On January 17, Weeta Milk International fell 4 per cent in intraday trading, which seemed to be bearish, but it was strange that after being sniped by short seller Valiant Varriors yesterday, Vitasoy was not afraid to go short, and its share price fell first and then rose, closing up 5.6 per cent.

Has "Hong Kong Stock Little Maotai" made a comeback?

Source: Futu Securities

Vitasoy International hit an all-time high of HK $46.832 on June 14, 2019, and its share price collapsed after falling about 40 per cent in the following seven months. But yesterday such a short selling institution in the face undoubtedly shows the market's confidence in Vitasoy. In the face of short selling, investors in Vitasoy International jokingly said that "some people say that Tesla is only worth $10", and investors were overjoyed: "the more you fall, the better", and even shouted "bottom reading".

So is the short selling agency's report credible, and is this the perfect time to "bottom" Vitamin Milk International?

What is the strength of the short selling report?

First of all, let's take a look at Valiant Varriors's main points:

Vitasoy misrepresented profits in China and Australia. The profit figures disclosed to investors in the financial report are quite different from those submitted by the Trade and Industry Bureau. There is a huge difference between the financial report and the information submitted by the Group to the State Administration for Industry and Commerce of China, which fully proves that Vitasoy's cash flow is not good.

Abnormal cost structure. It is totally against common sense that Vitasoy can maintain or even continue to increase its gross profit margin under multiple cost pressures.

Competition is intensifying as sales slow. The company had set a target of 20 per cent growth in Chinese mainland sales in 2019, but the first half of 2019 showed that Vitasoy sales grew by just 8 per cent. Inventory turnover days have increased from 15 days to 60 days, the development in the north is mediocre, the development of new products is difficult, and the market share is gradually decreasing.

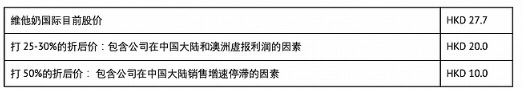

According to Vitasoy's data in the Bureau of Industry and Commerce, it is estimated that its real operating profit growth rate is only 2.9%. Only give Vitasoy International a target price of HK $10.

Source: Valiant Varriors short selling report

In short, the pattern of shorting the report is very common. Around 2010, Chinese stocks encountered crazy short selling, and most institutions were looking for differences and opportunities in SAIC documents and SEC documents, such as classic cases such as Citong and Southern Energy.

However, judging from yesterday's stock price reaction, the market did not approve of the report.

In addition, Valiant Varriors, a short seller, is not well known in the market. Its website shows that its short selling report dates back to March 2018. Companies that have shorted Singapore and South Korea, the more famous of which are Best World International Ltd., but the short seller Bonitas also released the relevant report at that time.

In response to the announcement in the afternoon, Vitasoy International did not refute the views of shorting the report one by one, but only stated: "the board of directors strongly denies the allegations contained in the report and considers them inaccurate and misleading. Since then, the share price of "Hong Kong Stock Little Maotai" has risen further, closing up 5.6% on January 16, with a turnover of 17.5269 million and a turnover of 489 million.

「Davis double kill"when will it end?

Let's take a look at whether the share price of Vitasoy International has "turned around". Weeta Milk International shares hit a new low for nearly a year on January 8, followed by three consecutive gains-5.19% on the 9th, 1.28% on the 10th and 2.35% on the 13th, when many investors might want to "bottom out."

Bottom-reading matters, not only to analyze why Vitasoy International has been falling, but also to make clear the driving force of the rise since then.

Weeta Milk International generally maintained a steady and small rise from 1994 to 2008, becoming a 50-fold bull stock in 10 years from 2009 to 2018, but the upward trend ceased in 2019 and has fallen by 5.88% so far.

Judging from the stock price chart, the sharp decline in 2019 is closely related to the operating results announcement, and also fell sharply when it hit the bull-bear dividing line (250-day moving average).

Source: Futu Securities

The specific data of the two financial reports and the decline of the stock price at that time can be found through public channels, which will not be repeated in this article.

The impact of the two results on stock prices can be summed up in one sentence: Weeta Milk International suffered a "Davis double kill", that is, the double effect between market expectations and price fluctuations of listed companies. In recent years, income in mainland China, which is supported by Vitasoy's international performance, has slowed significantly, falling short of market expectations. Before the share price crashed in June 2019, Vitasoy was valued at as much as 70 times.

"Cheng Ye Xiao he loses Xiao he", before the "Davis double kill", Weeta Milk International also experienced a "Davis double click", the stock price rose under the strong fundamentals, and the huge growth potential pushed up the valuation, enabling Weitar International investors to get the multiplication benefit of earnings per share (EPS) and price-to-earnings ratio growth at the same time.

Although Vitasoy's performance in the previous decade was not very impressive, Vitasoy and lemon tea have long maintained their leading brand status and have a high penetration in Hong Kong, from the phrase "Vitasoy lemon tea." you can see how much consumers like it, and whether investors are optimistic about mainland business. As a result, the share price and valuation of Vitasoy International have naturally risen.

Weeta Milk International's performance growth slowed in 2019, the growth space is limited, the market began to kill valuations, this round of "Davis double kill" came.

So the question of when to copy Vitasoy International, to put it another way, that is, when will the "Davis double kill" end?

Performance aspectFrom the financial reports, senior executives' speeches and media reports, we can see that the reasons for the slowdown in Vitasoy's international performance include fierce competition in the industry, brand aging, limited production capacity, investment in brand value and infrastructure, raw material costs, and so on. At present, we can see that the company has also made some efforts: building a factory in Dongguan to expand production capacity and launching new products such as soy milk specially used for coffee blending. However, the factory is still under construction, and the influence of the new products is not great, so all kinds of attempts have not yet let people see substantial progress.

For the financial year 2019DT 2020, Executive Chairman Luo Youli previously said that in mainland China, the relevant business is expected to maintain growth in the second half of the year, and the new plant in Dongguan, Guangdong Province is expected to start production in the middle of next year. The group's Philippine joint venture company also plans to produce there next year, but the business in Hong Kong, Australia and New Zealand is expected to continue to slow in the second half of the year. It is a good thing that there are competitors in China's soy milk market, which attracts more investment and is a "big pie" for the industry, and the group's China business is expected to continue to expand in the next two years.

Source: company website

ValuationThe dynamic price-to-earnings ratio of Vitasoy International has fallen from a high of 70 to 40. However, the average valuation of the food and beverage industry in the market is about 30 times, and the valuation of Uni-President Kang, which has already entered a period of steady growth and whose main revenue is beverage, is now about 25 times. Subdivided into the non-alcoholic beverage sector, Vitasoy International is also valued higher than Uni-President China. As a result, many investors still think Vitasoy International is too expensive.

Source: Futu Securities

So do we have to wait until Weeta Milk International is valued at 30 times the industry average? This depends on the perception of investors, if you think that Weeta Milk brand aging and performance growth will continue to slow to a steady state, it is not impossible to have a valuation of less than 30 times in the future; but if you still think that Vitasoy International will still do well, then as the industry leader, the valuation of large Niu stocks is usually higher than that of the industry, and it is normal for you to be more expensive.

As early as November 2019, Guotai Junan published a research report saying that despite more fierce competition, the moat of Vitasoy International still exists. The most important advantage for Vitasoy International is that it defines the authentic taste and packaging of lemon tea and has become a representative of this category. It is believed that Vitasoy International has a unique competitive advantage in products and brands, which gives the company more time to strengthen other competitive advantages, such as investing in brand building and building more perfect distribution channels. As Vitasoy expands across the country step by step, the company will continue to use its brand awareness to generate more revenue, and the company is expected to grow in double digits over the next five years. The target price of HK $31.50 is equivalent to the price-to-earnings ratio of 46.5x / 41.7x / 36.7x for fiscal year 2020 / fiscal year 2021 / fiscal year 2022.

Societe Generale Securities expects Vitasoy International to maintain the trend of income growth in the mainland in the second half of the fiscal year, but the exchange rate impact is basically eliminated; income growth in Hong Kong may be under pressure; and Australia and New Zealand will still be affected by the drought. The target price is HK $34.19, and the PE corresponding to FY2020/FY2021 is 49 times / 43 times.

HSBC's latest forecast for Vitasoy International is 39 times forecast 2021 earnings and expects earnings growth of 12% from 2019 to 2022. It is believed that the stock will continue to fluctuate in the short term, while Australia's continuing drought and forest fires may have a significant impact on farm production. Australia's shortage of raw materials has intensified and its profit margins have been affected. However, the report adds that even if Vitasoy faces short-term operating pressure, the company has a strong competitive position in the mainland soy milk beverage market and can benefit from long-term and healthy nutritional diet trends. The bank cut its profit forecasts for 2020-22 by 8.1 per cent, 7.4 per cent and 2.7 per cent, mainly reflecting the impact of adverse weather on its Australian business, which correspondingly lowered its target price from HK $33 to HK $30, maintaining its "hold" rating.

So do you choose to copy the bottom to get on the bus or cut the meat to get off?

Edit / Iris Ray

Market panic, individual stocks fell sharply, stock investment professional threshold is high? Can't accurately grasp the timing to enter and exit? You might as well hand over the funds to professional fund managers to invest, so as to achieve benefit-sharing and risk-sharing. Choose the rich way cash treasure, the investment threshold is low, the income is endless all the year round, effectively enhance the income level of idle funds, one-second redemption helps investors to seize the market opportunity.

"" Click the link to learn about Futu Cashbao immediately ""