The 2025 and 2026 net profit margins of Top Glove Corporation Bhd are projected to grow at 39% and 42%, respectively, as a result of higher sales volume and factory utilisation rate, according to Kenanga Investment Bank Bhd (Kenanga Research).

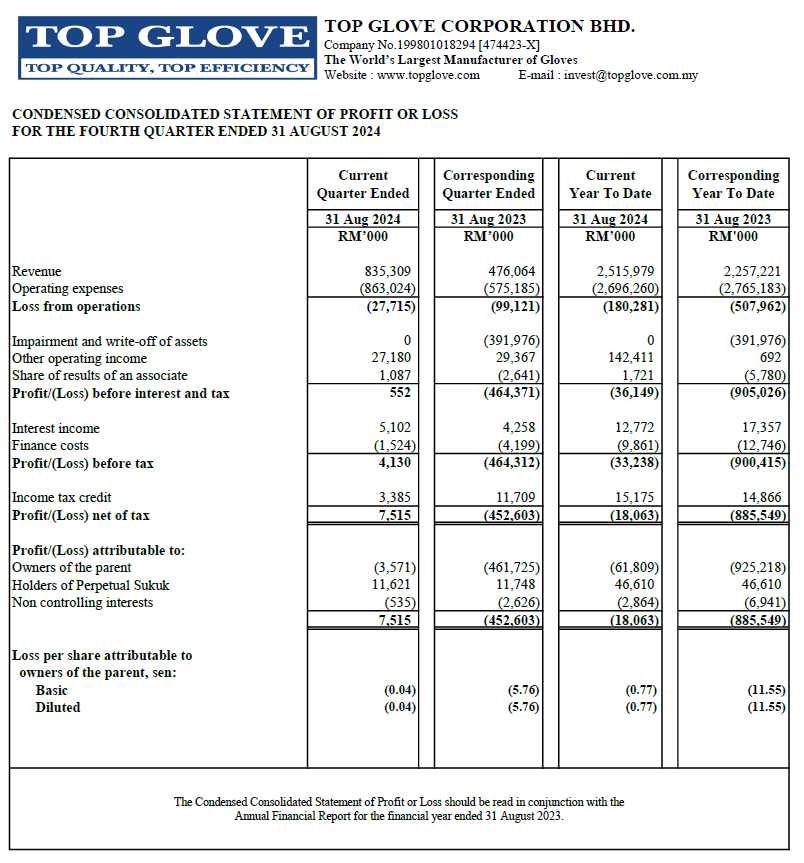

Unsurprisingly, the glove manufacturer recorded a 75.5%1 revenue surge year-on-year (YoY) in the last quarter of financial year 2023/242 (4QFY23/24), and its revenue for the full-year grew by 11.5%, according to a press release circulated by Top Glove on Thursday.

The 4QFY23/24 revenue amounted to RM835 million, representing a 75.5% increase from the same quarter of the previous year. This is the strongest sales volume growth for Top glove since the peak of the pandemic in 2021.

Notably, the group acknowledged that its bottom line for 4QFY23/24 was affected by the weakening of the US dollar against the ringgit, prompting an upward revision to its selling prices. However, the effect of the revision will be realised from November 2024 onwards due to time lag.

Notably, the group acknowledged that its bottom line for 4QFY23/24 was affected by the weakening of the US dollar against the ringgit, prompting an upward revision to its selling prices. However, the effect of the revision will be realised from November 2024 onwards due to time lag.

Mr Lim Cheong Guan, Managing Director of Top Glove remarked, "We are pleased that the group's financial performance has improved significantly over the course of FY2023/24, bringing us closer to breaking even. Our full year sales volume growth continues to be healthy. These are strong indicators of market resurgence and we are well positioned to ride the recovery wave. Our consistent progress has been driven by ongoing improvement initiatives, and with the continued support of our employees, the group is confident we are well on the path to profitability and sustainable growth."

Following the announcement of the 4Q financials, Top Glove's stock price was largely unmoved, lingering around RM1.00, possibly due to the widespread news of positive revenue and profitability figures on the glove manufacturing sector going into today's announcement.

- The percentage is stated in a Top Glove-circulated press release and seems to be calculated from the attached Consolidated Statement of Profit and Loss (enclosed).

︎ - Financial year ended 31 August 2024. ︎