Those holding Snap Inc. (NYSE:SNAP) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 25% in the last year.

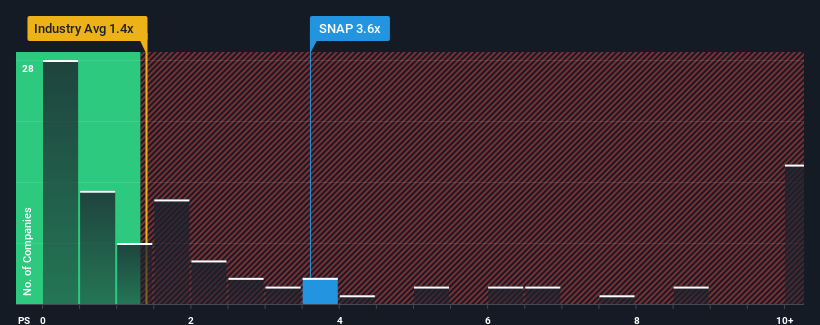

Following the firm bounce in price, given around half the companies in the United States' Interactive Media and Services industry have price-to-sales ratios (or "P/S") below 1.4x, you may consider Snap as a stock to avoid entirely with its 3.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

How Snap Has Been Performing

With revenue growth that's inferior to most other companies of late, Snap has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Snap.Is There Enough Revenue Growth Forecasted For Snap?

In order to justify its P/S ratio, Snap would need to produce outstanding growth that's well in excess of the industry.

In order to justify its P/S ratio, Snap would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 14% per annum as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 12% each year, which is not materially different.

In light of this, it's curious that Snap's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Shares in Snap have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Analysts are forecasting Snap's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

You always need to take note of risks, for example - Snap has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Snap's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.