The bull market in the US stock market is about to celebrate its two-year anniversary.

The bull market in the US stock market is about to celebrate its two-year anniversary, marking the latest milestone of this round of rebound. This rebound has exceeded almost everyone's expectations, except for the most optimistic investors on Wall Street.

According to 36Kr, since the S&P 500 index touched a closing low of 3,577.03 on October 12, 2022, the index has risen by more than 60%, a much faster pace than many financial professionals expected, forcing Wall Street institutions to raise their year-end targets multiple times.

Data shows that despite some fluctuations in the upward trajectory over the past three months, there is hardly any sign of slowing down in the overall bull market. According to FactSet data, the Cboe Volatility Index (VIX), also known as the "Wall Street Fear Index," briefly touched its highest intraday level since March 2020 on August 5 when global markets plummeted significantly. However, this fear quickly dissipated, and the stock market quickly rebounded. Similar declines occurred in the first week of September, but this pullback also attracted demand from investors buying at low levels.

Data shows that despite some fluctuations in the upward trajectory over the past three months, there is hardly any sign of slowing down in the overall bull market. According to FactSet data, the Cboe Volatility Index (VIX), also known as the "Wall Street Fear Index," briefly touched its highest intraday level since March 2020 on August 5 when global markets plummeted significantly. However, this fear quickly dissipated, and the stock market quickly rebounded. Similar declines occurred in the first week of September, but this pullback also attracted demand from investors buying at low levels.

Subsequently, the S&P 500 index has shown strong performance in the first three quarters of this year, achieving its best performance since the late 1990s. If the current uptrend can be maintained until the end of the year, the S&P 500 index will have two consecutive years of gains exceeding 20%, the first time since 1998.

However, the potential risks facing the market have increased recently. The current valuation of the US stock market is relatively high compared to historical levels, second only to the peak at the end of 2021. In addition, geopolitical risks have reemerged, with tensions escalating between Israel and Iran, driving up crude oil prices and making stock market investors nervous.

With the arrival of the third-quarter earnings season, investors will closely monitor the financial reports of giant companies like Microsoft (MSFT.US), Alphabet (GOOGL.US, GOOG.US), hoping to find clues as to when these companies' massive investments will pay off. Subsequently, Nvidia (NVDA.US)'s earnings will also be in focus. Nvidia performed strongly in the previous earnings report in August but has still not boosted the stock price.

In addition, the US presidential election on November 5 has prompted many traders to buy hedging tools to guard against potential volatility that the election results may trigger, especially in the case of potential disputes over the results.

Due to these uncertainties, millions of global investors are seeking guidance on the next market trends.

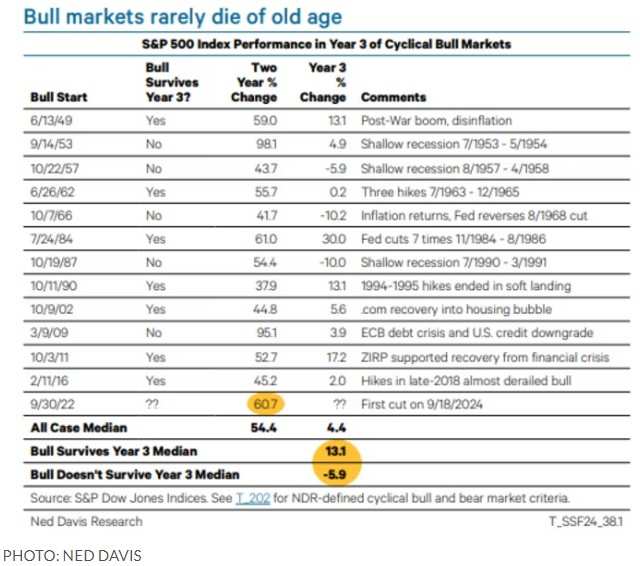

A group of analysts from Ned Davis Research has conducted in-depth studies on the performance of bull markets at the two-year mark. Data shows that since the end of World War II, there have been 12 bull markets lasting at least two years. If the current bull market can continue until this weekend, it will be the 13th.

Of these, 7 bull markets have successfully entered the third year, indicating a favorable probability for investors for the continuation of the current bull market. According to Ned Davis' statistics, the median increase of the past 12 bull markets at the two-year mark is 54.4%, which means the increase over the past two years is not particularly significant compared to history.

However, predicting future trends is more difficult. According to the analysis by the Ned Davis team, bull markets in the third year usually achieve a median increase of 13.3%, but bull markets that do not continue have experienced a 5.9% decline.

It is worth noting that bull markets do not end just because of 'aging.' Analysis by Ned Davis shows that each bull market's end is triggered by some catalyst. Economic recession is the most common reason, leading to the end in the third year in three different bull markets. The fourth exception occurred in October 1966 when the Federal Reserve ended the bull market with a tightening monetary policy to combat inflation.

The fifth exception was the bull market that began in March 2009, where the stock market decline was caused by global panic triggered by Standard & Poor's downgrade of the US credit rating and the European sovereign debt crisis.

The Ned Davis team believes that as long as the following three conditions are met, the current bull market is likely to enter the third year.

First of all, the downward trend of inflation that began at the end of 2022 must continue. If investors see clear signs of inflation accelerating again, it may trigger market volatilities. But after the bursting of the internet bubble and the Fed's rate cut in 2001, the ROI dropped by more than 10%.Secondly, the Federal Reserve must successfully achieve the target range of keeping inflation under 2% while maintaining a slight slowdown but still positive growth in the US economy. If the economy goes into recession, the stock market may plummet significantly. However, the Ned Davis economic team believes there is currently not much reason to worry about this.

Thirdly, the largest companies in the United States must continue to maintain profit growth. Wall Street expects profit growth of the 'Big Seven' companies benefiting from artificial intelligence to start slowing down later this year. Other companies will need to fill this gap, even though forecasts indicate this could happen, forecasts always have uncertainties, and the outcome ultimately depends on the economic performance in the coming year.

On Monday, the three major US stock indices fell, with the Nasdaq dropping over 1.1%, the S&P 500 index, and the Dow falling nearly 1%.

数据显示,尽管过去三个月的上涨路径有些波动,整体牛市几乎没有放缓的迹象。根据FactSet的数据,Cboe波动率指数(VIX),即“华尔街恐慌指数”,在8月5日全球市场大幅下跌时一度触及自2020年3月以来的盘中最高水平。然而,这一恐慌很快消退,股市也迅速反弹。类似的下跌也在9月第一周发生,但这一回调同样吸引了投资者低位买入的需求。

数据显示,尽管过去三个月的上涨路径有些波动,整体牛市几乎没有放缓的迹象。根据FactSet的数据,Cboe波动率指数(VIX),即“华尔街恐慌指数”,在8月5日全球市场大幅下跌时一度触及自2020年3月以来的盘中最高水平。然而,这一恐慌很快消退,股市也迅速反弹。类似的下跌也在9月第一周发生,但这一回调同样吸引了投资者低位买入的需求。