Bank of America stated that the third quarter will be an excellent environment for stock pickers, with the performance of S&P 500 index constituents driving a significant portion of the index's returns.

According to the iFinTech APP, Bank of America mentioned that the third quarter will be an excellent environment for stock pickers, with the performance of S&P 500 index constituents driving a significant portion of the index's returns.

The bank's stock and algo strategist believes that the pricing in the derivatives market reflects the largest historical single-stock level implied volatility since 2021 after the data release. Meanwhile, as of September, corporate earnings have contributed 45% to the 12-month roi of the S&P 500, and in the 'macro-driven market' from 2022 to 2023, earnings multiples lag far behind the roi.

Bank of America's stock strategist Ohsung Kwon stated in a report on Sunday, "This earnings season might be a paradise for stock pickers." Kwon mentioned the Federal Reserve's significant 50 basis point rate cut last month to 4.75%-5%, saying, "With the beginning of an easing cycle, we expect company earnings to occupy a larger proportion in future returns."

Bank of America's stock strategist Ohsung Kwon stated in a report on Sunday, "This earnings season might be a paradise for stock pickers." Kwon mentioned the Federal Reserve's significant 50 basis point rate cut last month to 4.75%-5%, saying, "With the beginning of an easing cycle, we expect company earnings to occupy a larger proportion in future returns."

S&P 500 index constituent companies will kick off the third-quarter earnings season this week, including Domino's Pizza (DPZ.US), investment bank JPMorgan (JPM.US), Wells Fargo & Co (WFC.US), and BlackRock (BLK.US) among others will report their performance.

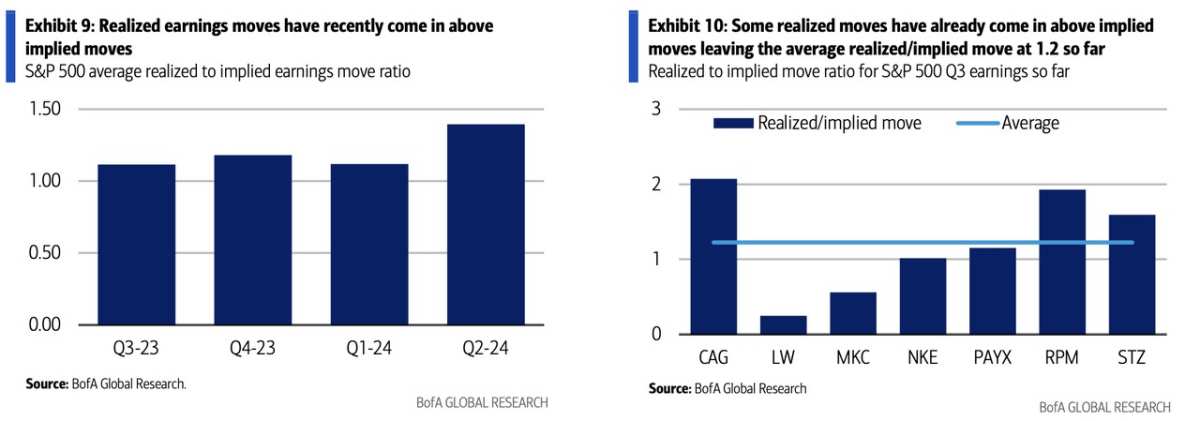

Bank of America indicates that it made a profit in the third quarter.option pricesPotentially more expensive than recent levels, the increase in average stock price suggests a trend. However, the volatility of realized returns has been higher than implied volatility recently, with the average of realized or implied volatility standing at 1.2 so far, Bank of America has released the following chart:

Kwon stated, 'The underestimation of risks in the previous quarter may explain the reason for the increase in implied volatility this quarter, but if the actual financial performance once again leads to a higher level of volatility than expected by the options market, the purchased straddle options may be in-the-money at expiration.'

美国银行股票策略师Ohsung Kwon在周日的一份报告中称:“这个财报季可能将是选股者的天堂。”Kwon提到美联储上个月大幅降息50个基点至4.75%-5%,并称“随着宽松周期的开始,我们预计公司盈利将在未来的回报中占据更大比例。”

美国银行股票策略师Ohsung Kwon在周日的一份报告中称:“这个财报季可能将是选股者的天堂。”Kwon提到美联储上个月大幅降息50个基点至4.75%-5%,并称“随着宽松周期的开始,我们预计公司盈利将在未来的回报中占据更大比例。”