Whales with a lot of money to spend have taken a noticeably bullish stance on Walt Disney.

Looking at options history for Walt Disney (NYSE:DIS) we detected 15 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

From the overall spotted trades, 4 are puts, for a total amount of $403,422 and 11, calls, for a total amount of $531,075.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $80.0 and $110.0 for Walt Disney, spanning the last three months.

Insights into Volume & Open Interest

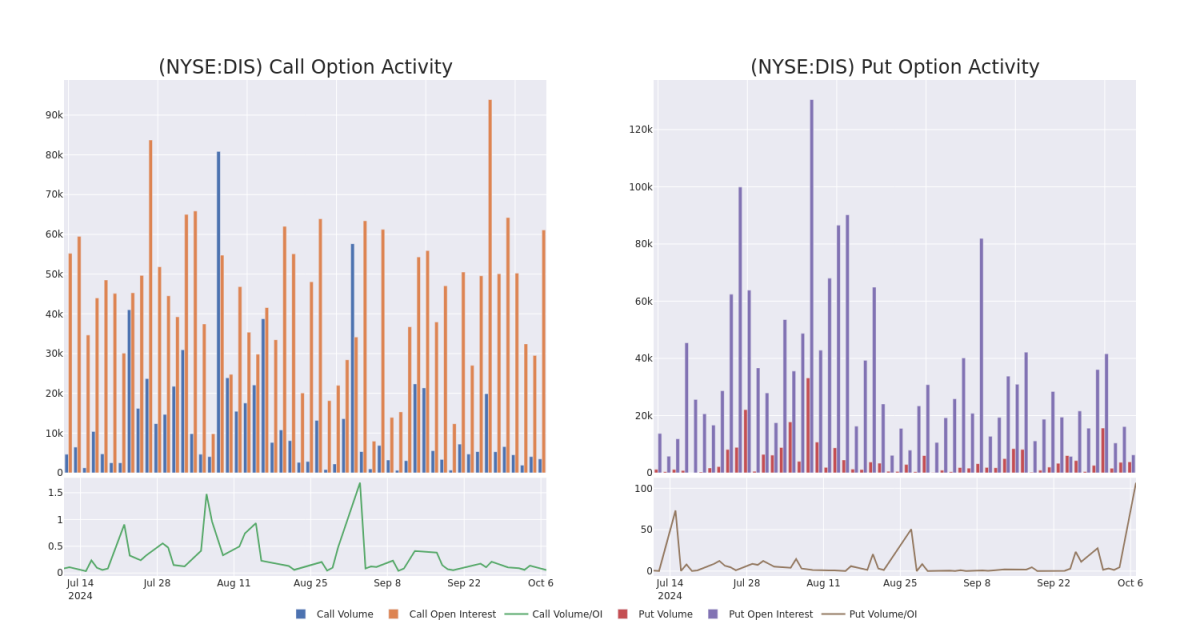

In today's trading context, the average open interest for options of Walt Disney stands at 5183.77, with a total volume reaching 7,325.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Walt Disney, situated within the strike price corridor from $80.0 to $110.0, throughout the last 30 days.

Walt Disney Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | PUT | TRADE | BEARISH | 11/08/24 | $0.7 | $0.64 | $0.68 | $86.00 | $238.0K | 33 | 3.5K |

| DIS | CALL | TRADE | BULLISH | 01/16/26 | $11.5 | $11.0 | $11.3 | $100.00 | $135.6K | 3.5K | 120 |

| DIS | PUT | SWEEP | BEARISH | 04/17/25 | $7.25 | $7.15 | $7.25 | $95.00 | $100.7K | 317 | 139 |

| DIS | CALL | TRADE | NEUTRAL | 10/18/24 | $1.43 | $1.31 | $1.36 | $95.00 | $73.1K | 11.0K | 562 |

| DIS | CALL | TRADE | BEARISH | 01/16/26 | $10.85 | $10.65 | $10.7 | $100.00 | $64.2K | 3.5K | 205 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from franchises and characters the firm has created over the course of a century. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

After a thorough review of the options trading surrounding Walt Disney, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Walt Disney's Current Market Status

- With a trading volume of 2,189,917, the price of DIS is down by -1.94%, reaching $93.31.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 38 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.