The new product did not significantly change the recent financial outlook. Investors are looking forward to the return brought by AMD's AI investment, and are still waiting for signs of AMD catching up with nvidia before the third quarter financial report may be released. Comments suggest that AMD's new GPU MI325X cannot effectively challenge nvidia's dominant position, claiming to benchmark Blackwell, but actual performance may not be as good as Blackwell.

Despite the release of a new product claiming to surpass Nvidia's similar ai chip in reasoning performance, AMD's stock price still closed sharply lower. Investors seem to be unimpressed by verbal presentations, they are truly expecting signs of return on investment in AI deployment.

On Thursday, October 10, Eastern Time, during AMD's datacenter event introducing the MI325X AI accelerator and multiple network chips, AMD's stock price briefly rose in early trading and at the beginning of the lunch break in the US stock market, before continuing to decline throughout the afternoon, hitting a new low of $162 at the end, with an intraday decline of about 5.3%, eventually closing down 4%, extending the decline for two consecutive days to a low close of the week, marking the largest intraday and closing decline since September 3.

One would think that the launch of a powerful AI chip should be bullish, especially since AMD's new product also competes with Nvidia's highly anticipated Blackwell architecture chip, why then is AMD's stock price accelerating its decline?

One would think that the launch of a powerful AI chip should be bullish, especially since AMD's new product also competes with Nvidia's highly anticipated Blackwell architecture chip, why then is AMD's stock price accelerating its decline?

Media summarised that the stock price decline shows that investors are still waiting for returns from AMD's AI business. Their comment suggests that although AMD has released new chips, the company's near-term financial outlook has not changed significantly. Like Nvidia, AMD also promises to release new AI accelerators every year to accelerate innovation. However, AMD still has a long way to go to catch up with Nvidia, Wall Street has been waiting for signs of progress from AMD catching up with Nvidia. This progress may have to wait until the next financial report from AMD, expected to be released around the end of this month after the third quarter earnings report.

The second quarter financial report released at the end of July this year showed that AMD's net revenue from the datacenter business was $2.8 billion, a year-on-year increase of 115%. This was mainly due to strong demand for the AI accelerator MI300. As the flagship product competing with Nvidia's H100, MI300's single-season sales exceeded $1 billion, far surpassing market expectations. At that time, AMD CEO Lisa Su stated that AMD's AI chip sales were "higher than expected", with plans to launch MI325X in the fourth quarter of this year, a "very competitive" MI350 compared to Nvidia's Blackwell next year, and MI400 in 2026.

After AMD released its financial report, some analysts believe that Nvidia still has a leading advantage over AMD. Compared to Nvidia, AMD's datacenter business scale is still very small - with quarterly sales of only $2.8 billion. As of the end of April in the first quarter of the 2025 fiscal year, Nvidia's datacenter revenue reached $22.6 billion, setting a record high for the business unit in a single quarter, with a 23% increase from the previous quarter and a staggering 427% increase year-on-year.

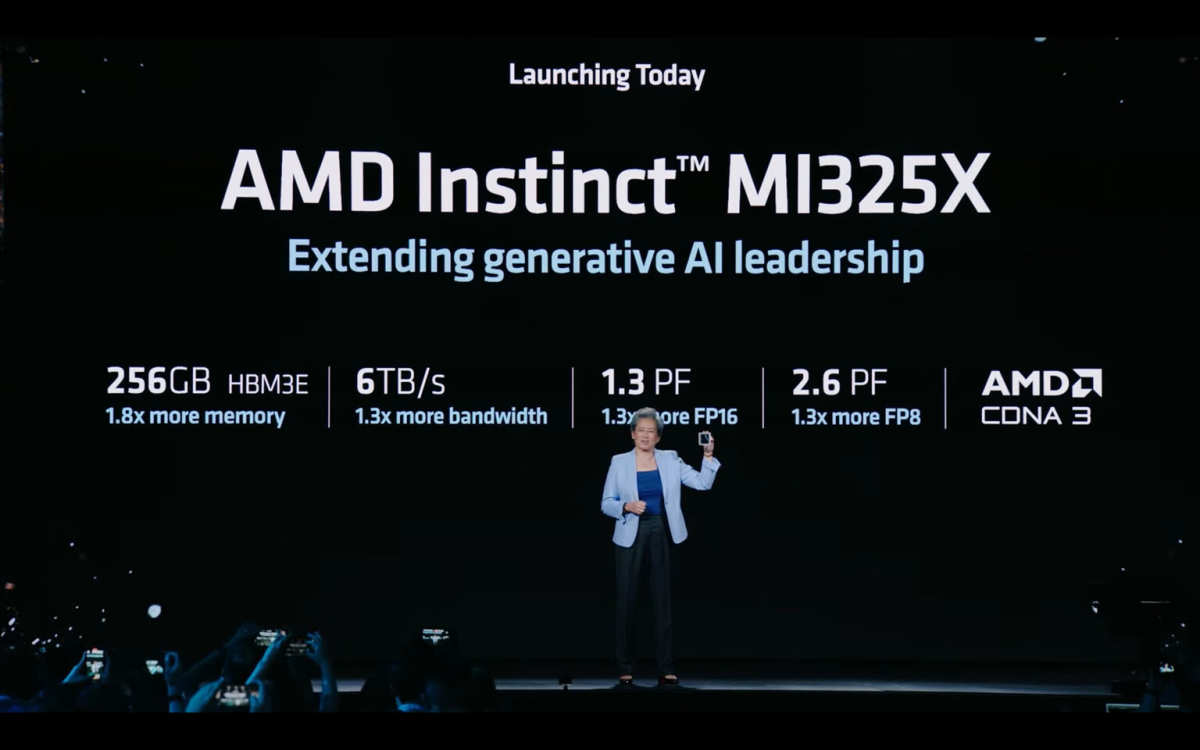

During this Thursday's datacenter event, AMD introduced that the company's latest AI datacenter GPU, MI325X, is expected to be shipped in the fourth quarter of this year and will be launched into the market in the first quarter of next year through partners such as Dell, Eviden, Gigabyte, Huiyu, Lenovo, and Super Micro Computer.

Some media reports indicate that the event this Thursday reflects AMD's increasingly optimistic view on the long-term market potential of AI chips. Su Zifeng mentioned that in the past year, the demand for AI has exceeded AMD's expectations. She now predicts that by 2028, the market size of AI datacenter GPUs will reach $500 billion, with an annual growth rate of over 60%. In December of last year, she predicted that the market would exceed $400 billion by 2027.

Regarding whether AMD's MI325X will surpass Nvidia's products, the media cannot assert and implies it as an unknown. It is pointed out that the most comparable to MI325X is not Nvidia's H200, but Nvidia's most powerful Blackwell architecture GPU, which has already been introduced to customers this quarter. The performance of the Blackwell GPU may be comparable to the MI325X, as the MI325X is based on the same CDNA 3 architecture as AMD's older MI300X GPU.

Earlier, Lynx Equity Strategies commented that the sharp drop in AMD's stock price on Thursday may be due to MI325X's inability to significantly change AMD's lagging position and effectively challenge Nvidia's dominant status. "Unless AMD can demonstrate a clear market share growth driver, the stock may retest its annual low point."

Lynx Equity Strategies also pointed out,

AMD's 'management may promote that its chip benchmark test results are better than Nvidia's Hopper series, but in actual workload operations, we believe that MI300X still lags behind Nvidia's H100. In addition to superior HBM memory density, software stack, backplane networking, and power consumption are equally important.'

However, KeyBanc's analyst John Vinh believes that even though AMD is far behind Nvidia, the trajectory of AMD's development is clearly optimistic. It is expected to ship 0.5 million units of Instinct MI300X AI accelerators this year, making a more prominent presence in the AI market.

Some media reports that the AI hardware sector is attracting enterprises to invest huge budgets, and AMD hopes to get a share of the pie. Nvidia is currently the leader in the entire market, and some analysts believe that given the huge opportunities in the AI hardware sector, many companies have the space to succeed.

Editor/Lambor

按说推出功能强大的AI芯片应该是利好,何况AMD的新品还对标英伟达备受关注的Blackwell架构芯片,为什么AMD股价还加速下跌?

按说推出功能强大的AI芯片应该是利好,何况AMD的新品还对标英伟达备受关注的Blackwell架构芯片,为什么AMD股价还加速下跌?