that time, due to government stimulus measures and forced savings, many borrowers had unusually strong financial conditions. Under these circumstances, some borrowers obtained credit that would be difficult to obtain under normal conditions. However, overall, Wall Street banks believe that the scale of these problematic loans is generally manageable.

Wells Fargo & Co CEO Charlie Scharf believes on Friday that slowing inflation and dropping interest rates will alleviate consumer pressures, especially for low-income groups.

"The benefits of slowing inflation and decreasing interest rates should extend to all customers, particularly those with lower incomes."

It is worth noting that some media analysis suggests that the rising credit card cancellation rate may also reflect a loosening credit environment, which is favorable for economic growth. For example, JPMorgan Chase stated that this year it expects a credit card net cancellation rate of about 3.4%, lower than its long-term target in underwriting new credit card debt. The media believes that this means the bank can offer loans to a wider range of customers, or allow customers to borrow more, even if the default rate slightly rises, they can still maintain profitability.

In the face of these signs, Wells Fargo & Co and JPMorgan Chase both remain bullish on the growth prospects of the credit card business. JPMorgan Chase informed analysts that although lower rates may slow the bank's core net interest income by 2025, the bank expects the growth of revolving credit card balances to begin helping it grow again by the middle of next year. To seize market opportunities, the banks are launching new credit card products, such as the travel reward card recently launched in cooperation with$Expedia (EXPE.US)$.

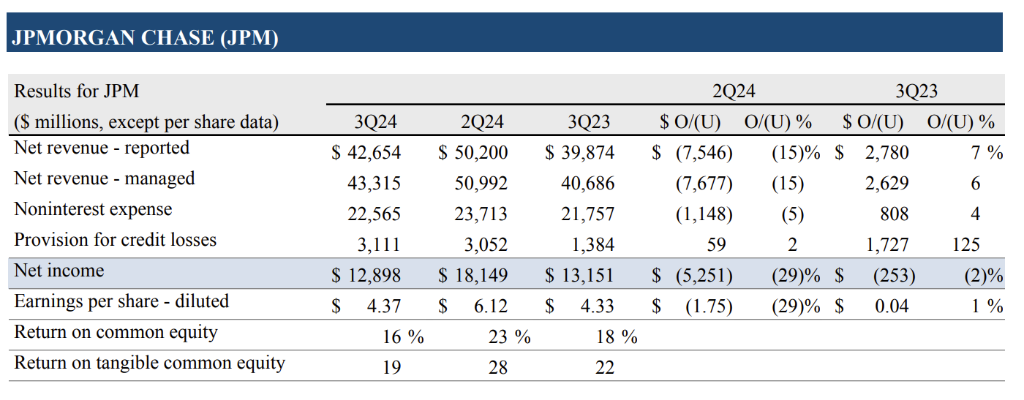

Overall, the performance and views of some Wall Street major banks seem to suggest that the American economy is in a state of "non-landing". For example, reports from Wall Street indicate that JPMorgan Chase has performed exceptionally well, with revenue and profit exceeding expectations. Meanwhile, consumer spending remains robust, credit conditions are moderately easing, and the expected easing of inflation and interest rate declines all provide support for the non-landing pattern of the American economy.

However, analysts warn that it is still necessary to closely monitor the changes in future economic indicators to confirm whether this trend can be sustained. With the continuous changes in the global economic situation, the phrase "non-landing" will stand the test of time, and it still needs further observation.

Editor/Jeffy

所谓不着陆,通常是指经济在高增长后没有经历预期的放缓或衰退,而是继续保持强劲的增长势头,但通胀水平也未能得到有效控制,导致美联储几乎没有降息空间的情况

所谓不着陆,通常是指经济在高增长后没有经历预期的放缓或衰退,而是继续保持强劲的增长势头,但通胀水平也未能得到有效控制,导致美联储几乎没有降息空间的情况