There are already concerns about the growth of DHA “carriers”.

The Hong Kong Stock Exchange disclosed on September 30 that Newmans Health Food Holdings Co., Ltd. (“Newmans”), a retailer of DHA products for mother and child, applied for listing on the main board of the Hong Kong Stock Exchange. The sole sponsor was Caitong International. Notably, this is the sixth time since April 2019 that the company has submitted a statement to the Hong Kong Stock Exchange.

It should be noted that as a company with a “brain gold” concept on the popular “Big Health” circuit, Newmans's financial data with high performance growth and high gross profit is also impressive. However, even for such a company, the path to listing is still “repeated defeats and battles.”

The Zhitong Finance App noticed that Newmans is only an importer of algae oil DHA, and the company's core product, algae oil DHA, is imported by suppliers. Furthermore, the company has no R&D or production departments; it mainly earns money from algae oil DHA products. It can be seen that it has no core technical advantage, so it has a long way to enter the Hong Kong stock market.

The Zhitong Finance App noticed that Newmans is only an importer of algae oil DHA, and the company's core product, algae oil DHA, is imported by suppliers. Furthermore, the company has no R&D or production departments; it mainly earns money from algae oil DHA products. It can be seen that it has no core technical advantage, so it has a long way to enter the Hong Kong stock market.

The growth of DHA “carriers” is already weak

According to the prospectus, Newmans is mainly engaged in marketing, sales and distribution of finished nutritional products in China. The company's nutritional products are sold under exclusive brands (i.e. “Newmans” and “Newmans” (English “Nemans”)), and can be roughly divided into five main categories, namely algae oil, DHA, probiotics, vitamins, multi-dimensional nutrients, and algae calcium products. The Newmans business relies heavily on the Newmans brand. Newmans suppliers use the OEM model to produce Newmans nutritional products and/or attach the Newmans brand label to Newmans nutritional products.

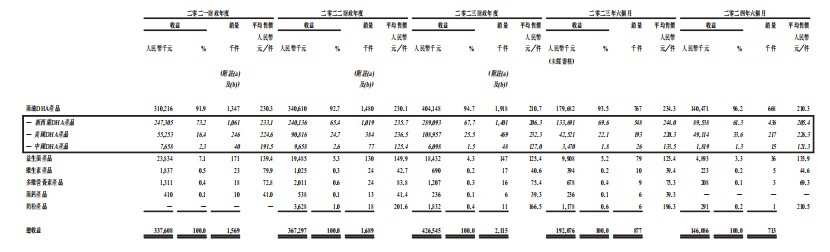

Algae oil DHA products are the company's main products and account for a large part of the revenue during the performance period. In fiscal year 2021, fiscal year 2022, fiscal year 2023, six months of 2023, and six months of 2024 (hereinafter referred to as the reporting period), the company's sales of algae oil DHA products accounted for about 91.9%, 92.7%, 94.7%, 93.5% and 96.2% of total revenue, respectively.

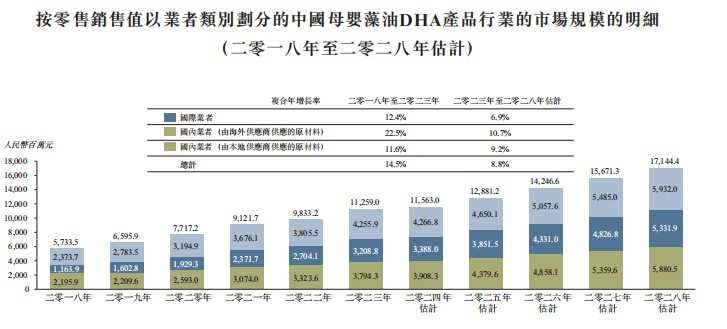

According to Frost & Sullivan, China's maternal and child algae oil DHA market can be subdivided into products launched by international and domestic traders. Among them, domestic products can be further divided into products using locally purchased and imported algae oil DHA raw materials. In 2023, domestic brands using imported algae oil DHA raw materials accounted for 28.5% of the total retail value of algae oil DHA products in China. Of these, the company accounted for about 20.5% in 2023. Based on the total retail value of algae oil DHA products made from imported raw materials, Newmans is the largest domestic brand.

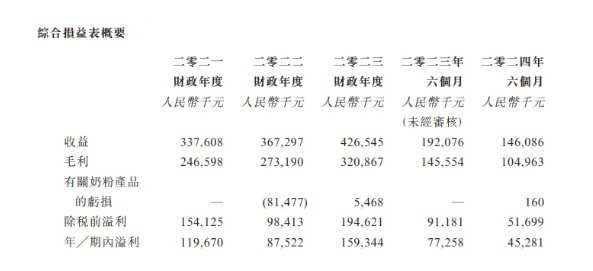

It is worth noting that Newmans, as a “carrier” of algae oil and DHA, has shown weak performance growth. From 2021 to 2023, the company's revenue was approximately 0.338 billion yuan (unit: RMB, same below), 0.367 billion yuan, and 0.427 billion yuan respectively; net profit for the same period was approximately 0.12 billion yuan, 0.088 billion yuan, and 0.159 billion yuan, respectively.

Continued steady revenue growth is not unrelated to Newmans' price cuts to promote growth. Sales of the company's algae oil DHA products from 2021 to 2023 were 1.347 million units, 1.48 million units, and 1.918 million units, respectively, with a significant increase in 2023. Also in this year, the average selling price of the company's algae oil DHA products dropped sharply. In 2023, the average price of Newman's algae oil DHA products was 210.7 yuan/piece. Previously, in 2021-2022, it was 233.1 yuan/piece and 235.7 yuan/piece, respectively, which stabilized at around 230 yuan/piece.

However, price cuts do not promote growth once and for all. In the first half of 2024, Newmans's growth declined. In the first half of 2024, the company's revenue was 0.146 billion yuan, down 24% year on year; net profit was 45.281 million yuan, down 41.4% year on year, and the decline was even more obvious.

More importantly, under the influence of price cuts, Newmans interest rates have declined markedly. During the reporting period, the company's gross margins were approximately 73.04%, 74.38%, 75.22% and 71.85% respectively; the net margins for the same period were approximately 35.45%, 23.83%, 37.36% and 31.00%, respectively. Despite falling interest rates, we are still seeing “huge profits” in algae oil DHA.

According to the Zhitong Finance App, the price reduction did not significantly reduce Newmans' inventory. At the end of 2022, the company's inventory was 69.36 million yuan, a sharp increase of 1.8 times over the previous year, accounting for about 17.2% of total assets; at the end of 2023, it was 62.3 million yuan, and inventory did not drop much. From 2022 to 2023, the total amount of the company's inventory (including milk powder products) deducted and provisions was approximately $41.3 million and $5.4 million, respectively.

In this context, if there is an unexpected major fluctuation or anomaly in the company's demand for manufactured products, or changes in customer tastes and preferences, or a new product is launched on the market, it may lead to a decline in demand and excessive inventory of specific products. In this way, the company's inventory will inevitably face the risk of obsolescence and slow flow. Additionally, the company may be required to write off and/or make provision for inventory, which will reduce the company's net profit.

China's health products industry will maintain rapid growth

The above data may be a true picture of Newmans' future performance growth and transformation from “price driven” to “volume driven”. On the good side, the Chinese health products market will maintain healthy growth for a long time, giving industry companies a wider room to grow.

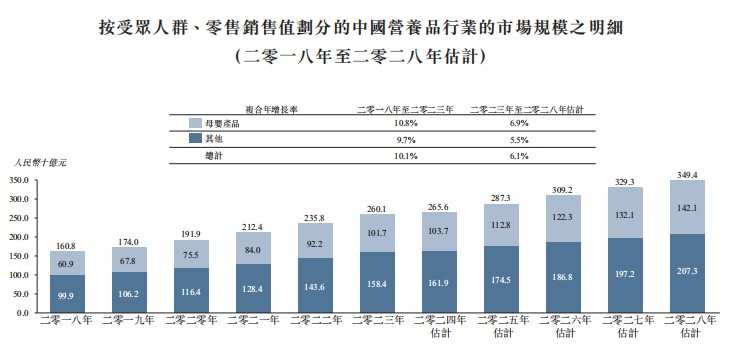

As Gen Z becomes the main fertility group with more scientific nutritional methods, the maternal and child products market is expected to become more segmented and specialized. Supported by increasing health awareness and growing demand for dietary supplements, the nutritional products market is expected to continue to grow at a compound annual growth rate of 6.9% from 2023 to 2028, reaching RMB 142.1 billion by 2028. At the same time, the general market for adults and the elderly is expected to grow at a moderate pace.

Among them, maternal and infant DHA has maintained a long-term rapid development trend as one of the main tracks in the health products market. The retail sales value in this market increased from approximately RMB 5.7335 billion in 2018 to approximately RMB 11.259 billion in 2023, with a CAGR of 14.5%. It is expected that with the steady development of the Chinese economy, the DHA market for maternal and child algae oil will continue to grow. The market size will reach approximately RMB 17.1444 billion in 2028, with a compound annual growth rate of 8.8% from 2023 to 2028.

Because of the good development prospects of the company's industry, Newmans also revealed in its prospectus that it hopes to use the power of the capital market to seize market opportunities to expand the company's business, expand its product portfolio through capital raising, and at the same time increase its brand awareness, position and market layout.

However, Newmans's business model: no product research and development, only terminal sales and brand operation, and the uncertainty is still strong. The company chose to cooperate with foreign manufacturers, entrust them to produce Newmans products, and then ship them back to China as original imported products to be sold at a high price.

As a “porter” of algae oil DHA, Newmans cannot control the quality of products provided by overseas suppliers. Furthermore, once overseas suppliers stop supplying, it will have a big impact on the company. Newmans also confessed in the prospectus that the company cannot guarantee the continued stability of suppliers of raw materials for algae oil, nor can it guarantee that there are no quality problems with the raw materials of algae oil. The company relies on suppliers of algae oil raw materials to indirectly supply algae oil DHA raw materials. If there is a shortage, interruption or delay in supply, it will pose a risk to the company's business, financial situation and operating performance.

智通财经APP注意到,纽曼思只是藻油DHA的进口商,公司核心产品藻油DHA均是靠供应商进口而来。此外,公司并无研发、生产部门,主要靠藻油DHA产品赚钱。可见并无核心技术优势,导致其进军港股长路漫漫。

智通财经APP注意到,纽曼思只是藻油DHA的进口商,公司核心产品藻油DHA均是靠供应商进口而来。此外,公司并无研发、生产部门,主要靠藻油DHA产品赚钱。可见并无核心技术优势,导致其进军港股长路漫漫。