Despite signs of escalating inflation rates and the heavy pressure of high interest rates in recent years, some low-income Americans are struggling, but overall US consumers maintained strong consumption momentum in the third quarter.

The two largest commercial banks in the United States stated on Friday that despite signs of escalating inflation rates and the heavy pressure of high interest rates in recent years, some low-income Americans are struggling, but overall US consumers maintained strong consumption momentum in the third quarter. Financial report data shows that Wall Street financial giant $JPMorgan (JPM.US)$ and $Wells Fargo & Co (WFC.US)$ overall profitability is resilient. Despite JPMorgan increasing its provisions for bad loans, optimistic comments from the bank's executives further eased investors' concerns about the rising borrowing costs for consumers and significantly alleviated worries about the US economy approaching the edge of recession.

In terms of stock prices, the stock price of the financial giant JPMorgan, with a market cap as high as $600 billion, rose over 5% during regular trading hours in the US stock market, closing with an increase of over 4%; Wells Fargo & Co's stock price rose nearly 6% during trading hours and closed with a gain of 5.6%. Undoubtedly, these two high market cap heavyweight financial giants are driving the US stock market benchmark -$S&P 500 Index (.SPX.US)$Setting a record high on Friday, this index closed at its 45th record high this year, revealing optimistic information about a 'soft landing' and fueling investors' anticipation for the upcoming round of US stock earnings season.

"Overall, we believe that consumer spending patterns are very stable," pointed out Jeremy Barnum, Chief Financial Officer of JPMorgan. JPMorgan is one of the largest commercial banks in the USA and also one of the leaders of the country's economy. He added that consumer spending has returned to a normalized pattern post the COVID-19 rebound, with Americans splurging primarily on travel and dining out for some time after the pandemic, but now consumer spending is more balanced.

"Overall, we believe that consumer spending patterns are very stable," pointed out Jeremy Barnum, Chief Financial Officer of JPMorgan. JPMorgan is one of the largest commercial banks in the USA and also one of the leaders of the country's economy. He added that consumer spending has returned to a normalized pattern post the COVID-19 rebound, with Americans splurging primarily on travel and dining out for some time after the pandemic, but now consumer spending is more balanced.

Occasional soft data in the US non-farm job market has sparked investors' concerns that the Fed's aggressive interest rate hikes to curb inflation might lead the US into an economic recession or a 'hard landing'. However, Barnum, in an interview with analysts, stated that the consumer spending pattern is "consistent with the notion of a solid consumer base, in line with a strong labor market, and with the central optimistic view of the current economy not 'landing'."

Michael Santomassimo, Chief Financial Officer of Wells Fargo & Co, told reporters that even though the scale of credit and debit card spending has decreased compared to earlier this year, it remains 'quite stable'.

According to the bank's financial reports, based on debit card purchases and overall transaction volume, there has been an almost 2% year-on-year increase, with credit card sales terminals showing an approximately 10% year-on-year growth in transaction volume. JPMorgan's latest debit and credit card spending has also grown by 6% year-on-year.

The other two financial giants on Wall Street - Bank of America (BAC.US) and Citigroup (C.US) - also major commercial banks in the USA, will release their performance reports next week. Retail sales data will also be announced next week, providing a more comprehensive understanding of a crucial data point for the US economy - consumer spending scale.

Some institutional investors believe that the confidence shown in the financial reports of Wall Street giants on Friday is a very positive and important signal for the US stock market and the overall US economy so far.

In terms of economic data, the latest unexpectedly strong non-farm job data, better-than-expected unemployment rates, significantly revised long-term GDP growth rates, combined with the broadly in-line initial jobless claims in recent weeks, and the sustained steady decline in US inflation, along with the financial reports released on Friday by Wall Street giants showing robust consumer spending, outline a scenario perfectly matching the 'soft landing' vision held by Federal Reserve officials for the US economy. Therefore, some economists are shouting out the success of the US economy in achieving a 'soft landing,' or being extremely close to it.

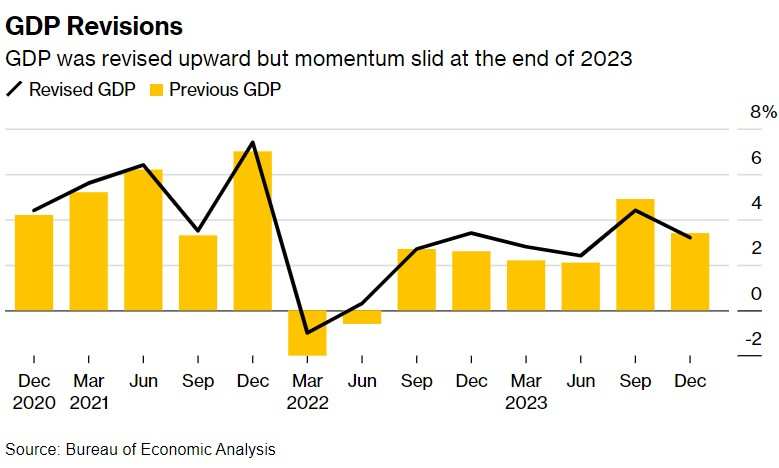

Following the sudden economic downturn in the United States caused by the epidemic, even after experiencing$Qualcomm (QCOM.US)$the Federal Reserve's aggressive interest rate hiking process after inflation, pushing the US benchmark interest rate to the highest level in over 20 years at 5.25%-5.5%, but the US economy rebounded quite strongly. The comprehensive annual update from the US Bureau of Economic Analysis shows that from the second quarter of 2020 to the end of 2023, the average inflation-adjusted annual growth rate of the Gross Domestic Product (GDP) in the United States is 5.5%. Compared to the previously announced 5.1% increase, the revised number is significantly more optimistic.

For the actual GDP annualized quarterly rate for the second quarter of the USA, the optimistic growth rate of 3% announced earlier is maintained, with the rebound from the previous quarter mainly reflecting the accelerated growth in U.S. consumer spending, inventory investment, and business spending, indicating that the economic output in Q2 of USA still achieved strong growth. In the first quarter of this year, the U.S. government revised the GDP growth rate from the previously reported 1.4% to the latest final value of 1.6%. The strong economic growth data in Q1 and Q2, combined with the Federal Reserve initiating a rate-cutting cycle with a 50 basis point cut, significantly boosts investors' confidence in the U.S. economy successfully achieving a 'soft landing.'

"In my opinion, JPMorgan and Wells Fargo's interpretation of consumer spending is very healthy. Consumer spending seems to be more normalized, which is very healthy for the overall US economy," said Dave Wagner, stock manager at Aptus Capital Advisors, who holds large bank stocks.

However, Santomassimo, the chief financial officer of Wells Fargo, warned that the cumulative impact of long-term inflation in the United States is lowering the income-oriented consumer group. The bank is observing whether this pattern will spread to high-income groups and high net worth groups not driven by wages for consumption.

On Friday, a survey from the University of Michigan showed a slight decline in US consumer sentiment in October due to continued dissatisfaction with high prices.

"When you look at the overall average level, it looks good, but I think it is more distorted by high-income, high net worth consumer groups." Paul Nault, senior wealth advisor and market strategist at Murphy & Sylvest in Illinois, said.

He added: "It must be admitted that the situation is somewhat severe for those with lower incomes. We see an increase in the scale of defaults and car loans. We see a decrease in deposit scale, while credit card balances continue to rise."

JPMorgan and Wells Fargo & Co, the two major commercial banks, have set aside huge amounts of cash to offset potential bad debt growth. JPMorgan set aside $3.11 billion, a significant increase from $1.38 billion set aside a year ago, mainly due to potential credit card loan losses. Meanwhile, Wells Fargo & Co set aside $1.07 billion, slightly lower than the $1.2 billion set aside in the same period last year, although the bank pointed out in its financial report that it has increased its credit card loan reserves in line with the trend of rising balances.

The Philadelphia Fed said on Wednesday in Eastern Time that earlier this year, concerns were raised over the over ten-year high credit card delinquency rate, indicating that Americans are becoming excessively stressed due to inflation and high interest rates, but this situation began to improve significantly in the second quarter.

The good news is that the Philadelphia Fed stated that signs of deterioration in short-term borrowing lasting a month or longer mark their largest drop in three years, although it is still premature to announce a turning point in the overall U.S. credit performance.

Barclays bank's analyst team stated in a report on Thursday that they expect "the scale of credit card loan losses for American consumers to continue to normalize, but the pace may be slower than the previous few months."

"We believe the situation of a 'soft landing' for the U.S. economy has become very clear, but it is still too early to conclusively say that the unexpected 50 basis point cut by the Fed in September has completely stabilized the labor market. We believe it is more likely that the Fed's next rate cut will follow the normal pace of a 25 basis point cut in November." Bloomberg Economics economists Anna Wong, Stuart Paul, Eliza Winger, and Estelle Ou said.

Editor/rice

“总体而言,我们认为消费者支出模式是非常稳定的,”摩根大通首席财务官杰里米·巴纳姆指出。摩根大通是美国最大规模商业银行,同时也是美国经济的领头羊之一。他补充表示,消费者支出已经从新冠疫情后的反弹中恢复常态化模式,疫情之后的一段时间内美国人挥霍主要在旅行和外出就餐上,但是现在消费支出更加均衡。

“总体而言,我们认为消费者支出模式是非常稳定的,”摩根大通首席财务官杰里米·巴纳姆指出。摩根大通是美国最大规模商业银行,同时也是美国经济的领头羊之一。他补充表示,消费者支出已经从新冠疫情后的反弹中恢复常态化模式,疫情之后的一段时间内美国人挥霍主要在旅行和外出就餐上,但是现在消费支出更加均衡。