As investors prepare for the US monthly inflation data that may shake the financial markets, 'sell the yen' is becoming an increasingly popular battle cry.

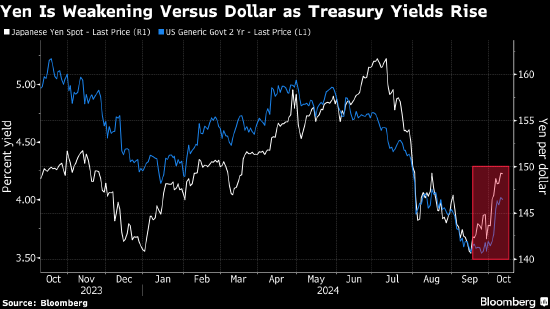

As traders reduce their bets on a Fed interest rate cut, pushing up the dollar and US Treasury yields, several major banks in Japan are almost unanimous in saying that the yen is likely to continue to weaken. The possibility of further decline in the yen is emboldening traders to re-establish bearish positions; the yen is one of the currencies most easily sold off when US data shows hot inflation trends.

'Sell the yen' is the most popular trade so far - the arbitrage space for hedge funds shorting the yen still exists," said Nick Twidale, Chief Analyst at ATFX Global Markets in Sydney, who has been trading the yen for over 20 years. "Given the market's skepticism about the extent of Fed rate cuts, investors naturally tend to lean towards shorting the yen.

The yen is the third most actively traded currency globally, after the dollar and the euro, and this high liquidity makes it easy for investors to buy and sell. The yen has been on a softening trend for three consecutive years because of relatively low interest rates in Japan, making the yen an ideal target for so-called arbitrage trading.

The yen is the third most actively traded currency globally, after the dollar and the euro, and this high liquidity makes it easy for investors to buy and sell. The yen has been on a softening trend for three consecutive years because of relatively low interest rates in Japan, making the yen an ideal target for so-called arbitrage trading.

Institutions such as Mizuho Securities, Nomura Securities, and Mitsubishi UFJ Financial Group have stated that the yen could fall to 150 yen per US dollar, or even lower, posing the risk of authorities intervening again. The yen has dropped by 4.5% in the past month, putting officials and yen traders on high alert.

If the US CPI exceeds expectations, there is a risk of a broad-based appreciation of the dollar, as Yujiro Goto, Head of Foreign Exchange Strategy at Nomura Securities in Tokyo, wrote in a research report. 'The dollar also has a good chance of attempting to reclaim the 150 yen level.'

Signs of unease are growing in Tokyo. Japan's top currency official, Junichi Mizumi, told reporters on Monday that he is closely monitoring the foreign exchange market with a sense of urgency. The newly appointed Finance Minister, Katsunobu Kato, also stated on the same day that sudden fluctuations in the yen exchange rate could have negative impacts on business activities and residents' lives.

The yen fell to a near two-month low of 149.55 in intraday trading on Thursday before turning higher. The last time it fell to 150 was on August 1st.

日元是全球交投第三活跃的货币,仅次于美元和欧元,这种强流动性使得投资者很容易买进卖出。日元已经连续三年走软,因为日本利率相对较低,使得日元成为所谓套利交易的理想目标。

日元是全球交投第三活跃的货币,仅次于美元和欧元,这种强流动性使得投资者很容易买进卖出。日元已经连续三年走软,因为日本利率相对较低,使得日元成为所谓套利交易的理想目标。