China Merchants Shekou Industrial Zone Holdings Institute stated that the performance of the 'Silver Ten' at the beginning of the month exceeded expectations, with clear signs of market stabilization. It is expected that the new policies will continue to take effect in the short term, and the significant rise in holiday subscription data will gradually be reflected in the online signing data. Sales data for the market in October is expected to show significant growth.

According to the Securities Times APP, China Merchants Shekou Industrial Zone Holdings Institute released a report stating that with the concentrated implementation of multiple policies before the holiday, from the central bank's reserve requirement ratio and interest rate cuts to the reduction of down payment ratios, and the successive implementation of real estate new policies in Beijing, Shanghai, Guangzhou, and Shenzhen, especially since the Political Bureau meeting on September 26 proposed 'to promote the stabilization of the real estate market and control the decline', greatly boosting market confidence. During the National Day 'Golden Week', real estate developers generally increased promotional efforts, with a widespread increase in visitations and subscriptions to core city properties and some projects achieving transaction volumes exceeding the entire month of September. The performance of the 'Silver Ten' at the beginning of the month exceeded expectations, with clear signs of market stabilization. It is expected that the new policies will continue to take effect in the short term, and the significant rise in holiday subscription data will gradually be reflected in the online signing data. Sales data for the market in October is expected to show significant growth.

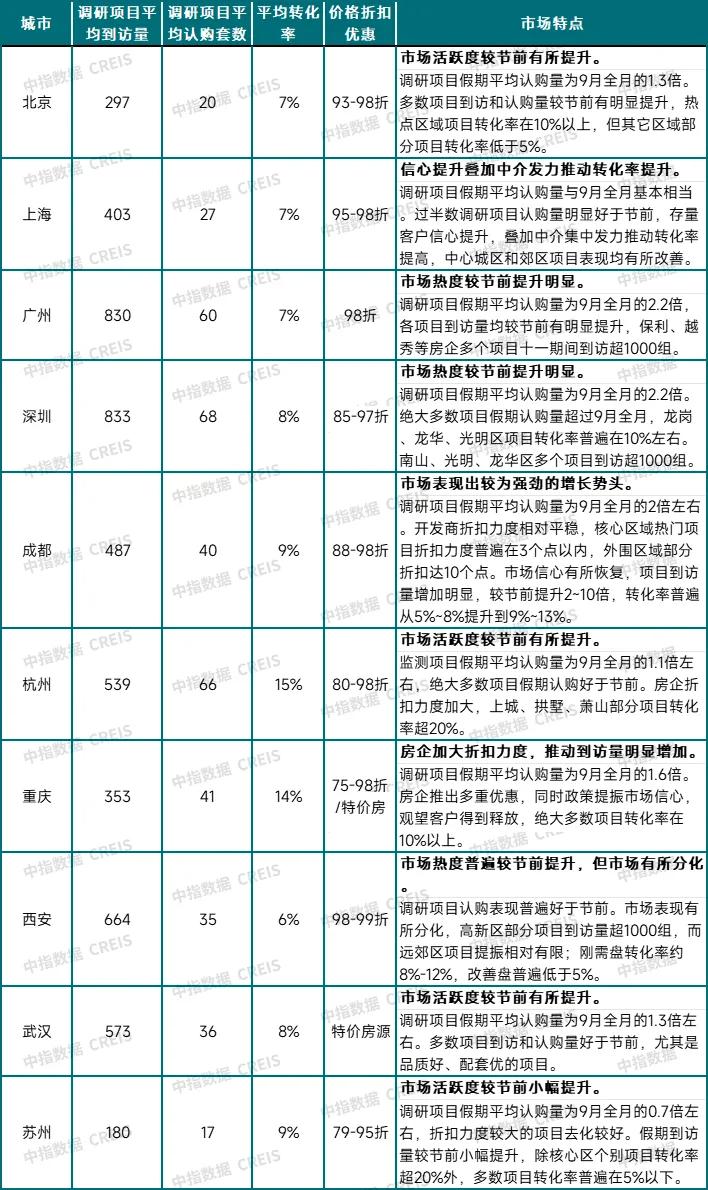

China Merchants Shekou Industrial Zone Holdings Institute pointed out that based on the performance of new property visits and subscriptions, the heat in most city markets has significantly increased compared to before the festival. According to monitoring by China Merchants Shekou Industrial Zone Holdings, the average subscription volume during the National Day holiday for most cities exceeded the entire month of September. Especially in first-tier cities, under the drive of policy optimization, visitations and subscription volumes for various projects have significantly increased, with Guangzhou and Shenzhen outperforming Beijing and Shanghai. During the holiday, the average subscription volume for monitored projects in Guangzhou and Shenzhen reached twice the level of the entire month of September, while Beijing and Shanghai surpassed the subscription volume for the entire month of September. It is worth noting that in addition to the good continuation of high-quality improvement projects in first-tier cities, several affordable housing projects have also shown significant improvement in sales during the National Day period. Second-tier cities such as Chengdu and Hangzhou maintained high levels of activity with an increase in transaction conversion rates, while cities like Chongqing still rely on large discounts to achieve project turnover.

Table: Market Performance of Key Cities during the 2024 National Day Holiday (Project Survey Findings)

Table: Market Performance of Key Cities during the 2024 National Day Holiday (Project Survey Findings)

Note: The above information is derived from the summary data of the survey of some key city projects by China Merchants Shekou Industrial Zone Holdings Institute. Source: China Merchants Shekou Industrial Zone Holdings Institute Data CREIS

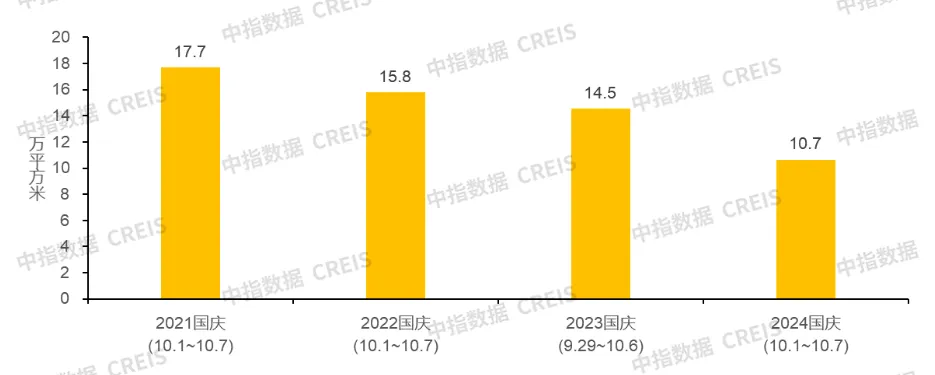

Looking at the online signing situation, according to China Merchants Shekou Industrial Zone Holdings data, during the National Day holiday period (10.1~10.7), the daily sales area of new homes in 25 representative cities decreased by about 27% compared to last year's holiday period (9.29-10.6). Considering that last year's National Day holiday included September 29-30, and some cities had high signing numbers at the end of the month, if we exclude the impact of these two days, the daily sales area of new homes in the 25 representative cities during this year's holiday increased by approximately 23% compared to last year's holiday period (10.1-10.6). In addition, due to the lag in signing data and the significant increase in subscriptions from various areas during the holiday, it is expected that signing data will significantly improve in the coming weeks. Regarding second-hand homes, during the National Day holiday period, the number of second-hand homes sold in key cities generally increased compared to the previous year's National Day holiday. Shenzhen, Qingdao, and Wenzhou all saw an increase of over 100%, while Beijing's performance declined compared to the same period last year due to delayed signing.

Figure: Average daily transaction area of new houses in 25 representative cities during the National Day holiday from 2021 to 2024 (based on online signing data)

Table: Transaction situation of new commercial residential buildings in representative cities during the National Day holiday in 2024 (10.1~10.7) (10,000 m²)

Note: Data for October 7, 2024 is not included for Guangzhou, Maoming, Meizhou, Shantou, Xiangyang, Zhanjiang, and Jining. Jiangyin does not include data for October 3 and October 6. Source of data: CRICREIS

Table: Transaction situation of second-hand houses in key cities during the National Day holiday in 2024 (10.1~10.7) (units)

Data Source: CREIS Data

Peking: Before the holiday, the new policy in Peking arrived as scheduled, driving a high market demand during the National Day holiday. Online consultation volume, site visits, subscriptions, and second-hand house viewings all saw significant growth compared to the same period last year and September, making the transaction volume for new and second-hand houses reach the peak of the National Day holiday in recent years, with a conversion rate of over 10% in hotspot areas.

Looking at the performance over the seven days, new house visits and subscriptions showed a high at the beginning and end of the holiday, with a slightly lower market trend in between. In the first few days before the holiday, after the new policy was released, the market quickly responded, with prospective customers quickly making reservations, and multiple Peking real estate companies releasing hot-selling posters. With the impact of holiday travel, site visits and subscriptions subsequently decreased; the return journey to Peking at the end of the holiday led to a significant increase in site traffic. In terms of project performance, the market continues to differentiate, with areas like Chaoyang, Haidian, Tongzhou, Changping being more active, where customers prefer high cost-effective projects, while the performance of end-project markets is average.

Shanghai: On September 29, Shanghai released new regulation policies, adjusting aspects related to rigid demand, improvement, and second-hand house transactions. During the National Day holiday, Shanghai's real estate market showed a noticeable increase in activity, with some projects' average subscription during the holiday almost equivalent to the entire month of September. In terms of new houses, there were two projects launched and eight projects subscribed to during the National Day holiday. With the new regulation requiring a change in personal income tax from three years to one year outside the outer ring, the purchasing threshold for rigid demand customers was significantly reduced. Visits and subscriptions for most projects increased during the National Day holiday, with Poly Xijiao and He Re subscription rates exceeding 80%. Regarding second-hand houses, policies such as changing the exemption period for value-added tax from "5 years to 2 years" and the cancellation of non-standard ordinary residential requirements have reduced the cost of purchasing second-hand houses, leading to a significant increase in house viewings.

Guangzhou: On September 29, Guangzhou completely lifted property purchase restrictions and lowered the down payment ratio for second home mortgages, leading to increased market heat during the "Golden Week" of National Day. Many real estate projects had strong on-site popularity, with a significant increase in visits and subscriptions. The pace of buyers entering the market notably accelerated, with multiple projects from companies like Poly and Yuexiu attracting over 1000 groups during the National Day period, thereby many projects achieving their sales targets ahead of time. It is expected that with the favorable policies and the gradual recovery of buyer confidence, market demand will gradually be unleashed.

Shenzhen: On September 29, Shenzhen issued new real estate policies, including easing purchase restrictions, canceling sales restrictions, changing the annual exemption period for value-added tax from 5 years to 2 years, and optimizing personal housing loans, providing incentives for both rigid demand, improved demand, and luxury home customer groups.

The combination of new real estate policies and the National Day holiday effect has not only increased the willingness of local residents in Shenzhen to enter the market but also attracted a large number of out-of-town and overseas buyers. The number of house viewings at various new real estate sales centers has surged, with many sales offices selling houses around the clock without closing, and some projects experiencing queues at model homes. There have been frequent reports of successful transactions, with many projects in Nanshan, Guangming, and Longhua districts receiving over 1000 visits. According to the statistics from the Shenzhen Housing and Construction Bureau, the volume of newly built commercial residential sales has increased by 664.1% compared to the same period last year. Buyers have strengthened their expectations for the future market and have increased confidence in property prices, providing a good start to Shenzhen's real estate market in the fourth quarter of the year.

Chengdu: During the National Day period, Chengdu's real estate market has shown a strong growth trend, with a significant increase in site visits and transactions, and a notable recovery in market confidence. Before the National Day holiday, policy incentives increased layer by layer, with policies such as "no house ownership in the district considered as the first house" and "old for new" being implemented at the city level, and various districts launching supporting policies such as supporting house purchase for educational purposes, issuing subsidies to the public, distributing housing ticket rewards, etc. within a short period, further boosting buyers' willingness to enter the market. From the project visit perspective, there was a widespread significant increase in visits, up 2 to 10 times from the pre-holiday period, with some hotspot projects requiring queuing for appointments, daily visit quantities exceeding 100 groups, and conversion rates generally increasing from 5%-8% to 9%-13%.

Hangzhou: With the promotion of major favorable policies before the holiday, both the supply and demand sides of Hangzhou's National Day holiday real estate market have become more active. On the supply side, eight projects were launched during the seven-day holiday, with a total of over 700 new house sources. Real estate developers' marketing activities were frequent, offering visit gifts, subscription gifts, car parking spaces, coupons, straight price reductions, large discounts on properties, and promotional methods like smashing golden eggs. On the demand side, the market saw a small peak in house purchase activities. In the opening projects, two projects were subjected to a lottery (with the number of registrants exceeding the housing sources opened for sale). Among them, the 213 units of houses released on October 5th by Binyun Jinxiuli attracted 1877 groups of clients for the lottery, with an average drawing rate as low as 11.35%, slightly higher than Shoukai, and 150 units of housing from Chaoyu Mingcuixuan attracted 218 groups of clients for the lottery. Apart from the opening projects, the sales office of projects launched during the National Day period also saw significantly higher popularity than before, with popular projects attracting eight or nine hundred groups for viewings, with transaction volumes ranging from seventy to eighty units, and many projects that previously performed poorly in sales also experienced a peak in foot traffic, with daily visit quantities doubling and seven-day National Day transaction volumes reaching levels comparable to the monthly transaction levels in previous months.

Chongqing: With the implementation of several favorable policies in September and the acceleration of multiple properties during the National Day holiday, Chongqing witnessed a significant increase in the flow of visitors and transactions at sales offices. Among them, the number of visits to Poly Gold Dust, Poly Time Zone, and Shanyu Taoyuan exceeded 200 groups each, but various properties are still primarily attracting customers with discounts and benefits.

Xi'an: Before the holiday, Xi'an Real Estate Association responded to the 'National City-Thousand Enterprises Property Sales Promotion Campaign' organized by the China Real Estate Industry Association. At the same time, developers intensified marketing efforts, introducing various housing purchase discount measures (mostly multiple 99% discounts, actually around 95%), including purchasing to get parking vouchers, group purchase discounts, special price homes, heating for floors, enclosed balconies, and more. During the holiday, the number of visitors to sales offices generally increased, and popular projects showed a significant increase in visits and transactions. It is reported that China Merchants Shekou Industrial Zone Holdings subscribed to 307 units totaling 1.03 billion, Vanke subscribed to 377 units totaling 0.4 billion, and COFCO's Future City single project sales exceeded 0.32 billion.

Tianjin: With the introduction of a series of favorable policies before the holiday, the Tianjin real estate market showed signs of stabilizing and rebounding. During the National Day holiday, the average daily number of transactions for new homes exceeded the same period last year, indicating a recovery in market confidence. However, the real estate market differentiation remains prominent, with the main urban areas and surrounding areas performing well. The number of visits and subscriptions increased significantly before the holiday, with overall transaction volume doubling from September. Projects in Hexi, Xiqing, and other areas achieved conversion rates of around 30%-40%. The hot projects during the holiday mainly focused on entry-level units with low overall prices, high-quality improved units, and completely new developments, making these types of properties the main force behind holiday transactions. Overall, during the National Day holiday, the Tianjin real estate market demonstrated a trend of recovery under the influence of policies.

Wuhan: During the holiday period, there was a noticeable increase in market activity based on the number of visits to construction sites and subscription status. On September 30, Wuhan announced the "Han Ten Measures" 3.0, including optimizing the criteria for individual housing loan units recognition, providing temporary purchase incentives, improving pre-sales management plans, encouraging housing consumption through 'trade in old for new' measures, and ten other initiatives. At the same time, Wuhan's East Lake High Technology Group, Economic Development Zone, and other regions held special property fairs, with major developers seizing the window of opportunity. Combining with active marketing during the golden autumn housing festival, the limited further discounts during the National Day period, some projects saw significant improvements in sales. The average subscription volume during the holiday was around 1.3 times that of September's full month. However, looking at the daily transaction volume, due to the higher base in the same period last year and the lag in signing data, the year-on-year comparison still showed a decrease.

Qingdao: The real estate market in Qingdao showed increased activity during the National Day holiday, with more visits to properties and improved transaction conversions. During the holiday, various property discounts, competition among many improved property quality units, reduced market supply, and recent price hike expectations all had a significant impact on the National Day real estate market. In the short term, the market remains sensitive to prices, with market observers responding quickly to expectations of price increases in individual properties. The long-term performance will depend on the strength of subsequent policies.

Zhengzhou: During the National Day holiday period, the Zhengzhou market showed high activity, with daily visits to multiple projects exceeding 100 groups, and subscription numbers significantly higher than the previous period. At the same time, some projects reduced discount intensity compared to before the holiday, while some even raised sales prices. Overall, during this year's National Day holiday, the real estate market sentiment in Zhengzhou reached a temporary peak, with noticeable improvement in market confidence on the developer and customer sides. With continuous policy efforts, market stabilization and recovery can be expected in the future.

Nanjing: During the holiday period, the new housing market in Nanjing presented a lively scene, with several projects offering various National Day holiday limited-time promotions, such as an additional 3% discount, a limited-time 85% discount, and 'work instead of housing' offers. Most project sales offices saw a significant increase in visitors, and the number of transactions and subscriptions rose noticeably compared to the same period last year. Before the holiday, the new project section in the southern part of the city, Citic Taifu Jiu Lu, applied for a sales license, with over 500 groups visiting the project during the National Day holiday. Market confidence has somewhat recovered, but there are still apparent differences between sectors, showing a trend of partial improvement, with core sectors and luxury homes leading the recovery.

Suzhou: During the holiday period, many property projects in Suzhou introduced a series of promotional measures. Overall, there was an increase in visits to new properties and viewings of second-hand properties during the holiday. Negotiations between buyers and sellers were slightly less challenging compared to September, and subscription conditions were relatively better than before the holiday. However, market differentiation remains apparent, with less attention given to properties in non-core locations.

Looking ahead, from a policy perspective, there is still room for optimization of restrictive policies in Beijing, Shanghai, and Shenzhen in the future. Second and third-tier cities are also expected to increase housing subsidies, further promoting market stability in terms of volume and price. It is worth noting that in addition to the "promote sales" policy, improving state-owned enterprise inventory reduction policies will also be a major focus of future policies. At the market level, the current performance of the "Silver Ten" season opening is "better than expected", with a clear trend of market stabilization in core cities. Residents' confidence in home buying is starting to recover, and it is expected that the new policies will continue to take effect in the short term. The significant rebound in holiday subscription data will also gradually be reflected in the transaction data, and October's market sales data may show a significant increase.

Next, promoting the improvement of the economic fundamentals remains the key to stabilizing the real estate market and expectations. If policies continue to exert force in the fourth quarter and the economy accelerates its recovery, the housing market in core cities may stabilize at the bottom, and national market stability can also be expected.