Recently, liquidity pressure in the US financing market has intensified, making some people on Wall Street nervous about the greater challenges in the last month of this year.

According to the Caijing APP, the recent liquidity pressure in the US financing market has intensified, causing some people on Wall Street to feel nervous about the greater challenges in the last month of this year.

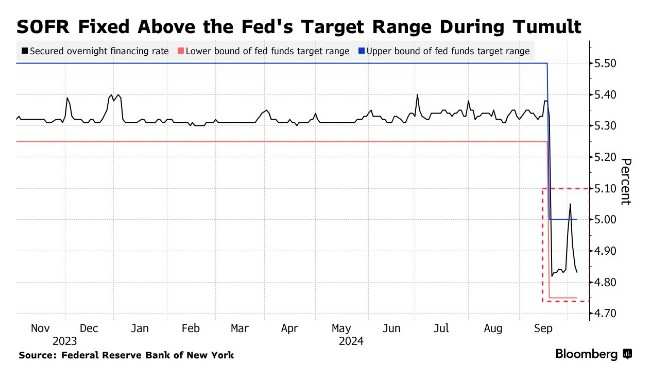

Market participants indicate that the soaring rates related to repurchase agreements (overnight loans collateralized by US Treasury bonds) may escalate in December due to regulatory burdens and the second clash within three months of US Treasury bond auctions settlement, leading to a capital outflow from the financing market. These conditions are pushing rates to atypical levels seen at the end of the third quarter.

Peter Nowicki, Head of Repurchase Trading at Wedbush Securities Inc., states, "Given the volatility at quarter-end, the year-end now poses a bigger issue."

Peter Nowicki, Head of Repurchase Trading at Wedbush Securities Inc., states, "Given the volatility at quarter-end, the year-end now poses a bigger issue."

While the recent market turbulence is more due to balance sheet constraints of primary dealers rather than the quantitative tightening by the Federal Reserve, it has stirred memories of September 2019 when increased government borrowing and corporate tax led to reserve shortages. This caused overnight repo rates to surge fivefold, pushing the federal funds rate above the target range, compelling the Fed to intervene by expanding its balance sheet to stabilize the market.

Strategists from Bank of America anticipate that traders will prepare more thoroughly for the year-end funding strains, but they do not rule out the possibility of a recurrence of this situation, as trader balance sheets are still filled with government debt. Making this potential issue more complex, an estimated massive $147 billion US Treasury coupon auction settlement is expected on December 31, about 25% higher than September 30.

The financing market will also face pressure from Global Systemically Important Banks (GSIBs). At the year-end, the risks exposures of GSIBs will be briefly analyzed to determine whether their capital requirements will increase in the next full calendar year. Jan Nevruzi, US Interest Rate Strategist at Morgan Stanley, explains that, hence, it is easier for institutions to reduce repo activities when reorganizing their balance sheets and adds that companies are less likely to engage in 'low-margin businesses.'

Nevruzi states, "If you want to shrink your balance sheet, this is the area you must first consider."

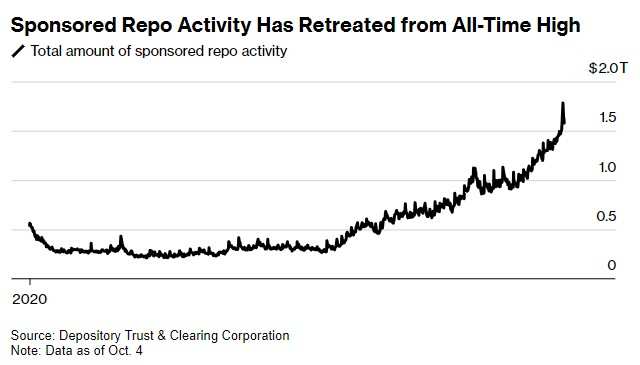

On the contrary, traders may rely more on sponsored repurchases, allowing lending institutions to trade with counterparties such as money market funds and hedge funds without being subject to regulatory constraints on their own balance sheets. These agreements are actually "sponsored" or settled through the repurchase platform of fixed income clearing firms, enabling trading banks to net settle the counterparties and reduce the amount of capital required to hold.

Data from the Depository Trust & Clearing Corporation shows that as of September 30, sponsored repurchase activities totaled $1.78 trillion USD, dropping to $1.58 trillion USD on October 4.

The surge in sponsored repurchase activities highlights the growing demand from hedge funds, as their activities surpass those of cash lending institutions. This may be because traders do not have enough cash on hand, leading lending counterparties to participate in sponsored repurchases, causing chaotic risks around the year-end. In fact, due to traders rejecting money market funds, the balance of the Fed's overnight reverse repurchase tool nearly doubled in the second half of September, reaching $466 billion USD.

Nowicki states: "A bigger issue is the mismatch between cash lenders and borrowers. It seems that if lending institutions don't lend, this activity could spike."

Next is the Fed's Standing Repo Facility (SRF), which allows eligible institutions to borrow cash at a rate up to the upper end of the Fed's target range (currently at a minimum of 5%) in exchange for U.S. Treasury and agency securities. This move is aimed at setting a cap on repo rates, but market participants question its effectiveness as overnight repo rates have soared to 5.9%, with only $2.6 billion USD drawn from the SRF.

Wells Fargo rate strategist Angelo Manolatos says: "I think that if year-end volatility increases and rates rise, then all of these factors combined could mean the SRF is indeed seeing more meaningful utilization."

Despite all these factors, market participants may still be able to lock in financing rates before January 2, rather than locking in overnight rates immediately. Therefore, this could ease pressure on the repo market by year-end.

Blake Gwinn, Head of U.S. Rate Strategy at RBC Capital Markets, says: "It's always contradictory, isn't it? The more concerned we are in October, the smaller the problem becomes."

Editor/rice

Wedbush Securities Inc.的回购交易主管Peter Nowicki表示,“考虑到季度末的波动性,年底现在是一个更大的问题”。

Wedbush Securities Inc.的回购交易主管Peter Nowicki表示,“考虑到季度末的波动性,年底现在是一个更大的问题”。