Financial giants have made a conspicuous bearish move on Procter & Gamble. Our analysis of options history for Procter & Gamble (NYSE:PG) revealed 8 unusual trades.

Delving into the details, we found 37% of traders were bullish, while 62% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $64,067, and 6 were calls, valued at $265,953.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $175.0 for Procter & Gamble, spanning the last three months.

Analyzing Volume & Open Interest

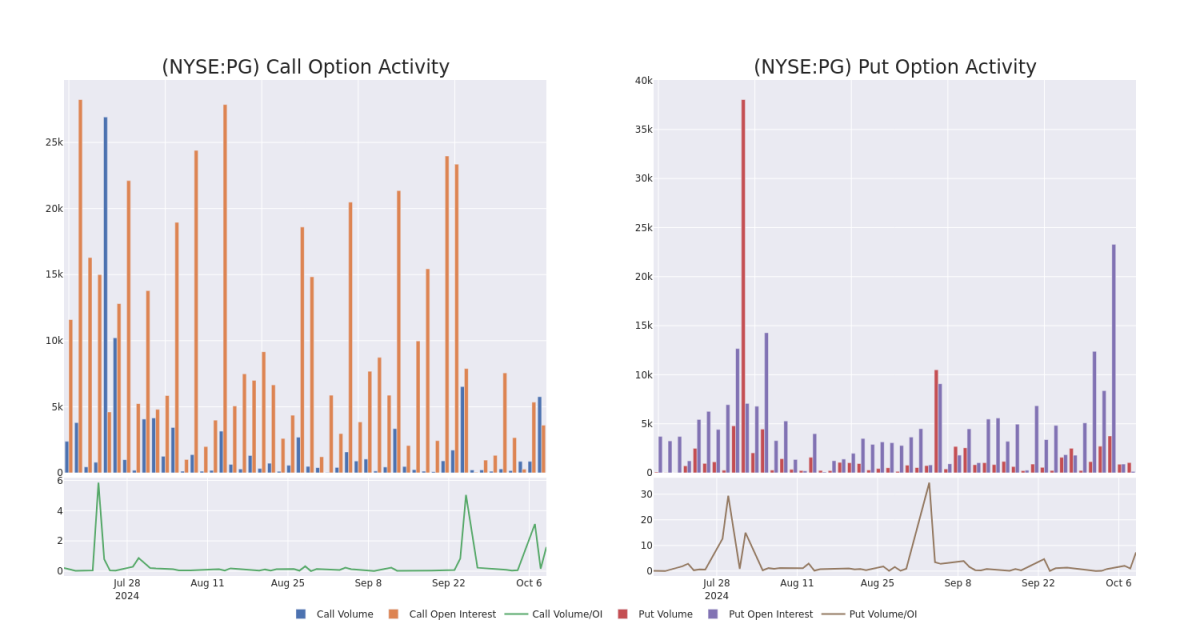

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Procter & Gamble's significant trades, within a strike price range of $150.0 to $175.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Procter & Gamble's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Procter & Gamble's significant trades, within a strike price range of $150.0 to $175.0, over the past month.

Procter & Gamble Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 12/20/24 | $20.85 | $20.5 | $20.8 | $150.00 | $66.5K | 89 | 34 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $0.97 | $0.96 | $0.96 | $175.00 | $65.2K | 532 | 879 |

| PG | CALL | TRADE | BEARISH | 12/20/24 | $5.45 | $5.3 | $5.35 | $170.00 | $39.0K | 2.2K | 161 |

| PG | CALL | SWEEP | BEARISH | 10/25/24 | $1.03 | $0.94 | $0.94 | $175.00 | $37.4K | 532 | 2.1K |

| PG | PUT | SWEEP | BULLISH | 04/17/25 | $2.33 | $2.32 | $2.32 | $150.00 | $36.4K | 143 | 638 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

After a thorough review of the options trading surrounding Procter & Gamble, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Procter & Gamble

- Currently trading with a volume of 3,925,689, the PG's price is up by 0.59%, now at $169.15.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 9 days.

Expert Opinions on Procter & Gamble

3 market experts have recently issued ratings for this stock, with a consensus target price of $174.33333333333334.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for Procter & Gamble, targeting a price of $186. * Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $174.* In a cautious move, an analyst from Barclays downgraded its rating to Equal-Weight, setting a price target of $163.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.