According to sources, activist investor Starboard believes that under the leadership of current Pfizer CEO Albert Bourla, the company has deviated from its traditional cost control and rigorous structure for new drug investments. They have already contacted former Pfizer CEO Ian Read and former CFO Frank D’Amelio. Boosted by this news, Pfizer's stock price rose more than 4.4% in Monday's intraday trading.

According to sources, activist investor Starboard Value has about $1 billion in shares of Pfizer, and hopes to reform the company to reverse its current situation. Driven by this news, Pfizer's stock price rose more than 4.4% on Monday.

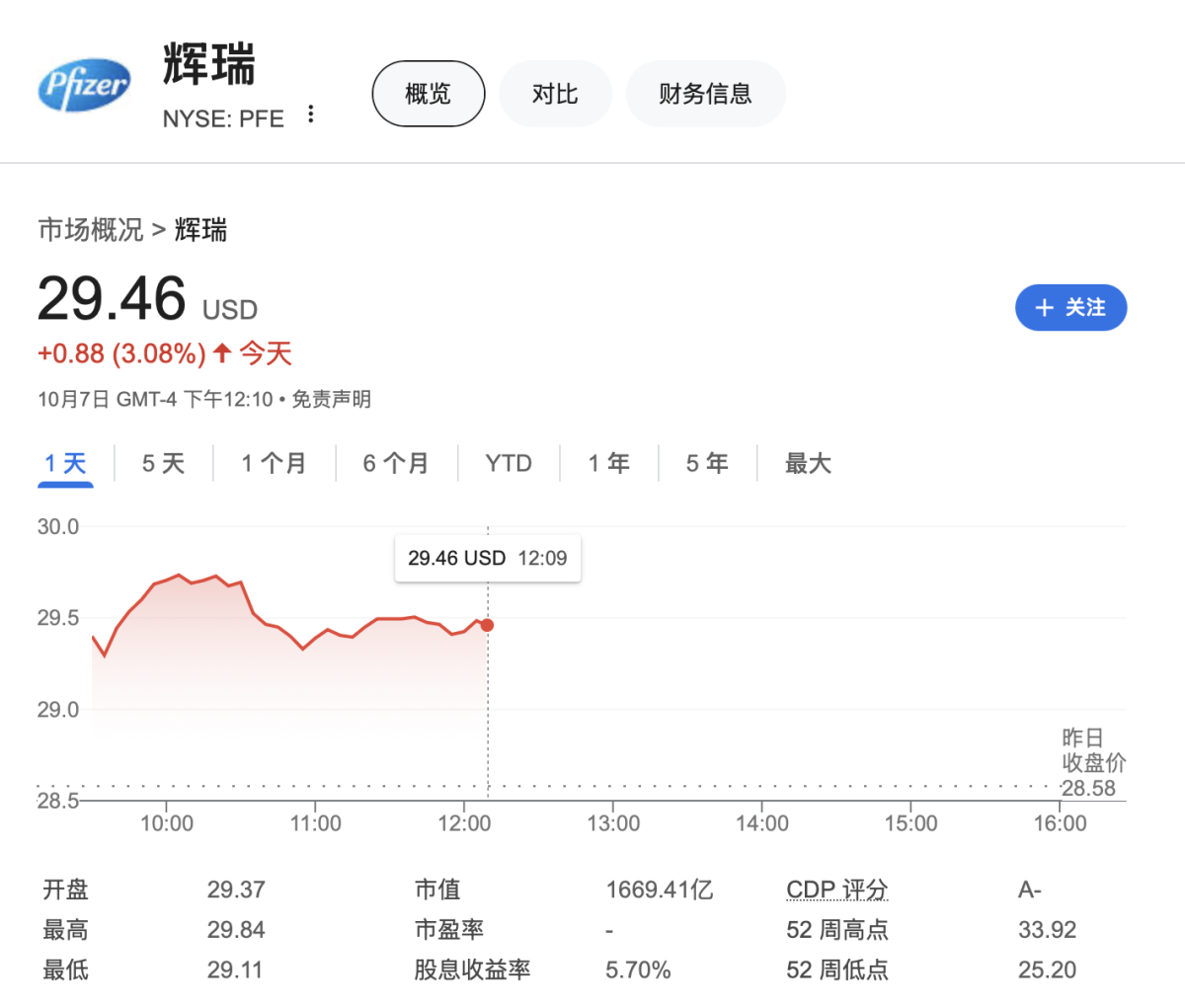

Data shows that as of last Friday, Pfizer's market cap was approximately $162 billion. Since the company launched the world's first global COVID-19 vaccine, its stock price has almost halved from the historic high set at the end of 2021. This year, Pfizer's stock price has remained virtually unchanged while the S&P 500 index has risen by 21%.

According to reports, Starboard has contacted former Pfizer CEO Ian Read and former CFO Frank D’Amelio, who have expressed willingness to help Starboard achieve its goals. Read served as Pfizer's CEO from 2010 to 2018 and personally selected current CEO Albert Bourla as his successor. D’Amelio was Pfizer's CFO from 2007 to 2021.

According to reports, Starboard has contacted former Pfizer CEO Ian Read and former CFO Frank D’Amelio, who have expressed willingness to help Starboard achieve its goals. Read served as Pfizer's CEO from 2010 to 2018 and personally selected current CEO Albert Bourla as his successor. D’Amelio was Pfizer's CFO from 2007 to 2021.

Sources told the media that Starboard believes that under current CEO Albert Bourla's leadership, Pfizer has deviated from its traditional cost control and rigorous structure for investing in new drugs.

Driven by this news, Pfizer's stock price once rose more than 4.4% in Monday's trading session, then narrowed to around 3%, closing at $29.46.

Starboard, led by Jeff Smith, invests across industries, with a particularly active focus on technology. Recently, they have taken action in Salesforce and Autodesk. In 2019, Starboard attempted to stop pharmaceutical giant Bristol-Myers Squibb from acquiring Celgene for $74 billion, but was unsuccessful. That same year, Starboard won a board seat at medical technology company Cerner.

In a difficult situation.

Pfizer CEO Bourla is currently under pressure from investors, as the company previously overestimated the demand for pandemic-related products post-pandemic, and Pfizer's leadership has been seeking ways to address the issue.

During the pandemic, Pfizer delivered the new coronavirus vaccine in record time, solidifying its well-known reputation. In 2022, Pfizer's vaccine and the new COVID-19 drug Paxlovid drove the company's sales to exceed $100 billion.

However, as the pandemic is put behind, Pfizer is facing a decline in COVID-19 sales, and the company's other products have failed to fill this gap. Additionally, in the coming years, some of the company's best-selling drugs such as the blood thinner Eliquis and the arthritis treatment Xeljanz will also face competition from low-cost alternatives.

To make matters worse, the company's highly anticipated weight-loss drug had a disappointing first trial, while competitors like Eli Lilly and Novo Nordisk achieved greater success.

Pfizer is betting on cancer drugs for the future, believing that these drugs can bring billions of dollars in new sales. Last year, Pfizer agreed to acquire biotechnology company Seagen and its groundbreaking targeted cancer drugs for $43 billion. Pfizer expects Seagen's drugs (i.e., antibody-drug conjugates or ADCs) to generate $10 billion in annual sales by 2030.

Furthermore, Pfizer has made a series of smaller acquisitions using funds accumulated during the pandemic, including acquiring Arena Pharmaceuticals for $6.7 billion, and spending about $11.6 billion to acquire a stake in Biohaven Pharmaceutical Holding.

One particularly concerning deal was Pfizer's acquisition of Global Blood Therapeutics. Two years ago, Pfizer acquired a sickle cell disease drug for about $5 billion, but the drug has recently been withdrawn. Pfizer downplayed the financial impact of this decision in September, stating that the drug Oxbryta brought in just over $0.3 billion in revenue last year.

Cost reduction

Some analysts criticize the company for lacking discipline in mergers and other business management. In contrast, during Read's tenure as CEO of Pfizer from 2010 to 2019, the company was in turmoil. However, under his leadership, Pfizer was known for focusing on core businesses (such as vaccines and cancer), the stock price more than doubled, and the management established a culture centered on cost control and core business, a culture that has clearly now been diluted.

Under Bourla's leadership, the company significantly increased its research and development budget and divested its generic drug business. Pfizer's stock price is currently lower than the level when Bourla became CEO in 2019.

Pfizer warned at the end of 2023 that its revenue may decline this year and released disappointing expectations for 2024. The company also announced a $3.5 billion cost reduction plan at the end of last year, expected to be completed by the end of 2024.

In May of this year, Pfizer announced the initiation of a new multi-year cost reduction plan. In July, the company raised its full-year outlook, with the launch of some acquired products and new commercial products helping to drive business growth, offsetting the decline in sales of the COVID-19 vaccine. Pfizer released 'encouraging' data for its once-daily anti-obesity drug 'danuglipron' in July, showing efforts in expanding its product pipeline.

"We're making progress on all fronts," Bourla said in a media interview in July.

据报道,Starboard已经接触了辉瑞前首席执行官Ian Read和前首席财务官Frank D’Amelio,他们表示愿意帮助Starboard实现其目标。Read在2010年至2018年期间担任辉瑞CEO,并亲自挑选现任CEO Albert Bourla作为继任者。D’Amelio则在2007年至2021年期间担任辉瑞的CFO。

据报道,Starboard已经接触了辉瑞前首席执行官Ian Read和前首席财务官Frank D’Amelio,他们表示愿意帮助Starboard实现其目标。Read在2010年至2018年期间担任辉瑞CEO,并亲自挑选现任CEO Albert Bourla作为继任者。D’Amelio则在2007年至2021年期间担任辉瑞的CFO。