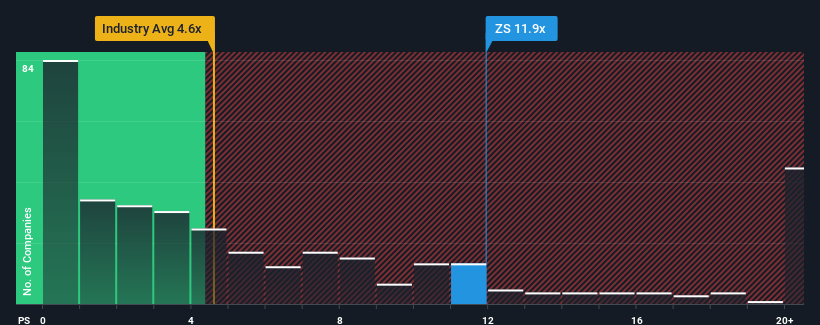

Zscaler, Inc.'s (NASDAQ:ZS) price-to-sales (or "P/S") ratio of 11.9x might make it look like a strong sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.6x and even P/S below 1.9x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Zscaler's P/S Mean For Shareholders?

Recent times have been advantageous for Zscaler as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zscaler.Do Revenue Forecasts Match The High P/S Ratio?

Zscaler's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The latest three year period has also seen an excellent 222% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

If we review the last year of revenue growth, the company posted a terrific increase of 34%. The latest three year period has also seen an excellent 222% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 21% per year over the next three years. That's shaping up to be similar to the 19% per year growth forecast for the broader industry.

In light of this, it's curious that Zscaler's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Zscaler's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Zscaler currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Zscaler, and understanding these should be part of your investment process.

If you're unsure about the strength of Zscaler's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.