Samsung used to be a cyclical chip stock, attracting buy on dips whenever its stock price seemed cheap. But now the situation is no longer the same.

Financial and Economic APP noticed that Samsung used to be a cyclical chip stock, attracting buy on dips whenever its stock price seemed cheap. But now the situation is no longer the same.

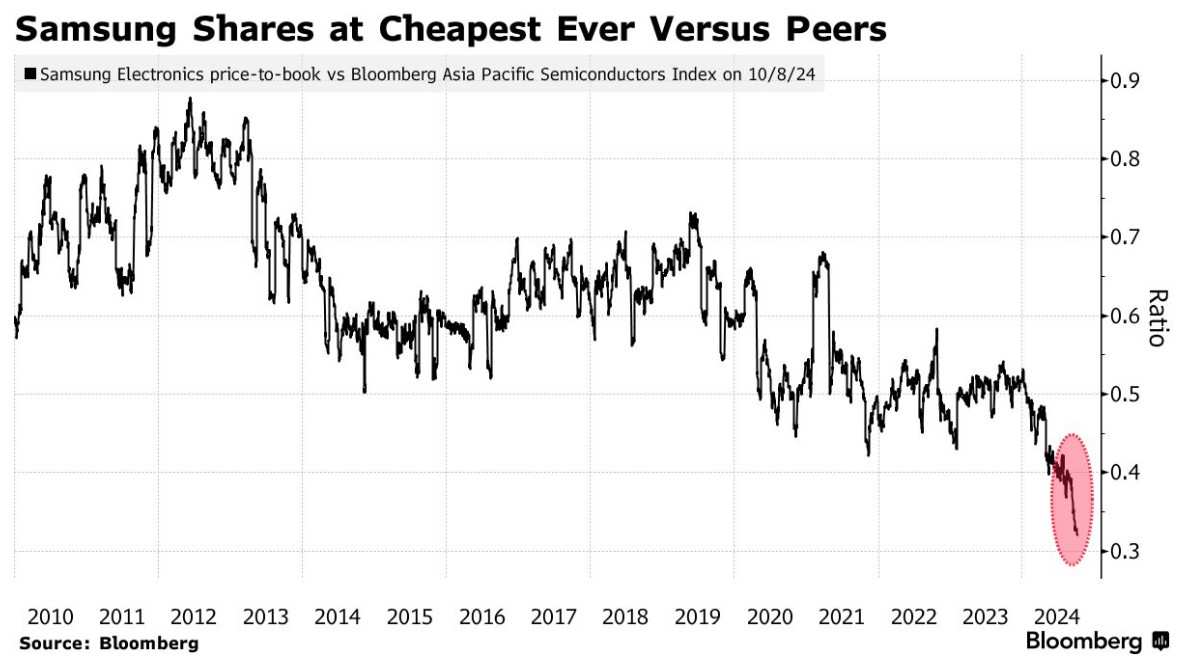

In the past three months, Samsung's stock price has declined by one-third, currently with a P/B ratio of less than one, hitting a historical low compared to major Asian peers since the end of 2009. This is not enough to attract investors.

This company, which has long been in a leading position in memory chips, is facing a potential crisis as it struggles to make breakthroughs in high-end AI semiconductor field, while the rise of Chinese competitors threatens its mid-end chip sector. Investors and analysts are starting to question something they have never questioned before: Samsung's competitiveness.

This company, which has long been in a leading position in memory chips, is facing a potential crisis as it struggles to make breakthroughs in high-end AI semiconductor field, while the rise of Chinese competitors threatens its mid-end chip sector. Investors and analysts are starting to question something they have never questioned before: Samsung's competitiveness.

Jinho Park, head of private equity investments at NH-Amundi Asset Management, said, 'There is too much uncertainty.' He added that if investors believe Samsung is leading among its peers, its stock price will rise. 'Ultimately, the key question is whether the company is competitive enough.'

On Tuesday, Samsung uncommonly apologized to investors for its preliminary performance being below expectations, citing efforts to address delivery delays of Nvidia's AI training chips. This allows SK Hynix to dominate in the high-bandwidth memory sector, while Samsung's progress in customized chip outsourcing compared to Taiwan Semiconductor is minimal.

Eugene Investment Banking analyst Lee Seung-woo wrote in a report on Thursday: "Samsung's plan mentioned in the last earnings call has become an unfulfilled commitment, and the gap with Taiwan Semiconductor's market cap will only grow wider." "This raises a question: whether the one-time non-memory factor affecting performance is really one-time," he added, referring to the impact on performance bonuses.

Goldman Sachs is one of the banks that lowered Samsung's profit expectations. The company cut Samsung's target stock price by 9.5% to reflect worse forecasts for DRAM and NAND chip shipments, as well as memory and contract chip manufacturing business profit margins. Analysts led by Giuni Lee wrote in a report that the company sees a low likelihood of Samsung achieving the guidance it provided during the July earnings call.

Despite Morgan Stanley's expectation that the company's profit growth is limited as quarterly DRAM contract prices begin to stabilize, it does see a possibility for buying on dips. Analyst Shawn Kim noted that historically, buying stocks when the price is below book value has resulted in over 40% ROI in most cases within six months.

However, for Neil Campling, founding partner of Chameleon Global Capital, the focus is not on these preliminary performances, but on the company's missteps.

"Samsung's pain is SK Hynix's gain", he said, adding that SK Hynix is making strong progress in the profitable HBM field, ensuring Nvidia's allocation in 2025.

这家长期处于内存芯片领先地位的公司正面临一场潜在危机,因为它难以在高端人工智能半导体领域取得突破,而中国竞争对手的崛起威胁着其中端芯片领域。投资者和分析师开始质疑他们从未质疑过的东西:三星的竞争力。

这家长期处于内存芯片领先地位的公司正面临一场潜在危机,因为它难以在高端人工智能半导体领域取得突破,而中国竞争对手的崛起威胁着其中端芯片领域。投资者和分析师开始质疑他们从未质疑过的东西:三星的竞争力。