The heat of A shares is still continuing!

On October 8th, the A-share trading volume hit a new historical high. By the closing bell, the total daily trading volume of A-shares reached 3,483.543 billion yuan, breaking the 3 trillion yuan mark for the first time in history, and also marking the second consecutive trading day to break the 2 trillion mark.

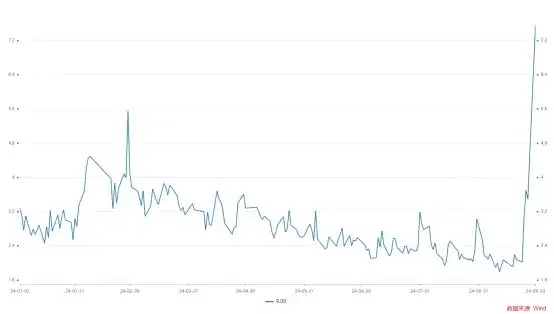

With the massive trading volume in A-shares, investors engaged in a profound 'chip' exchange. Data shows that the turnover ratio of A-shares reached 9%, setting a new high for the year.

So where did all the money go?

So where did all the money go?

Games under the sky-high trading volume

On October 8th, less than 20 minutes after the market opened, the trading volume of A-shares exceeded 1 trillion yuan. Compared to the previous trading day, the volume at this time exceeded 240 billion yuan, breaking the record set on September 30th for the fastest trillion yuan mark.

At 10:44 a.m., the trading volume of A-shares exceeded 2 trillion yuan, marking the second consecutive trading day to exceed 2 trillion yuan.

By the closing bell, A-share trading volume once again hit a new historical high, successfully breaking through 3 trillion yuan to reach 3,483.543 billion yuan.

In terms of sectors, the trading volume of the Shanghai and Shenzhen main boards reached 2.23 trillion yuan; the gem board reached 968.726 billion yuan; the star board reached 253.004 billion yuan; and the BSE trading volume reached 33.177 billion yuan.

It is important to note that under the huge trading volume, A-shares also saw the largest 'turnover' of the year.

As of the closing day, the turnover rate of A-shares reached 9%, hitting a new high for the year. In terms of sectors, the BSE ranked highest at 16.94%; followed by the gem board at 13.82%, also exceeding 10%; the star board at 6.8%; and the Shanghai and Shenzhen main boards at 6.7%.

Journalists found that since the beginning of this year, the turnover rate of A-shares has mostly remained within 3.5%. With the recent continuous rise in the heat of the stock market and the continuous expansion of trading volume, the turnover rate of A-shares has also been increasing. On September 27, the turnover rate of A-shares was 4.57%, and on September 30, it further rose to 7.56%.

Behind the deep game of capital, where does the flow go?

Block transactions: Institutional designated seats bid at a premium

Block trading is an important trading method for institutional investors to improve trading efficiency and reduce trading costs.

After-hours data on October 8th showed that institutional designated seats accumulated 31 block trades involving 20 stocks.

In terms of single transaction amount, involving $Sungrow Power Supply (300274.SZ)$ two "buy" transactions ranked first and second, reaching 0.565 billion yuan and 3.53 billion respectively. In addition, including $Contemporary Amperex Technology (300750.SZ)$Please use your Futubull account to access the feature.$Winner Medical (300888.SZ)$N/A.$KSEC Intelligent Technology (301311.SZ)$and other 'buy' amounts exceeding 50 million yuan.

From the perspective of transaction prices, institutions have to 'bid up' in order to snatch high-quality chips. Among 31 'buy' transactions, 19 transactions were priced higher than the previous day's closing price. Among $Sungrow Power Supply (300274.SZ)$Please use your Futubull account to access the feature.$Contemporary Amperex Technology (300750.SZ)$Please use your Futubull account to access the feature.$Winner Medical (300888.SZ)$N/A.$Shenzhen SEICHI Technologies (688627.SH)$and$Suzhou Novosense Microelectronics (688052.SH)$Please use your Futubull account to access the feature.$Grandit Co.,Ltd. (688549.SH)$ The transaction prices of individual stocks are all at a premium of more than 10%.

Judging from the performance of the relevant stocks, most of the stocks bought by institutional dedicated seats have achieved good performance. Among the 20 stocks, $Grandit Co.,Ltd. (688549.SH)$N/A.$Zhejiang Sling Automobile Bearing (301550.SZ)$and$Suzhou Novosense Microelectronics (688052.SH)$ Among the 13 stocks, only exceeded a 15% increase.$Tibet Urban Development And Investment (600773.SH)$showed a decrease, with a decline of 3.73%.

As for sales, institutional exclusive seats completed a total of 9 "sell" orders involving 8 individual stocks on the same day. The sale of single transactions exceeding 10 million yuan involved 3 individual stocks, namely$Shanghai Suochen Information Technology (688507.SH)$(22.1306 million yuan),$Zhongfu Information Inc. (300659.SZ)$(2077.64 million yuan),$Fengzhushou (301382.SZ)$(17.88 million yuan).

Dragon and Tiger List: Institutions withdraw from stocks with large rise

In addition to being able to glimpse the flow of institutional funds through block trades, as a summary list of abnormal stock movements, the Dragon and Tiger List data from the Shanghai and Shenzhen Stock Exchanges after hours also shows the inflow and outflow of funds of stocks with abnormal movements.

On October 8, the data from the Shanghai and Shenzhen Stock Exchanges showed that a total of 119 stocks made it to the "Dragon and Tiger List" of the day, with 9 of them experiencing "severely abnormal fluctuations." There were 70 stocks on that day showing the "presence of institutions."

Overall, for the stocks on the "Dragon and Tiger List" that have already accumulated considerable gains in stock price, institutions mostly chose to withdraw. The data shows that for these 70 stocks, institutions cumulatively bought 3.942 billion yuan and sold 9.286 billion yuan on that day, resulting in a net sell of 5.344 billion yuan.

Among the 70 individual stocks, there are 20 institutions' seats with a "net buy", among which $Sieyuan Electric (002028.SZ)$ ranks first in net buying amount, reaching 0.12 billion yuan,$Jwipc Technology (001339.SZ)$,$Henan Shuanghui Investment & Development (000895.SZ)$,$CGN Power Co.,Ltd. (003816.SZ)$Individual stocks with institutional net buy amount exceeding 50 million yuan.

Among the stocks with institutional net sell positions, $East Money Information (300059.SZ)$N/A.$Aier Eye Hospital Group (300015.SZ)$,$Jchx Mining Management (603979.SH)$,$Shanghai Jin Jiang International Hotels (600754.SH)$,$Shaanxi Coal Industry (601225.SH)$,$Zhongji Innolight (300308.SZ)$,$Beijing Urban Construction Investment & Development (600266.SH)$,$China Merchants Expressway Network & Technology Holdings (001965.SZ)$,$Eve Energy Co.,Ltd. (300014.SZ)$,$Inner Mongolia Dian Tou Energy Corporation (002128.SZ)$,$Guangdong Provincial Expressway Development (000429.SZ)$,$Eoptolink Technology Inc., (300502.SZ)$A total of 12 individual stocks with a net selling size exceeding 0.1 billion yuan.

Editor/Emily

那么,资金都去哪儿了?

那么,资金都去哪儿了?