If Khark Island is attacked, it would take several months to repair the facilities even under the best circumstances. About 90% of Iran's exports pass through these ports, and in the event of such an incident, it is expected that oil prices will immediately soar by more than 10% and continue to rise. If the oil transportation in the Strait of Hormuz is disrupted, the world will face an even bigger issue.

The escalation of the Middle East conflict, if Israel strikes Iran's "oil island", could lead to a surge in oil prices.

On Friday, October 4th, "Market Observation" reported that after Iran launched missile attacks on Israel, Iran's Khark Island oil terminal is highly likely to become a target of Israel. Gerard Filitti, Senior Attorney at the Lawfare Project, stated: An attack on the Khark Island oil terminal would have the most destructive impact, as about 90% of Iran's exports pass through these ports. In the event of such an incident, it is expected that oil prices will immediately surge by more than 10% and continue to rise.

According to the U.S. Energy Information Administration (EIA) data, most of Iran's crude oil is exported through Khark Island in the northeast of the Persian Gulf, which is known as Iran's "oil island".

According to the U.S. Energy Information Administration (EIA) data, most of Iran's crude oil is exported through Khark Island in the northeast of the Persian Gulf, which is known as Iran's "oil island".

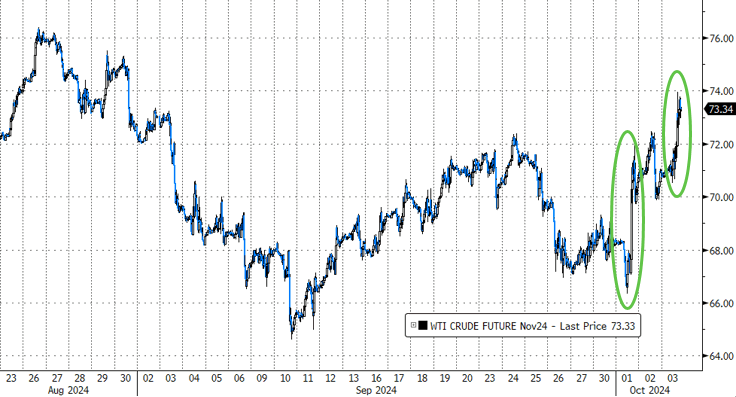

Due to concerns over disruptions in the Middle East's crude oil supply, Brent crude has accumulated an 8.5% increase this week, while the U.S. benchmark West Texas Intermediate crude has a 8.1% increase this week.

The tense situation between Iran and Israel has also put pressure on the benchmark indices of the U.S. stock market, with the Dow and Nasdaq likely to end the week lower, but the S&P 500 energy sector is expected to rise by over 5% this week.

However, Simon Lack, Co-Manager of the Catalyst Energy Infrastructure Fund, pointed out that the oil market may have already partly digested the Israeli attacks on Iranian infrastructure, which resulted in a daily interruption of 1.5 million barrels of oil supply.

OPEC may increase production to address the shortage of Iranian oil supply.

If Kharg Island is attacked, it would take several months to repair the facilities even under the best circumstances. Filitti stated that although Iran has other docks available for exports, the distance and capacity of these docks cannot replace the output of Kharg Island.

A comprehensive strike on Kharg Island would be devastating because Iran's economy relies on oil exports to earn US dollars and access the global market.

Data from S&P Global Commodity Insights shows that in 2023, Iran's average crude oil production is 2.82 million barrels per day, with the country's oil fields accounting for about 12% of global oil reserves.

This year, Iran's average crude oil exports were 1.5 million barrels per day, nearly half of its oil production. Additionally, Iran plans to increase its oil production capacity from this year's 3.4 million barrels per day to 3.9 million barrels per day by 2025.

Rob Thummel, manager of the Tortoise Energy Infrastructure Total Return Fund, stated that if Iran's oil production and exports are disrupted, other OPEC countries may quickly increase oil production to prevent long-term oil shortages.

Lack also stated that if Iran's 1.5 million barrels per day oil supply is interrupted, OPEC member countries could produce an additional approximately 0.5 million barrels per day, while US production could potentially increase by about 0.25 million barrels per day. Therefore, 'this can still be managed.'

However, OPEC member countries face significant risks in oil transportation through the Strait of Hormuz. The Strait of Hormuz is one of the most crucial transportation bottlenecks for global oil supply. US Energy Information Administration data shows that the average daily oil transportation through the Strait of Hormuz in 2022 was 21 million barrels, accounting for 21% of global oil consumption. Thummel stated:

'The problem is, the most likely suppliers to fill the gap in Iranian oil are Saudi Arabia or Kuwait, and this oil needs to be transported through the Strait of Hormuz. If oil transportation through the Strait of Hormuz is disrupted, the world will face an even bigger problem.'

If the Strait of Hormuz is closed, it will temporarily reduce global crude oil supply by 20%, causing oil prices to "soar in the short term," possibly exceeding $100 per barrel. However, Thummel added that the United States "is very aware of the importance of the Strait of Hormuz and may use all means to ensure that the strait remains open."

Israel may target various facilities in Iran.

Lack stated that Israel's threat to Iran's oil infrastructure "is currently more of a warning." However, if Israel decides to target Iran's oil & gas infrastructure, the Abadan refinery near the Iraq border could be a potential target, accounting for 17% of Iran's refinery capacity and 13% of gasoline supply.

"Attacking refineries would impact Iran in multiple ways, not only reducing its gasoline supply but also releasing crude oil supply - Iran already struggles to find buyers for its crude oil due to sanctions."

Simon Wong, an analyst at Gabelli Funds, also stated that oil export facilities are not Israel's only potential targets in Iran, other potential targets include nuclear facilities, refineries, and air defense facilities.

Wong further added that if Israel were to target Iran's oil export facilities or refineries, oil prices could experience an "immediate response" and rise. Brent crude prices could rise by $10 to $15 per barrel due to interruptions in Middle Eastern oil supply, "what happens next depends on Iran's response".

Editor/Lambor

根据美国能源信息署(EIA)的数据,大部分伊朗原油通过位于波斯湾东北部的哈尔克岛出口,这座岛被称为伊朗的“石油岛”。

根据美国能源信息署(EIA)的数据,大部分伊朗原油通过位于波斯湾东北部的哈尔克岛出口,这座岛被称为伊朗的“石油岛”。