Source: Caihua News Agency

$Guotai Junan (601211.SH)$ und $Haitong (600837.SH)$ The merger rules were announced. For A-share shareholders, this “aircraft carrier-grade” merger is unquestionably popular. After the two companies' A-share shares resumed trading on October 10, their A-share prices both rose and stopped. Cathay Pacific Junan now reports 16.17 yuan, a 16.92% premium over its consolidated benchmark price of RMB 13.83 yuan, with a market value of RMB 143.973 billion; Haitong Securities's A share price spike of RMB 9.65, compared to RMB 8.57 billion. Price 12.60% The market value of A-shares is 126.07 billion yuan, which is equivalent to 87.57% of Guotai Junan's current A-share market value.

The corresponding H shares of the two brokerage firms also soared sharply after the resumption of trading to keep up with the period of their suspension $CITIC SEC (06030.HK)$ Wait for the increase in brokerage firms, of which $HAITONG SEC (06837.HK)$ H shares closed up 95.48% to HK$7.09, with a market capitalization of HK$92.625 billion; $GTJA (02611.HK)$ H shares surged 55.07% to HK$12.26, with a market capitalization of HK$109.16 billion.

Merger transaction rules

Cathay Junan will issue Guotai Junan's A shares to all A-share exchange shareholders of Haitong Securities and will issue Cathay Junan H shares to all H-share exchange shareholders of Haitong Securities. The A shares and H shares to be issued will be separately applied for listing and circulation on the Shanghai Stock Exchange and the Hong Kong Stock Exchange. Haitong Securities's A shares and H shares will be cancelled accordingly, and Haitong Securities will also terminate its listing. As the surviving company, Guotai Junan inherits and undertakes all assets, liabilities, business, personnel, contracts, and other rights and all rights of Haitong Securities Obligations. After the merger, the company will adopt a new company name.

Cathay Junan will issue Guotai Junan's A shares to all A-share exchange shareholders of Haitong Securities and will issue Cathay Junan H shares to all H-share exchange shareholders of Haitong Securities. The A shares and H shares to be issued will be separately applied for listing and circulation on the Shanghai Stock Exchange and the Hong Kong Stock Exchange. Haitong Securities's A shares and H shares will be cancelled accordingly, and Haitong Securities will also terminate its listing. As the surviving company, Guotai Junan inherits and undertakes all assets, liabilities, business, personnel, contracts, and other rights and all rights of Haitong Securities Obligations. After the merger, the company will adopt a new company name.

At the same time, Cathay Pacific Junan issued no more than 0.626 billion A-shares to state-owned companies to raise supporting capital of no more than 10 billion yuan. The issue price may be 15.97 yuan/share. The funds raised will be used to supplement capital, support business development, supplement working capital, repay debts, and pay for mergers and acquisitions related to this merger transaction.

The exchange prices for Cathay Pacific Junan A shares and HK$7.73 per share for H shares are respectively RMB 13.83 per share and HK$7.73 per share (adjusted by mid-term dividend payout in 2024). Haitong Securities's share absorption and consolidated pricing benchmarks are RMB 8.57 per share and HK$3.58 per share for A shares, respectively.

The stock exchange price is calculated based on A-shares. Since the A-share price of Haitong Securities is approximately 62% of the benchmark price of Cathay Pacific Junan A-share transaction, the exchange ratio between Haitong Securities and Cathay Junan is 1:0.62, that is, each share of Haitong Securities A shares can be exchanged for 0.62 shares of Cathay Junan A shares. The exchange ratio of H shares is also the same. Each share of Haitong Securities H shares can be exchanged for 0.62 shares of Cathay Junan H shares.

It is worth noting that Haitong Securities's H shares have a higher discount compared to its A shares. Its H shares are equivalent to 46% of the Cathay Junan H share pricing benchmark. That is, according to the exchange rules and benchmarks, Haitong Securities's H share exchange price is HK$4.79 per share, a 33.8% premium over its benchmark price of HK$3.58. This is a good return for shareholders who held H shares of Haitong Securities before the suspension of trading was issued.

If the shareholders of Haitong Securities disagree with the share exchange, they may choose to leave the market at RMB 9.28 per share for A shares and HK$4.16 per share for H shares. However, it is worth noting that although Haitong Securities shareholders have a premium of RMB 9.28 compared to the share exchange pricing benchmark of RMB 8.57, considering that Cathay Pacific Junan plans to issue RMB 10 billion in A shares to state-owned companies at 15.97 yuan/share. Based on this sale price, if Haitong Securities shareholders choose to exchange Cathay Pacific Junan shares rather than hold cash, their shareholding value per share is expected to rise to 9.90 yuan, which is more cost-effective in exchange for cash. The value gap has narrowed significantly.

If calculated based on the size of Guotai Junan after absorbing Haitong Securities, Guotai Junan's total share capital will expand to 17.004 billion shares. After the merger, Guotai Junan will also issue 0.626 billion A-shares to state-owned companies to raise capital. After issuance, Guotai Junan's total share capital will be further expanded to 17.6297 billion shares.

If the sale price of A-shares issued to state-owned companies is calculated at RMB 15.97 per share, its overall market value may expand to RMB 281.546 billion, while according to Cathay Pacific Junan's current A share price of RMB 16.17, its consolidated and additional market value is expected to expand to RMB 274.955 billion, further narrowing the market value gap with CITIC Securities.

Based on the current A-share price of RMB 28.52, the A-share market value of CITIC Securities is approximately RMB 422.5 billion.

After Guotai Junan and Haitong Securities completed the merger and successfully issued A-shares, the current largest shareholder International Group and its co-actors will have a share of Guotai Junan's shares diluted from 30.26% before all transactions occurred to 18.83% after all transactions occurred.

The impact of the merger on the existing brokerage landscape

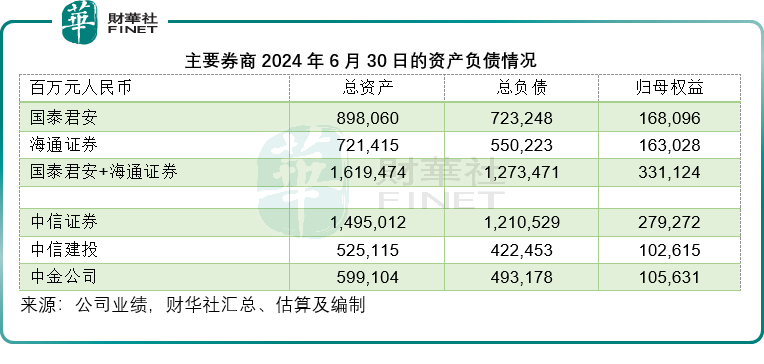

Based on current prices, the market value of Cathay Pacific Junan after the merger and issuance of additional A-shares may not have caught up with CITIC Securities, but judging from the balance and liability situation, the total asset size and share capital size of the two major brokerage firms after the merger will probably surpass CITIC Securities.

Coupled with additional funding of 10 billion yuan to consolidate Cathay Pacific Junan Capital, the merged Cathay Pacific Junan may have an advantage in securities business, investment business, and asset management business.

Judging from Wind's data (as of before the two brokerage firms announced their merger plans, same below), in the equity underwriting list since 2024, CITIC Securities and $CICC (03908.HK)$ It still ranks first and second, with equity underwriting amounts reaching 33.319 billion yuan and 30.567 billion yuan respectively. The third is Huatai Securities, with an underwriting scale of about 24.848 billion yuan. Cathay Pacific Junan and Haitong Securities ranked sixth and eighth respectively, with equity underwriting amounts of 9.857 billion yuan and 8.628 billion yuan respectively since this year.

If Guotai Junan and Haitong Securities merge, their share underwriting amount since this year could reach 18.485 billion yuan, suddenly jumping to fourth place.

In terms of shareholder underwriter revenue, Haitong Securities may have ranked third since this year, with a market share of 9.37%, and Guotaijun ranked sixth, with a market share of 7.34%. If the two brokerage firms merge, their shareholder underwriter revenue may reach 0.555 billion yuan, which will surpass CITIC Securities, as shown in the chart below.

In terms of bond underwriting, Cathay Pacific Junan and Haitong Securities may have reached 7.87% and 3.17%, respectively. If the two are combined, their underwriting scale may reach 988.4 billion yuan, which will surpass CITIC Construction Investment, which is in second place, but still lower than CITIC Securities's 1.27 trillion yuan.

In terms of equity underwriting for Hong Kong stocks, Haitong International ranked fourth among Chinese brokerage firms, after CICC, Huatai and CITIC. The scale of capital raised may be HK$0.898 billion, while Cathay Pacific Junan may be HK$0.155 billion. The merger of the two brokerage firms may strengthen its position in the Hong Kong stock underwriting business.

Therefore, as far as the investment banking business is concerned, the merger of Guotai Junan and Haitong Securities may achieve a strong alliance, becoming a strong competitor challenging the leading investment banking position of CITIC Securities and CICC.

Wealth management business — the main source of revenue for brokerage firms. Haitong Securities's stock trading volume in the first half of 2024 may be 5.8 trillion yuan, fund trading volume is 1.56 trillion yuan, while Cathay Pacific Junan's stock trading scale may be 9.87 trillion yuan, and securities investment funds have an estimated market share of 4.92% and 5.54%, respectively. The two brokerage firms will further expand their market share.

The two brokers' main handling fee income is the securities trading business. In the first half of 2024, Guotai Junan and Haitong Securities' brokerage securities business revenue was 1,965 billion yuan and 1,191 billion yuan respectively. If the two businesses merge, their total securities trading business revenue is expected to reach 3.155 billion yuan, which is higher than CITIC Securities's 2.986 billion yuan.

In terms of retail customers, the monthly activity of Haitong Securities's “e-Haitong” app during the period was 5.83 million, ranking fourth in the industry, while Guotai Junan's Junhong App had a monthly activity of 8.2873 million users. If the two were merged, their monthly activity could further increase dramatically.

summed

After announcing the merger, Cathay Pacific Junan and Haitong Securities experienced a month-long suspension of trading and missed out on the recent brokers' market. Therefore, their AH stock prices both surged after the resumption of trading, but because the increase in A-shares was limited, their increase was not yet complete. Therefore, based on the current price and the share exchange ratio and the subsequent increase in issuance, the combined market value of Cathay Pacific Junan may not be able to catch up with CITIC Securities — CITIC Securities's A share price has risen by a cumulative total of 45% since the brokerage market began on September 24.

However, judging from the scale of the business and the potential synergy of the merger, the merger of Cathay Pacific Junan and Haitong Securities may challenge the current leading positions of CITIC Securities, CICC, and Huatai Securities.

From an industry perspective, the merger of Cathay Pacific Junan and Haitong Securities may also trigger more and more small brokerage firms to seek to consolidate their business advantages through mergers. This will drive a wave of industry integration, enhance operators' overall business and pricing competitiveness through survival of the fittest, and facilitate the development of the industry.

Editor/jayden

国泰君安向海通证券全体A股换股股东发行国泰君安的A股股票,向海通证券全体H股换股股东发行国泰君安H股股票,拟发行的A股和H股股票将分别申请在上交所和港交所上市流通,

国泰君安向海通证券全体A股换股股东发行国泰君安的A股股票,向海通证券全体H股换股股东发行国泰君安H股股票,拟发行的A股和H股股票将分别申请在上交所和港交所上市流通,