Jefferies Financial is bullish on China's csi commodity equity index market, raising the target price of related symbols.

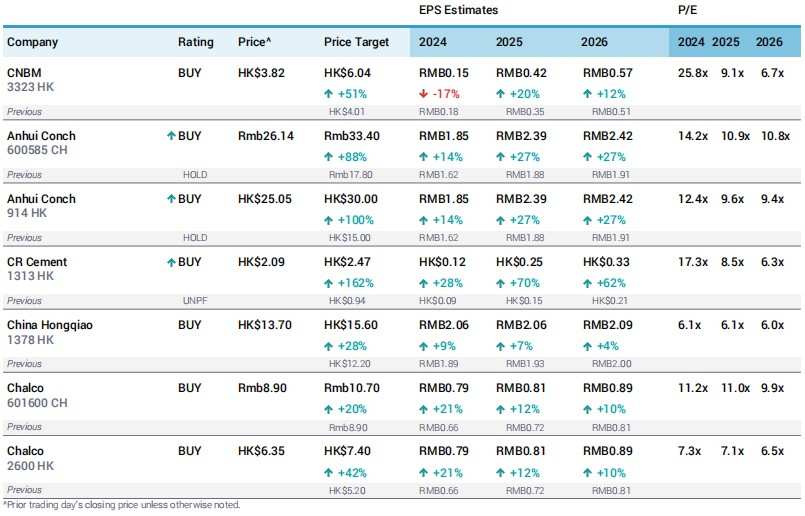

Zhitong Finance learned that after China announced a series of unexpected stimulus measures at the end of September, Jefferies Financial released a research report stating that this round of algo easing is sustainable and will help reverse demand. In this context, Jefferies Financial significantly raised the target prices of aluminum corporation of china (01378), cr bldg mat tec (01313), cnbm (03323), aluminum corporation of china (02600, 601600.SH), and conch cement (00914, 600585.SH) and other companies.

Jefferies Financial pointed out that before the peak season, most of the inventory of csi commodity equity index had been well destocked. It is expected that demand will improve in the fourth quarter, as the base of last year's fourth quarter for csi commodity equity index such as cement was low. In the fourth quarter market of csi commodity equity index, Jefferies Financial is most bullish on cement: "Because we see more convincing evidence that supply constraints will lead to more sustainable price increases."

Jefferies Financial pointed out that the 180-degree turnaround in policy stance adds a positive catalyst to the fourth quarter. Unlike the past, the strength of monetary, fiscal, and real estate policies this time indicates a major shift; the policy points to a positive direction, and further measures are expected to be introduced in the coming months. If the weakness of the real estate market is successfully controlled, that is, the sales area of buildings/land sales no longer falls further, or even rebounds, this will limit any downturn in the demand for basic materials. In addition, from September to the fourth quarter is the peak season for most csi commodity equity index, and positive sentiment increases the potential upside space.

Jefferies Financial pointed out that the 180-degree turnaround in policy stance adds a positive catalyst to the fourth quarter. Unlike the past, the strength of monetary, fiscal, and real estate policies this time indicates a major shift; the policy points to a positive direction, and further measures are expected to be introduced in the coming months. If the weakness of the real estate market is successfully controlled, that is, the sales area of buildings/land sales no longer falls further, or even rebounds, this will limit any downturn in the demand for basic materials. In addition, from September to the fourth quarter is the peak season for most csi commodity equity index, and positive sentiment increases the potential upside space.

Under the economic stimulus plan, Jefferies Financial is bullish on all csi commodity equity index in the fourth quarter: among them, most bullish on cement (cement > aluminum > copper > steel > thermal coal). Jefferies Financial stated that the biggest change in prices occurred after the introduction of new supply disciplines led by the government and producers. Jefferies Financial pointed out that in late September, cement prices in eastern China rose by 100 yuan/ton. Nationwide, clinker prices rose by 28 yuan/ton month-on-month, an increase of 27 yuan/ton year-on-year; cement prices rose by 4 yuan/ton month-on-month or an increase of 22 yuan/ton year-on-year; prices in eastern China usually lead other regions in the country, so it is expected that there will be more price increases in the fourth quarter. As of the end of September, output increased slightly by 4% month-on-month to 52% (a year-on-year decrease of 9%); inventory remained basically flat at around 65%, a year-on-year decrease of 10%.

In the non-ferrous metals sector, Jefferies Financial continues to be bullish on aluminum and copper, with demand for these two metals supported by economic stimulus and supply constraints. The continuous destocking of social inventories in September (a month-on-month decrease of 0.16 million tons or 17% for aluminum, and a month-on-month decrease of 1.25 million tons or 45% for copper) indicates a rebound in demand in the peak season; typically, the apparent consumption in the fourth quarter will be stronger, especially for aluminum.

Since September, especially later this month, steel inventory has decreased significantly, and prices have shown a good recovery, partly offsetting the weakness in August, in addition to seasonal factors. The main futures contract prices for rebar rose by 176 yuan/ton, an increase of 5.27%, and HRC prices rose by 202 yuan/ton, an increase of 6.26%. Jefferies Financial believes that the stimulus plan will benefit the steel and cement industries equally, but while waiting for new guidance on capacity swapping/supply control, the supply response is mainly market-driven.

In addition, thermal coal closed at 867 yuan/ton in September (an increase of 28 yuan/ton from the previous month), and prices will be supported in the peak winter season. However, due to sufficient inventory (a 6.5% increase from the previous month / an 8.9% increase year-on-year at northern ports) and sufficient imports (a 12% increase year-on-year in August), this change may be relatively moderate.

杰富瑞指出,政策立场的180度大转弯为第四季度增添了积极的催化剂,与以往不同,这次货币、财政和房地产政策的力度表明发生了重大转变;政策指出了一个积极的方向,预计未来几个月将出台后续措施。如果房地产市场的疲软得到成功控制,即楼房面积销售/土地销售不再进一步下跌,甚至有所回升,这将限制基本物资需求的任何下行。此外,9月至第四季度是大多数大宗商品的旺季,积极的情绪增加了潜在的上行空间。

杰富瑞指出,政策立场的180度大转弯为第四季度增添了积极的催化剂,与以往不同,这次货币、财政和房地产政策的力度表明发生了重大转变;政策指出了一个积极的方向,预计未来几个月将出台后续措施。如果房地产市场的疲软得到成功控制,即楼房面积销售/土地销售不再进一步下跌,甚至有所回升,这将限制基本物资需求的任何下行。此外,9月至第四季度是大多数大宗商品的旺季,积极的情绪增加了潜在的上行空间。