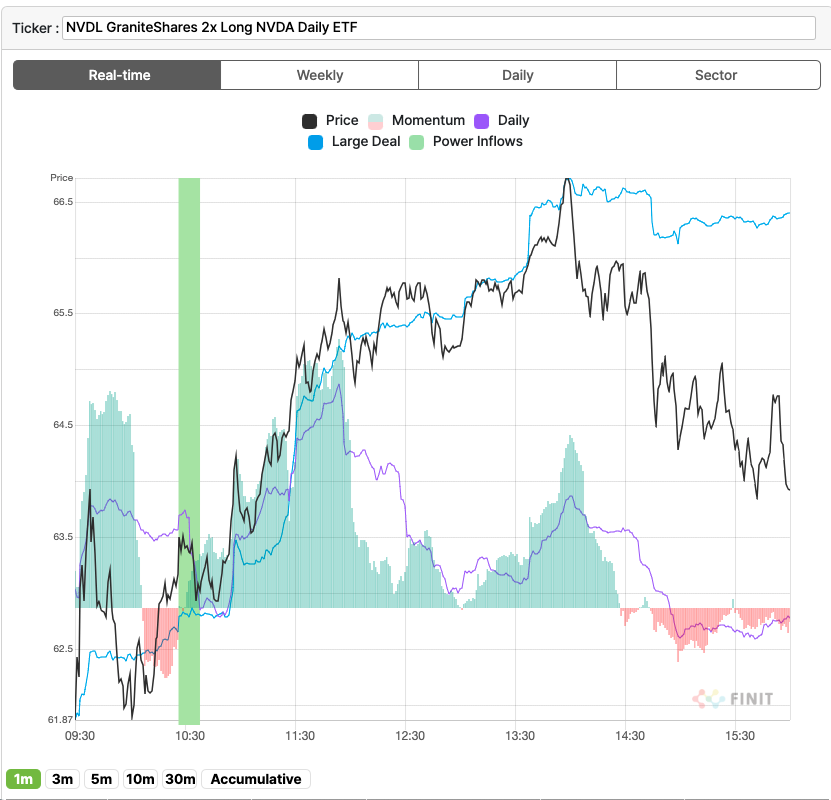

ETF HITS HIGH OF THE DAY AT 1:59 PM EDT AFTER SIGNAL AT 10:36 AM EDT

GraniteShares 2x Long NDVA , (NVDL) today experienced a Power Inflow, a significant event for those who follow where smart money goes and value order flow analytics in their trading decisions.

Today, at 10:36 AM on October 7th, a significant trading signal occurred for GraniteShares 2x Long NDVA, (NVDL) as it demonstrated a Power Inflow at a price of $62.93. This indicator is crucial for traders who want to know directionally where institutions and so-called "smart money" moves in the market. They see the value of utilizing order flow analytics to guide their trading decisions. The Power Inflow points to a possible uptrend in Amazon's stock, marking a potential entry point for traders looking to capitalize on the expected upward movement. Traders with this signal closely watch for sustained momentum in Amazon's stock price, interpreting this event as a bullish sign.

Signal description

Signal description

Order flow analytics, aka transaction or market flow analysis, separates and studies both the retail and institutional volume rate of orders (flow). It involves analyzing the flow of buy and sell orders, along with size, timing, and other associated characteristics and patterns, to gain insights and make more informed trading decisions. This particular indicator is interpreted by active traders as a bullish signal.

The Power Inflow occurs within the first two hours of the market open and generally signals the trend that helps gauge the stock's overall direction, powered by institutional activity in the stock, for the remainder of the day.

By incorporating order flow analytics into their trading strategies, market participants can better interpret market conditions, identify trading opportunities, and potentially improve their trading performance. But let's not forget that while watching smart money flow can provide valuable insights, it is crucial to incorporate effective risk management strategies to protect capital and mitigate potential losses. Employing a consistent and effective risk management plan helps traders navigate the uncertainties of the market in a more controlled and calculated manner, increasing the likelihood of long-term success

Market News and Data are brought to you by Benzinga APIs and include firms, like Finit USA, responsible for parts of the data within this article.

2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

The price at the time of the Power Inflow was $62.93. The returns on the High price ($66.71) and Close price ($63.92) after the Power Inflow were respectively 6.0% and 1.6%. That is why it is important to have a trading plan that includes Profit Targets and Stop Losses that reflect your risk appetite. In this case, the high of the day was much higher than the price at the market close.

Past Performance is Not Indicative of Future Results