Sify Technologies Limited (NASDAQ:SIFY) shares have had a horrible month, losing 43% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 78% loss during that time.

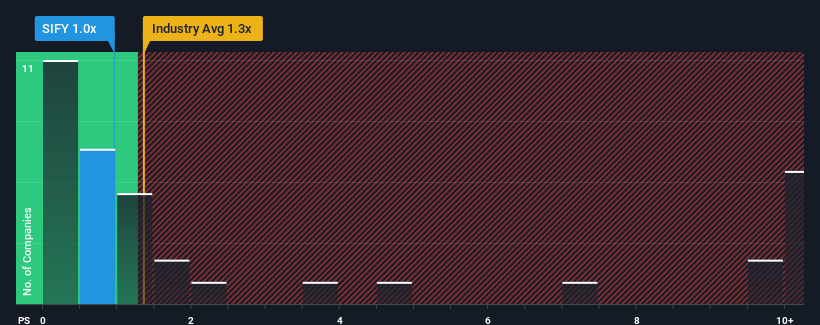

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Sify Technologies' P/S ratio of 1x, since the median price-to-sales (or "P/S") ratio for the Telecom industry in the United States is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Sify Technologies Has Been Performing

Recent times have been pleasing for Sify Technologies as its revenue has risen in spite of the industry's average revenue going into reverse. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Sify Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Sify Technologies?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sify Technologies' to be considered reasonable.

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sify Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.7% last year. The latest three year period has also seen an excellent 43% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 47% over the next year. With the industry predicted to deliver 49% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Sify Technologies' P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From Sify Technologies' P/S?

With its share price dropping off a cliff, the P/S for Sify Technologies looks to be in line with the rest of the Telecom industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Sify Technologies maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Sify Technologies (at least 2 which are potentially serious), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.