Whales with a lot of money to spend have taken a noticeably bearish stance on Block.

Looking at options history for Block (NYSE:SQ) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 33% of the investors opened trades with bullish expectations and 41% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.

From the overall spotted trades, 6 are puts, for a total amount of $241,874 and 6, calls, for a total amount of $262,790.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $77.5 for Block, spanning the last three months.

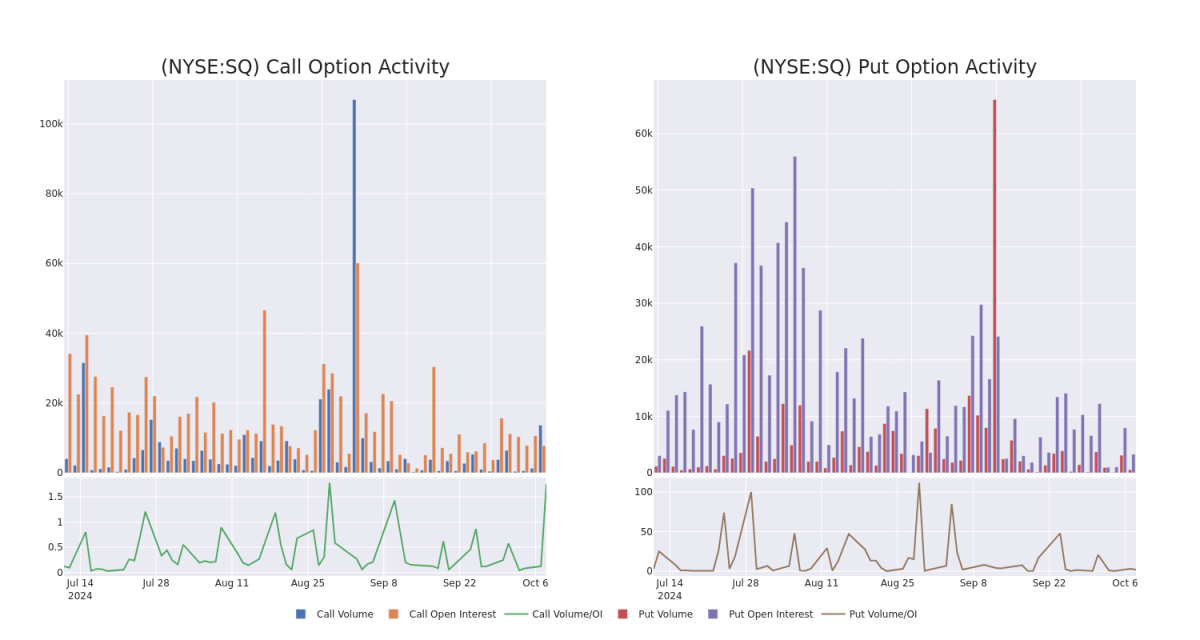

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Block's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Block's whale activity within a strike price range from $50.0 to $77.5 in the last 30 days.

Block Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | CALL | TRADE | BULLISH | 06/20/25 | $16.15 | $16.0 | $16.12 | $60.00 | $80.6K | 1.3K | 53 |

| SQ | PUT | SWEEP | BEARISH | 11/15/24 | $10.25 | $10.0 | $10.25 | $75.00 | $54.3K | 142 | 0 |

| SQ | PUT | TRADE | NEUTRAL | 11/08/24 | $3.4 | $3.3 | $3.35 | $65.00 | $51.5K | 126 | 156 |

| SQ | PUT | TRADE | BEARISH | 11/15/24 | $5.5 | $5.45 | $5.5 | $67.50 | $49.5K | 1.8K | 90 |

| SQ | CALL | SWEEP | BEARISH | 11/15/24 | $4.25 | $4.15 | $4.15 | $70.00 | $44.4K | 1.2K | 592 |

About Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Block

- Trading volume stands at 2,794,690, with SQ's price up by 3.53%, positioned at $68.03.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 23 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Block options trades with real-time alerts from Benzinga Pro.