Under the continuous large increase in the stock market, many listed companies' shareholders have begun planning to reduce their holdings and exit. In addition to A-share companies, Hong Kong-listed companies have also encountered shareholders reducing their holdings.

Caixin News on October 8th (Editor Lu Qinglian), the market opened significantly higher, then fell back before rising again, with the Chinext Price Index setting a new record for the largest single-day increase, and the SSE Composite Index has surged by 26.95% over the past 6 trading days. The total turnover of the Shanghai and Shenzhen stock markets reached 3.45 trillion yuan for the whole day, setting a new historical high. Under the continuous sharp rise in the stock market, many listed companies' shareholders have begun planning to reduce their holdings and exit.

From September 24th to the present, over 100 companies have disclosed progress or plans to reduce their holdings. At the time of publication, over 30 listed companies have announced plans to reduce their holdings today, including shareholders who are "clearing out" their holdings.

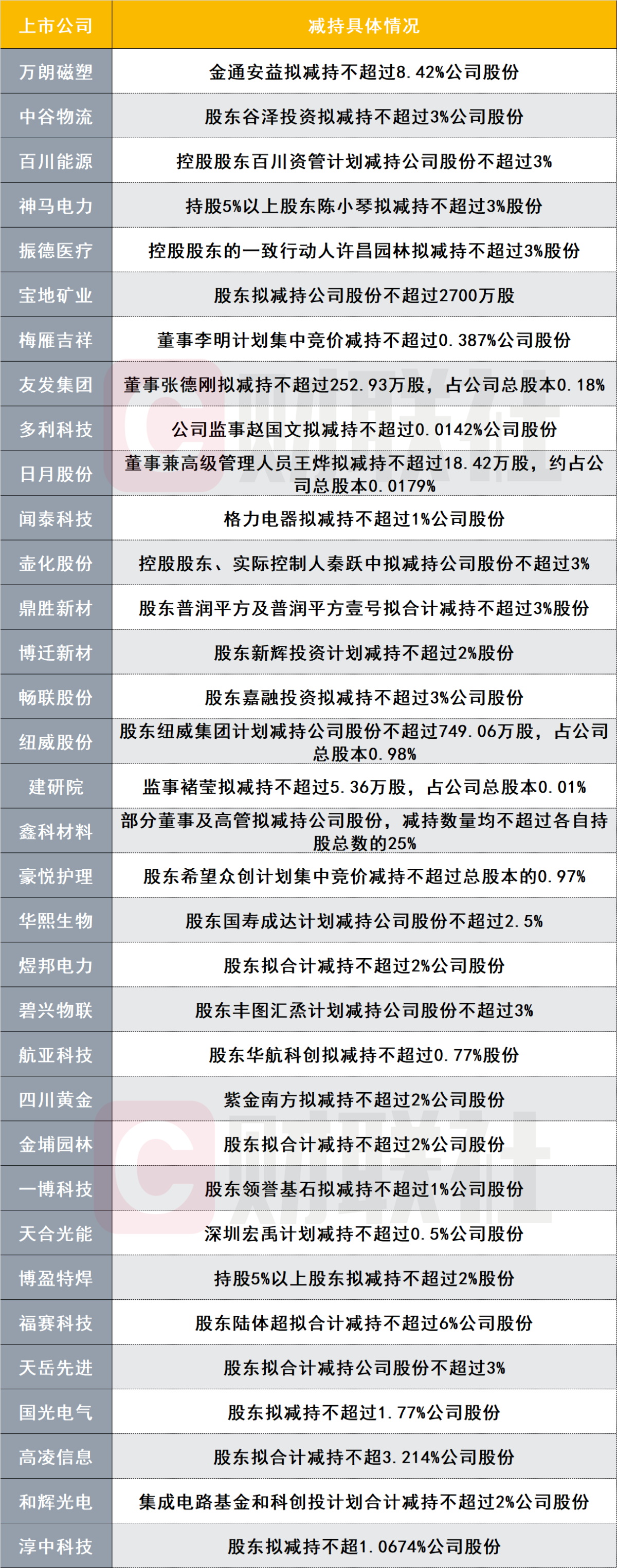

Caixin News statistics on October 8th regarding the planned reduction of holdings by listed companies are as follows:

Caixin News statistics on October 8th regarding the planned reduction of holdings by listed companies are as follows:

According to statistics, as of today, 34 listed companies have disclosed plans to reduce their holdings in a single day. In particular, Wanlang Magnetic Plastics Co., Ltd. has the highest planned reduction ratio. The company announced today that its shareholder Jintong Annaik, holding over 5% of shares, due to personal funding needs, plans to reduce the company's shares by a total of no more than 7.2 million shares within 3 months after 15 trading days from the disclosure date through block trading or bulk trading, with a reduction ratio not exceeding 8.42% of the total share capital. It is worth mentioning that the semi-annual report shows that Jin Tong Annaik holds 8.42% of Wanlang Magnetic Plastics' shares, making this reduction plan a "clear out" reduction.

Companies with relatively large reduction ratios include Fusai Technology, which announced that shareholder Lutiexu plans to reduce their shares by no more than 6% of the company. In addition, Gaoling Information shareholders intend to reduce their holdings by no more than 3.214% of the company's shares; Tianyue Advanced, Bixing IoT, Shanghai Shine-Link International Logistics, Jiangsu Dingsheng New Material, Shanxi Huhua Group, Zhende Medical, Jiangsu Shemar Electric, Bestsun Energy, Shanghai Zhonggu Logistics, and 9 other companies' shareholders or executives plan to reduce their holdings individually or collectively by no more than 3% of the company's shares.

In addition to A-share company shareholders' shareholding reduction, Hong Kong-listed companies have also experienced shareholder shareholding reductions. According to data disclosed by Hong Kong Exchanges and Clearing, China Galaxy Securities Co., Ltd. (06881.HK) had 39.233 million H shares reduced by shareholder Yan Yuqing on October 7, with an average price of 10.479 Hong Kong dollars, involving approximately 0.411 billion Hong Kong dollars. Yan Yuqing's shareholding percentage decreased from 5.63% to 4.57%.

From the perspective of the stock price of China Galaxy in Hong Kong, on October 7, the stock price reached a new high of 11 Hong Kong dollars per share. Today, the stock price has dropped by over 32%. The disclosed shareholding reduction situation above can be described as 'accurately' cashing in at a peak.

财联社统计10月8日上市公司计划减持的情况如下:

财联社统计10月8日上市公司计划减持的情况如下: