Buying shares in the best businesses can build meaningful wealth for you and your family. And highest quality companies can see their share prices grow by huge amounts. Just think about the savvy investors who held Axsome Therapeutics, Inc. (NASDAQ:AXSM) shares for the last five years, while they gained 424%. If that doesn't get you thinking about long term investing, we don't know what will. Also pleasing for shareholders was the 16% gain in the last three months.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Given that Axsome Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Axsome Therapeutics saw its revenue grow at 83% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 39% per year in that time. Despite the strong run, top performers like Axsome Therapeutics have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

In the last 5 years Axsome Therapeutics saw its revenue grow at 83% per year. That's well above most pre-profit companies. Fortunately, the market has not missed this, and has pushed the share price up by 39% per year in that time. Despite the strong run, top performers like Axsome Therapeutics have been known to go on winning for decades. On the face of it, this looks lke a good opportunity, although we note sentiment seems very positive already.

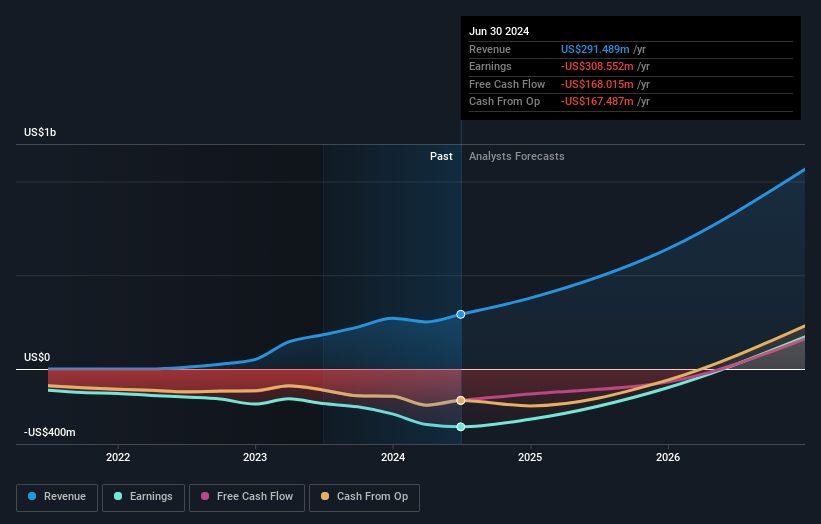

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Axsome Therapeutics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Axsome Therapeutics in this interactive graph of future profit estimates.

A Different Perspective

It's good to see that Axsome Therapeutics has rewarded shareholders with a total shareholder return of 44% in the last twelve months. That's better than the annualised return of 39% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. You could get a better understanding of Axsome Therapeutics' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like Axsome Therapeutics better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.