Source: Zhitong Finance

"Since 1950, the S&P 500 index has risen more than 10% 21 times as of the end of May. In about 90% of these cases, the S&P 500 index rose for the rest of the year. There were only two instances of declines for the rest of the year, in 1987 (-13%) and 1986 (-0.1%)."

With the rebound of the stock market, the old adage "Sell in May and Go Away" seems to have been a bad advice once again. Last month, the S&P 500 index rose 4.8%, the best May performance since 2009. The NASDAQ 100 index rose nearly 6.2%, and the NASDAQ Composite Index rose 6.9%. Goldman Sachs FICC & Equities Trading Division said: "History doesn't really support this saying. Don't sell, leave the market (go on vacation), and enjoy the good times."

The rising trend is still to be continued?

If history is any guide, it may indicate that the rise of the stock market is not over yet.

Looking ahead to the rest of 2024, Scott Rubner, Managing Director of the Goldman Sachs Global Markets Division and tactical expert, pointed out the following historical background for investors.

Rubner stated that the S&P 500 index has risen 10.7% year-to-date, and since 1950, the S&P 500 index has risen more than 10% 21 times as of the end of May. In about 90% of these cases, the S&P 500 index rose for the rest of the year. There were only two instances of declines for the rest of the year, in 1987 (-13%) and 1986 (-0.1%).

"Since 1950, the median return of the last 7 months of each year (June 1 to December 31) is 5.4%. In the aforementioned 21 cases, the average performance of the last 7 months increased to 8.1%." Rubner added.

Rubner also pointed out that the NASDAQ index has risen for 16 consecutive Julys, with an average return of about 4.64%.

Author: Rousseau

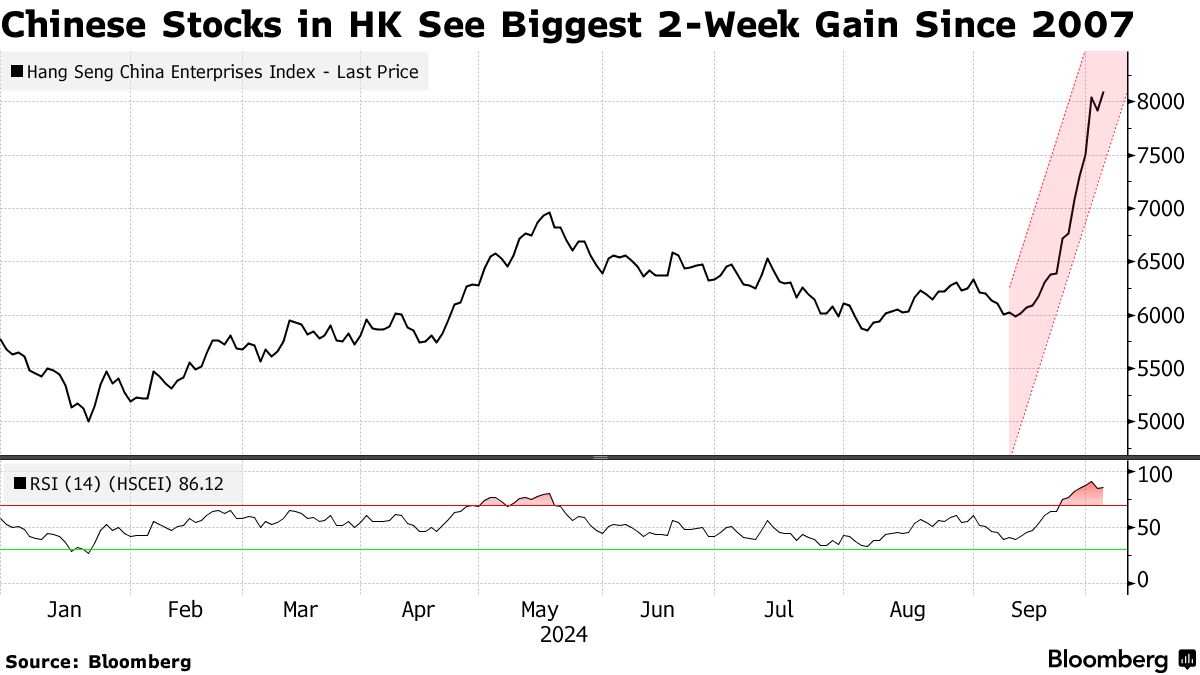

Since the temporary low point in September, the Hang Seng Index has risen sharply by over 35%; traders are anxiously awaiting the release of holiday data and fiscal stimulus details.

With the Hong Kong stock market experiencing the strongest two-week rebound since 2007, traders from Wall Street investment institutions are starting to ponder: if the Hong Kong stocks continue to soar during the National Day holiday, can the surging A-shares continue their rapid rise after the market opens next week? How far can this upward trend go? What details should be paid attention to in the future? Most foreign institutions are undoubtedly very optimistic about A-shares next week. During the Golden Week holiday, A-shares were not open for trading, but these foreign institutions significantly boosted the prices of H-share stocks in both the Hong Kong and US markets, indicating their expectation for A-shares to continue a strong surge after the market opens next week.

The latest statistical data shows that as of the close of trading on Friday, the Hang Seng Index has surged by over 35% since hitting a temporary low point last month, with a significant portion of the increase occurring after the Chinese government announced a series of large-scale stimulus measures on September 24. Since that day, the Hang Seng Index has accumulated a total increase of up to 25%. $Hang Seng Index (800000.HK)$ The latest statistics show that as of Friday's close, since hitting a temporary low last month, the Hang Seng Index has skyrocketed by over 35%, with the majority of the gains occurring after the Chinese government announced a series of large-scale stimulus measures on September 24. Since then, the cumulative increase in the Hang Seng Index has reached as high as 25%.

In the past two weeks, the Hong Kong stock market has surged due to a series of heavyweight stimulus policies from the Chinese government. Some stocks that have long been unremarkable have seen astronomical gains, with stock prices doubling or even more than doubling in just a few days. Since last week, the Chinese government has launched a package of stimulus measures to boost the Chinese economy and provide incredibly strong liquidity support to the domestic financial market. The policies aim to revitalize the long-sluggish real estate industry in the midst of a debt crisis and have comprehensively boosted global investors' confidence in the Hong Kong and A-share markets.

In the past two weeks, the Hong Kong stock market has surged due to a series of heavyweight stimulus policies from the Chinese government. Some stocks that have long been unremarkable have seen astronomical gains, with stock prices doubling or even more than doubling in just a few days. Since last week, the Chinese government has launched a package of stimulus measures to boost the Chinese economy and provide incredibly strong liquidity support to the domestic financial market. The policies aim to revitalize the long-sluggish real estate industry in the midst of a debt crisis and have comprehensively boosted global investors' confidence in the Hong Kong and A-share markets.

In addition, covering $BABA-W (09988.HK)$Please use your Futubull account to access the feature.$TENCENT (00700.HK)$ and $BIDU-SW (09888.HK)$ China's technology giants such as the "China Technology Stock Indicator"$Hang Seng TECH Index (800700.HK)$The Hang Seng Tech Index (HSTI) has a stronger increase compared to the Hang Seng Index.

Compared to a normal trading week, this week has one less trading day, but that does not prevent the Hang Seng Tech Index from rising by over 17% this week. In contrast, the Hang Seng Index has risen by about 10%. This also means that the core capital force of the Hong Kong stock market, led by foreign institutions such as Wall Street hedge funds, are extremely bullish on Hong Kong stocks, especially internet tech companies that will benefit comprehensively from a series of heavyweight stimulative policies from the Chinese government and the expectation of global loose liquidity. After all, the unrestricted Hong Kong stock market for foreign capital can enjoy the domestic stimulus policies, the rate cut cycle of the Fed, and even the massive liquidity stimulation brought about by rate cuts in Europe.

In the Hong Kong stock market, foreign investors are even more crazy about the optimism of the 'long bull market', benefiting from the unexpected 50 basis point rate cut by the Federal Reserve to start the rate-cut cycle, as well as the liquidity support provided by domestic monetary stimulus policies. Last week, the Hang Seng Tech Index soared over 20% in an epic rise. After the opening on October 2nd, the Hang Seng Tech Index continued to rise. Despite some pullback on October 3rd, the index closed the week with a 16% increase, and a whopping 40% increase since September 24th.

Foreign capital is pouring into both the Hong Kong and A-share markets.

The massive stimulus plan by the government has triggered a new wave of foreign capital inflow, with global asset management giant BlackRock Inc., and some foreign institutions such as Wall Street financial giant Morgan Stanley, which have been long bearish on the Chinese stock market (including Hong Kong and A shares), now taking a bullish stance. These foreign institutions are using real money to drive a significant rebound in the Chinese stock market.

Morgan Stanley's strategy team stated that if the Chinese government announces more bullish policies in the coming weeks, the Chinese stock market may rise further by 10% to 15%. 'Expectations for further fiscal expansion are back on the table, which has led investors to view China from a perspective of reflation for the first time in a long time,' said Laura Wang, Chief China Stock Strategist at Morgan Stanley. 'The last time investors looked at the Chinese market from this perspective was actually after the beginning of last year.'

Britney Lam, the long and short stock director at Magellan Investments Holding Ltd., stated, 'In the coming weeks, there may be more consumption-oriented fiscal stimulus measures, such as social welfare policies. Therefore, the return of global asset allocation to the Chinese stock market could signify a more significant trend reversal.' In a research report on the rise of the Chinese stock market, Britney Lam mentioned that more and more investors may choose to 'buy first, think later' - buy and hold stocks to avoid missing out on the market before considering future investment strategies.

On Friday, after experiencing a retracement on Thursday, the Hang Seng Index rose by 2.8% in a single day, recovering after a brief downturn. Judging from the performances of the Hang Seng Index and the HSTI, as well as the contribution of the HSTI's increase, the semiconductor manufacturing giant$SMIC (00981.HK)$, as well as the Chinese internet technology giant $MEITUAN-W (03690.HK)$ and Alibaba Group, are the main contributors to the rise of these two major indices.

According to some Wall Street analysts, the trend of the Hong Kong stock market remains strong after the opening on October 2nd this week, mainly because investors are hopeful that the National Holiday consumption data will provide more momentum for the stock market and the government's massive stimulus policies to boost the financial markets are expected to continue to push up the valuation of the Chinese stock market. In the past two weeks, the index has risen by about 25%, marking the largest two-week consecutive increase since August 2007.

The analysis team at Citigroup on Wall Street stated that the demand for leisure travel during the National Day holiday has been very strong, with travel transportation expenses being particularly pronounced. Data cited by the group shows that on the first day of the National Day holiday, China's railway passenger volume reached an astonishing 21.4 million, setting a new record for daily passenger volume.

Since the unexpected rate cuts by the People's Bank of China last week on key interest rates, reserve requirements, and mortgage rates, foreign institutions have been dominating the optimistic sentiment towards the Chinese stock market. This has been the core logic behind the collective frenzy of Chinese concept stocks in the entire Hong Kong stock market and the US stock market during the National Day Golden Week holiday, with Wall Street and other foreign institutions fully reflecting this optimistic sentiment towards A-shares on these core Chinese assets. In addition, these institutions have also seized the trend of the surge in the Chinese stock market by betting on the FTSE A50 equity index futures.

In the eyes of some analysts who have witnessed the Eurozone emerge from the Eurozone debt crisis, the timing of these heavyweight stimulus measures by the Chinese government is comparable to the 'whatever it takes' moment of the past, similar to the firm commitment by the former European Central Bank President Mario Draghi during the 2012 Eurozone debt crisis to uphold the common currency of the Eurozone.

Since September 24, these stimulus measures have completely changed the sentiment on Wall Street towards the world's second largest stock market, shifting from stubborn bears to actively bullish. Covering Alibaba, Tencent, and other core Chinese assets.$Kweichow Moutai (600519.SH)$The MSCI Chinese Index, including core Chinese assets such as Alibaba, Tencent, etc., has been in an unprecedented four-year continuous decline trend since 2024. However, this index has rebounded significantly by more than 34% as of 2024.

Last week, the net buying scale of Chinese stock markets (including Hong Kong and A-shares) by Goldman Sachs hedge fund clients reached the highest level since the relevant data of the main brokerage business of this Wall Street financial giant in 2016. According to data from LSEG Refinitiv, foreign exchange-traded funds (ETFs) focused on Chinese stocks received up to $2.4 billion in inflows in the last three trading days of September, sharply contrasting with the $2.7 billion outflows between the beginning of the year and September 25.

The optimistic sentiment of Wall Street towards the Chinese market has also spread to other major asset categories. The futures prices of iron ore, one of the most affected bulk commodities by fluctuations in the Chinese real estate market, have skyrocketed in recent days. Iron ore, one of the worst-performing major commodities this year, has seen a significant rebound on the trading front, as the Chinese government has been more actively supporting economic growth and promoting the vibrant development of the financial markets. Recently, the futures prices of copper and zinc on the London Metal Exchange (LME) have also surged significantly, with LME copper futures prices even briefly surpassing the $10,000 per metric ton mark.

Foreign investors who maintain a cautious stance still exist.

However, in this once sluggish stock market, some dissenting voices still persist. Rajiv Jain, the fund manager of the GQG Partners Emerging Markets Equity Fund, managing up to $23 billion, expects that this rebound may be short-lived, while economists at Nomura warn that risks of a bubble burst similar to 2015 still exist.

The sudden emergence of a new bull market in the Chinese stock market has triggered concerns among some analysts, questioning whether the surge has gone too far, too fast. Some analysts doubt whether the Chinese market can continue to recover if deep-rooted economic issues (such as long-standing imbalance in real estate supply and demand) remain unresolved.

Although the stock market response is generally very positive, it will to some extent depend on whether there will be specific and strong fiscal stimulus plans implemented. The Amundi Investment Solutions strategy team, including Alessia Berardi, wrote in a report. In the short term, a combination of a series of monetary easing policies and targeted substantial housing support should bring temporary stimulus effects, but a more sustainable recovery may require more decisive fiscal actions.

According to these more cautious analysts, the direction of the Chinese stock market depends on whether the government will take more specific measures to support economic growth. Some investors are also awaiting some consumption data from one of China's most important holiday seasons to see if there are any signs of significant improvement in consumer spending.

Tai Hui, Chief Market Strategist for the Asia-Pacific region at J.P. Morgan Asset Management, said in a media interview: "To me, the change in direction and mindset of the authorities is very important, but the market is expecting specific consumer spending during the Golden Week holiday period and how the government follows up with fiscal support implementation, these will be key catalytic factors to sustain the strong stock market rally we have seen so far."

Editor/Jeffy

最新统计数据显示,截至周五港股收盘,自上个月创下的阶段性低点以来,港股基准指数——

最新统计数据显示,截至周五港股收盘,自上个月创下的阶段性低点以来,港股基准指数——