Whales with a lot of money to spend have taken a noticeably bullish stance on Amazon.com.

Looking at options history for Amazon.com (NASDAQ:AMZN) we detected 25 trades.

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 40% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $215,418 and 19, calls, for a total amount of $2,041,296.

From the overall spotted trades, 6 are puts, for a total amount of $215,418 and 19, calls, for a total amount of $2,041,296.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $167.5 to $200.0 for Amazon.com over the recent three months.

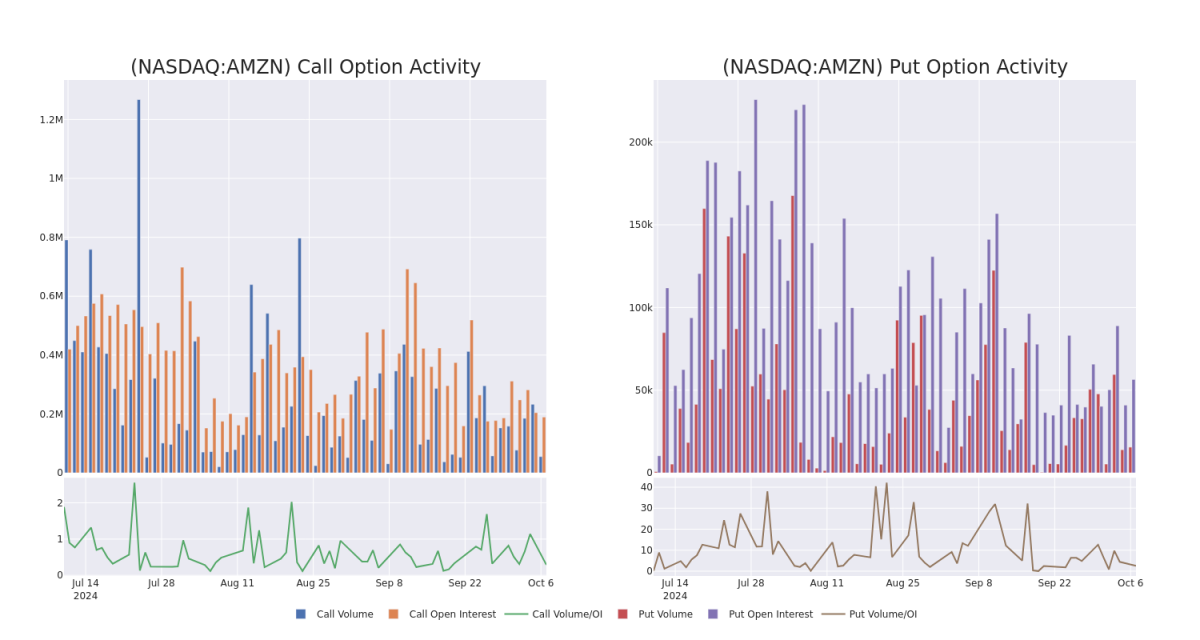

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Amazon.com's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amazon.com's whale trades within a strike price range from $167.5 to $200.0 in the last 30 days.

Amazon.com Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BULLISH | 12/18/26 | $34.95 | $34.2 | $35.0 | $200.00 | $1.0M | 3.8K | 6 |

| AMZN | CALL | SWEEP | NEUTRAL | 01/17/25 | $6.1 | $6.0 | $6.05 | $200.00 | $151.2K | 46.4K | 2.1K |

| AMZN | CALL | SWEEP | BULLISH | 10/11/24 | $2.65 | $2.62 | $2.65 | $182.50 | $133.2K | 3.4K | 1.0K |

| AMZN | CALL | SWEEP | BEARISH | 12/20/24 | $10.05 | $9.95 | $10.0 | $185.00 | $106.0K | 6.0K | 364 |

| AMZN | CALL | SWEEP | BEARISH | 11/15/24 | $8.05 | $8.0 | $8.0 | $185.00 | $81.6K | 26.6K | 1.4K |

About Amazon.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

Following our analysis of the options activities associated with Amazon.com, we pivot to a closer look at the company's own performance.

Present Market Standing of Amazon.com

- Currently trading with a volume of 16,835,876, the AMZN's price is down by -2.62%, now at $181.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 17 days.

Expert Opinions on Amazon.com

5 market experts have recently issued ratings for this stock, with a consensus target price of $229.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $230. * In a cautious move, an analyst from Morgan Stanley downgraded its rating to Overweight, setting a price target of $210. * An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $230. * Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Amazon.com, targeting a price of $265. * Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $210.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.