Source: MEGA WAVE

Author: Xiao Luyu

This National Day holiday is somewhat unusual, with the A-share market experiencing an unprecedented surge before the festival, making countless people restless, hoping for the first time not to take a break and to open the market quickly.

During the week from September 23 to September 27, the Shanghai Composite Index rose by 12.81%.$Shenzhen Component Index (399001.SZ)$It rose by 17.83% cumulatively.$Chinext Price Index (399006.SZ)$It rose by 22.71%, setting a record for the largest single-week increase. The total market cap of A shares surged by 9.6 trillion yuan within a week.

During the week from September 23 to September 27, the Shanghai Composite Index rose by 12.81%.$Shenzhen Component Index (399001.SZ)$It rose by 17.83% cumulatively.$Chinext Price Index (399006.SZ)$It rose by 22.71%, setting a record for the largest single-week increase. The total market cap of A shares surged by 9.6 trillion yuan within a week.

On the last trading day before National Day, the high market enthusiasm and momentum directly$SSE Composite Index (000001.SH)$rose by 8.06%, the Shenzhen Component Index rose by 10.67%, and the ChiNext Price Index rose by 15.36%, all achieving the largest single-day increase in history. The total trading volume exceeded 2.5 trillion yuan, even surpassing the record of the historical bull market.

Under the media's promotion, the internet is full of messages saying 'the bull market is back', shifting from 'Anything But China' to 'All in Buy China'. There are endless jokes about investors and the stock market, like 'the travel plan has changed from never switching to Japan and Europe, then to space', creating a lively and cheerful atmosphere online and offline.

During the holiday, brokerage employees who were urged to work overtime to open accounts finally experienced the joy of voluntary overtime. After all, having gone through the sharp deterioration in the industry trend over the past two years, brokerages probably need the bull market return more than the investors.

open account

Brokers are also concerned about the aging of their clients.

How many people saw advertisements for account opening by brokerages on their friends' circle, TikTok, Xiaohongshu, and other self-media platforms during this holiday? And how many of them chose to open accounts during the holiday, waiting for the first batch to enter the stock market after the holiday?

Although it was quickly denied by the relevant brokerage firm that China Securities Co., Ltd. had accumulated 1.4 million account opening applications before the holiday, the opening applications from new stock investors during this holiday did not stop. Over sixty brokerage firms have arranged holiday duty personnel to ensure full online availability, providing 24/7 account opening services.

It is rumored that even China Securities Depository and Clearing Corporation (CSDCC) has been forced to work overtime. Starting from October 6, the unified account platform and identity verification system have been opened in advance to handle the backlog of a massive amount of securities account opening applications since the holiday.

The Shanghai Stock Exchange's technical team also gave up the National Day holiday. Their goal is to conduct system boot connectivity tests on October 7 to prevent a repeat of the system failure on September 27 due to excessive trading volume, leading to customers being unable to place orders and resulting in a flurry of complaints.

Of course, the brokerage firms are the most proactive in working overtime. This bull market wave is crucial for them, especially as they are very interested in attracting a new generation of young clients.

In the first half of this year, there was a viral distribution on the internet about the age distribution of A-share stock investors. As of the end of May 2024, middle-aged and elderly stock investors aged 40-65 accounted for approximately 67.63% in A shares, constituting the absolute core force. Investors under 40 accounted for less than 20%, and those under 30 accounted for only 3.48%.

This generation of young people, the main consumers, and the pillars of society, seem to have no interest in A shares at all. Or perhaps they do not believe in stories of improving life through investment to achieve financial freedom, lacking the gambling spirit of people from the 60s and 70s, holding the simple belief that 'good things never happen to me,' consciously staying away from the stock market.

In recent years, the A-share market has indeed been extremely bearish. Older investors have at least witnessed and experienced two bull markets from 2006 to 2008 and 2014 to 2015. On the other hand, young people under 30 have neither experienced the bull market nor have they seen it. Those who just graduated and invested some of their salaries, have also been trapped by the funds launched in 2020-2021.

In this situation, it is not unwise for young people to be unwilling to enter the stock market as retail investors.

However, for brokerages, being completely abandoned by young people and having a highly elderly client structure is very painful. In fact, in China, any industry disliked by young people has no future, including the baijiu industry and consumer industries like real estate, furniture, as well as financial industries like brokerages and funds.

Moreover, according to JPMorgan's research report, there may be a negative correlation between aging population and stock market returns. For every 1% increase in the population aged 65 and above, the stock market's average annual return will decrease by 0.92 percentage points. The reasons behind this are partly due to slowing profit growth and partly due to decreasing valuations.

Translated, if young people do not consume and lack the courage, the valuations of listed companies cannot increase, and the stock market cannot thrive. After all, the silver economy's development cannot compare to the energy of young people.

The good news is that among the new account holders this time, those born in the 1980s and 1990s have finally become the main force, and the number of Gen Z account openings has also significantly increased. Even if they do not trade stocks, they are inquiring about fund-related matters, which is clearly welcomed by brokerages.

Merger

During a bull market, the structure of the securities industry is prone to reshuffling.

Although with the decline in commissions, the importance of brokerage business in the revenue structure of securities companies has decreased, but account opening is still considered the 'cash cow' of all brokerage business, and also the foundation for the survival of institutional businesses such as asset management.

In theory, brokerage firms that attract more new clients in each bull market will perform better, providing a more solid foundation for future industry positioning. Even in the event of an acquisition, they can sell at a higher price.

Therefore, when this bull market emerged, the brokerage sector once again took the lead in leading the gains. The A-share brokerage concept index quickly rose from 802.92 on September 23 to 1123.40 on September 30, with an increase of about 40% in the period, showing a strong momentum to boost the market along with bank stocks.

Online brokerage firms are considered to be able to maximize the benefits from new account openings, with substantial increases in stock prices. From September 23 to 30, East Money Information saw an increase of up to 89%, while Hithink Royalflush Information Network saw an increase of up to 88%, far exceeding the current top player in the brokerage industry, Citic Securities.

Another interesting investment target is Tianfeng Securities, with a range increase of about 60%. As a brokerage with net income loss, its stock price trend is even stronger than many leading and mid-tier brokerages. It is difficult to say whether this premium includes expectations of merger and reorganization themes.

Historically, bull markets have indeed been good times for speculating on merger and reorganization themes. Ample liquidity provides financial support, and market sentiment gives companies the opportunity to manage market cap through mergers and reorganizations, especially with the new "Six Mergers" policy explicitly supporting listed companies in mergers and acquisitions, even across industries.

After the shocking news of Guotai Junan merging with Haitong Securities was announced, a new round of major consolidation in the Chinese securities industry has almost become an open secret. Industry insiders should have a sense of the magnitude and significance far exceeding the mergers of Citic Securities with Guangzhou Securities and Shenwan Hongyuan with Hony Capital.

Moreover, it is rumored that the speed of the merger between Guotai Junan and Haitong Securities will be surprisingly fast. Financial advisors and intermediary agencies have all entered the field. The most specific implementation plan will be formulated as early as the end of this year or at the latest in March next year, emphasizing the importance of acting quickly, not wanting to repeat the mistake of Shenwan Hongyuan missing the bull market expansion period years ago.

However, as the stocks of Guotai Junan and Haitong Securities have long been suspended from trading, eager investors can only rush to buy shares of Guotai Junan International in the Hong Kong stock market, driving its stock price to climb from 0.64 Hong Kong dollars per share to as high as 2.18 Hong Kong dollars per share, with the range increase exceeding 240% at one point.

The upward trend of the Hong Kong stock market during the National Day holiday was indeed supported by the brokerage sector. In the three trading days after October 2, the average increase in the Hong Kong stock brokerage sector was 52.24%, with a total turnover of 41.963 billion Hong Kong dollars. $CITIC SEC (06030.HK)$Please use your Futubull account to access the feature.$CICC (03908.HK)$Please use your Futubull account to access the feature.$CGS (06881.HK)$ The turnover reached HK$10.181 billion, HK$6.142 billion, and HK$4.891 billion, respectively.

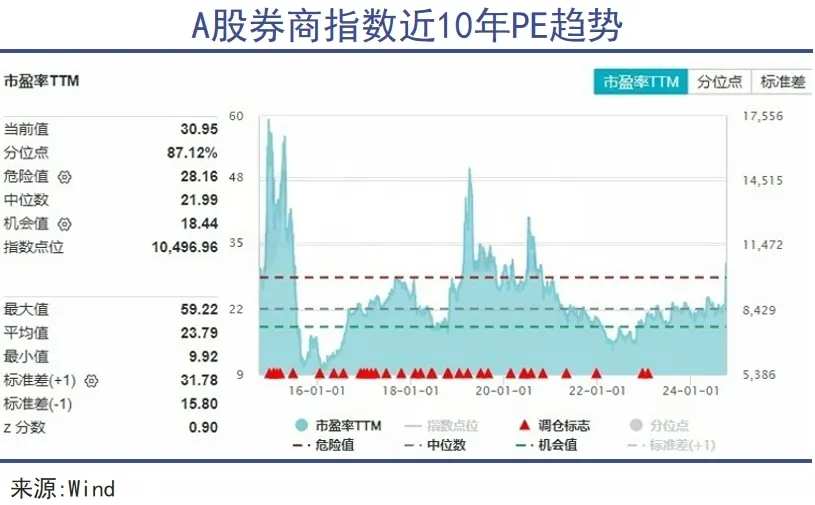

The Hong Kong brokerage sector also gave a good start to A-share brokerage stocks after the National Day holiday. After all, at the end of 2014, brokerage firms had a PE ratio of 59.22 times, which has dropped to only 20 times at the beginning of this year. Valuation repair in the sector is imperative.

If Guojun and Haitong resume trading in late October, the brokerage sector may become even more lively at that time.

Bull market

The release of liquidity is just the first step in the bull market.

Whether it is retail investors, institutions, brokerages, or banks, the emotions of market participants have already fallen into place, fearing missing out on this bull market. After all, China has not yet experienced a bull market as long as the ten-year one seen in the US stock market, often requiring another ten-year wait after missing out once.

The appearance of the bull markets in 2007-08 and 2014-15 was supported by loose monetary policy and the foundation laid by China's economic takeoff. However, this incipient bull market is emerging in a macro environment that is not too optimistic, so far only described as a “policy market”.

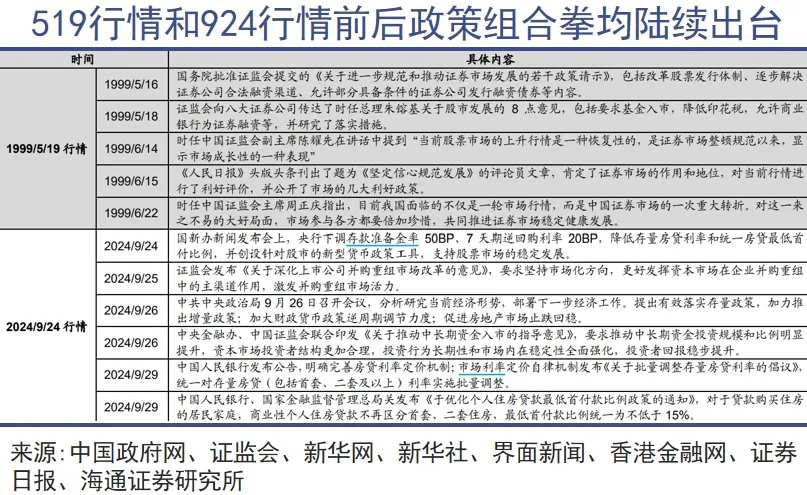

Some analysts even compare the current market situation to the 519 market in 1999, believing that the government's strategy is to act ahead in the face of deflationary pressure and prolonged stock market downturn, in order to quickly boost the market and repair the balance sheet.

The biggest innovation and incremental policy from the Political Bureau meeting and the State Council Information Office press conference held in late September is actually aimed at stabilizing asset prices.

In terms of the real estate market, for the first time, the concept of "promoting the stabilization of the real estate market" was raised, proposing supportive policies such as lowering the interest rates on existing home loans, unifying the minimum down payment ratio for home loans, optimizing policies on refinancing affordable housing loans, and further relaxing home purchase restrictions in first-tier cities. It is said that many landlords have raised the listing prices of second-hand homes before National Day.

Regarding the stock market, the Governor of the central bank mentioned the creation of monetary policy tools for securities-fund-insurance company swaps and share buyback increases, supporting the stable development of the financial market. Many investors have a more straightforward interpretation of this, saying that the central bank will provide "unlimited ammunition" for A-shares.

During the window of a 50-basis-point rate cut by the Federal Reserve, China gained policy space and then concentrated its efforts to offer an unexpected "big gift package," transforming market sentiment directly from panic to excitement.

Even though these policy funds have not yet actually flowed into the stock market, the funds transferred by bank transfers during the days before National Day are sufficient to make the daily trading volume of A-shares, which used to be only five hundred billion yuan, "rise with the tide."

The current ample liquidity is only the first step towards a bull market. This is because in history, every bull market has not happened overnight. Early on, it can rely on valuation repairs brought about by improved liquidity, while later on, it needs solid fundamentals as support.

According to the National Bureau of Statistics, in September, China's manufacturing Purchasing Managers' Index (PMI) was 49.8%, up 0.7 percentage points from the previous month, hitting a nearly 5-month high, indicating a good start for macroeconomic data stability. The more critical data will be whether there will be a real improvement in consumer spending after the National Day, driving corporate profits and employment recovery.

During this recovery process, peripheral bearish news will continue to appear. After all, it has reached this stage today, and no one can easily give up.

On October 4, the Federal Reserve couldn't wait to use the much better-than-expected September non-farm payroll data to suppress expectations of an interest rate cut later in the year. On the same day, the European Union voted in favor of imposing additional tariffs on Chinese electric cars. These bearish news indeed caused some disturbance in the performance of Hong Kong stocks and Chinese concept stocks.

A bull market without real economic support cannot go far, and relying solely on the brokerage sector's rise cannot drive the overall market. After all, historically in bull markets, finance usually leads only in the early stages, while information technology, discretionary consumption, and other industries closely related to consumer spending will stand out in the mid-term.

Hopefully, besides being busy with account openings, margin trading, and IPOs, brokerage firms can seriously think about how to truly provide financial services to the real economy, write a good chapter on finance, so that the general public can benefit from investing in Chinese assets, rather than suffer another mess after the stock disaster.

Editor/Rocky

在9月23日至9月27日的一周内,沪指累计上涨12.81%,

在9月23日至9月27日的一周内,沪指累计上涨12.81%,