This article comes from the official account "Zeping Macro" of Wechat. The author: Ren Zeping, a member of Evergrande Research Institute, Guo Shuangtao.

Guide reading

In 2019, the global new energy vehicle industry staged a song of ice and fire, and the industry differentiation intensified. On the one hand, giants such as GM and Ford are laying off staff one after another, Fiat Chrysler and Peugeot Citroen merged, traditional car companies huddled together to keep warm, and on the other hand, the new power represented Tesla, Inc. 's accelerated internationalization, annual sales of nearly 400000, an increase of 50 per cent over the same period last year. On the one hand, the subsidies for new energy vehicles in China have declined, and sales have shown negative growth for the first time, while on the other hand, Germany has increased subsidies for new energy vehicles, and sales of new energy vehicles in Europe have greatly increased.

Since Karl Benz invented the first modern car in 1885, the automobile industry has never become the intersection of so many technological changes, involving energy, transportation, communications, computer and many other industries. The new four modernizations of automobile-the wave of electrification, intelligence, networking and sharing has begun, and the automobile industry for a century is standing on the eve of the dawn of great changes and reshuffle.

China's new energy automobile industry has established a certain first-mover advantage and scale advantage.

In the first half of 2019, the market share of China's new energy passenger cars was more than half, and the growth rate was much faster than that of overseas. According to the statistics of the China Automobile Association, 2019H1 sold 562900 new energy passenger vehicles (EV+PHEV) in China, an increase of 57.75% over the same period last year. According to Markline, 2019H1 sold 421300 overseas new energy passenger vehicles, an increase of 24.50% over the same period last year. 2019H1 sold a total of 984200 new energy passenger vehicles worldwide, of which China accounted for 57.19%, more than half, and the growth rate was 33.25% higher than that of foreign countries.

The penetration rate of new energy passenger vehicles in China is the highest, far exceeding that of the European Union and Japan. According to the statistics of China Automobile Association, ACEA, Markline and other institutions, 2019H1 China, the European Union, the United States and Japan sold 1012.70, 818.36, 259.38 and 2.2857 million passenger cars respectively, of which 56.29,19.78,13.65 and 17300 new energy passenger vehicles were sold, accounting for 57.19%, 20.10%, 13.87% and 1.76% respectively. The penetration rates of corresponding new energy vehicles (EV+PHEV) are 5.56%, 2.42%, 5.26% and 0.76%, respectively.

The low penetration rate of new energy passenger cars in Japan is due to the large number of HEV models. According to the Ministry of economy, Trade and Industry, Japan accounted for 31.84% of the HEV market in 2018. The high penetration rate of new energy passenger vehicles in the United States is due to the low proportion of passenger cars. According to Markline, 2019H1 passenger cars and light trucks sell 259.38 and 5.8447 million vehicles respectively.

The penetration rate of Tesla, Inc. and BYD's new energy models is far higher than that of other car companies, while the pace of electrification transformation of American and Japanese car companies is relatively slow. In terms of car companies, with the exception of Tesla, Inc. and BYD, all other car companies accounted for less than 10% of new car sales in 2018, including more than 2% of BAIC, Volvo, BMW, Mitsubishi and SAIC. GM, Ford, Toyota, Honda and so on less than 1%.

2 Policy side: countries speed up the electrification transformation, the European Union is the most active, China is the second, Japan is the second, and the United States is the most conservative.

As a new thing, new energy vehicles are difficult to compete with traditional fuel vehicles in terms of cost and technology at the initial stage of its birth. During the period of technology accumulation and market introduction, new energy vehicles need strong support from the government. Major countries and regions such as China, the United States, Japan and EU member states have issued a variety of support policies to promote the technological upgrading and market promotion of new energy vehicles.

2.1 Master plans for electrification in various countries

The overall planning of new energy vehicles is divided into two categories: the ban on the sale of fuel vehicles and the development goals of new energy vehicles.

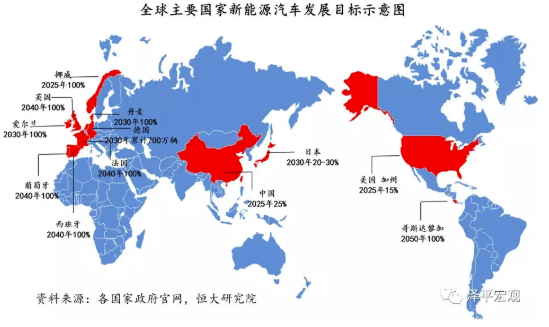

1) the ban on the sale of fuel vehicles: Norway is the most radical, followed by Britain and France, Japan is conservative, China, the United States and Germany have not yet issued documents. According to official disclosures, Norway, the Netherlands, the United Kingdom, France, Portugal and Japan are 2025, 2030, 2040, 2040, 2040 and 2050 respectively. China, the United States and Germany have not yet announced the ban schedule for the sale of national fuel vehicles: (1) China: the Ministry of Industry and Information Technology issued the reply to recommendation No. 7936 of the second session of the 13th National people's Congress in August 2019, pointing out that measures will be taken according to local conditions and classified measures will be adopted in the future. we will support pilot projects such as the advance replacement of urban public transport and the establishment of no-traffic zones for fuel vehicles in places and fields where conditions permit. (2) United States: Phil Ting, Democrat of California, proposed zero emissions in 2040 in 2018, and then came to nothing; (3) Germany: the German Federal Senate voted in 2016 to ban the sale of gasoline or diesel-powered vehicles in the European Union from 2030.

2) Development goals: Norway is the most radical, followed by China and the European Union, and Japan and the United States are the most conservative. According to the official disclosure of various countries, the sales of new energy vehicles account for 100% in Norway in 2025, 35% in the European Union in 2030, 25% in China in 2025, and 20-30% in Japan in 2030. California's electrification transformation is more active, but it will be only 15% by 2025, far lower than in other countries.

2.2 China: subsidies accelerate slope decline, double integral relay to build a long-term driving mechanism

As one of the strategic emerging industries in China, the government attaches great importance to the development of new energy vehicle industry and has issued omni-directional incentive policies, from government subsidies in R & D and double points in production to financial subsidies and tax relief in consumption, unlimited license and purchase in use, and charging concessions on the operation side, which almost cover the whole life cycle of new energy vehicles. Among them, subsidy policy and double points policy have the most far-reaching impact on the development of the industry.

2.2.1 Financial subsidy: accelerate the slope decline and shift from repurchase to supplementary operation

By the end of 2018, the central government had accumulated 66.2 billion financial subsidies. According to the Ministry of Finance, the central government allocated a total of 33.435 billion yuan in subsidies for new energy vehicles by the end of 2015, 123.33 yuan in 2016, 66.41 yuan in 2017 and 13.778 billion yuan in 2018, and 66.187 billion yuan in subsidies by the end of 2018. According to the 2.61 million new energy vehicle ownership data disclosed by the Ministry of Public Security at the end of 2018, the average subsidy for vehicles is 25400 yuan.

Financial subsidies began to decline significantly in 2017, accelerated in 2019 and completely withdrawn after 2020. Since 2013, the Ministry of Industry and Information Technology, together with other ministries and commissions, has successively issued six circular documents on subsidies for the purchase of new energy vehicles, and adjusted financial subsidy standards four times to guide the market:

The main results are as follows: 1) the intensity of slope retreat should be increased. At 150 ≤ R

2) encourage the technology of high energy density and low power consumption. Take pure electric passenger vehicles as an example, the financial subsidies from 2013 to 2016 only assess the mileage, increasing the power consumption, energy density and carrying capacity of 100 kilometers in 2017, 2018 and 2019, respectively. 3) the subsidies are shifted to operators and infrastructure construction. In November 2018, four ministries issued a notice on the Action Plan for improving the charging guarantee capacity of New Energy vehicles, requiring that local financial subsidies be directed from repurchase to supplementary operation, and gradually shift local financial subsidies to supporting the construction of charging infrastructure.

2.2.2 double points: relay financial subsidy, supply-side construction of long-term driving mechanism

Double points are driven by the supply side, which not only has the rigid restriction of energy-saving fuel consumption and the integral proportion of new energy vehicles, but also has the price signal guidance of integral transaction and transfer, which will play an important role in promoting the development of industry in the post-subsidy era. On July 9, 2019, the Ministry of Industry and Information Technology issued an amendment to the parallel Management measures for passenger vehicle Enterprises' average fuel consumption and New Energy vehicle points (draft for soliciting opinions), which mainly reflects three changes compared with the 2017 edition:

The main results are as follows: 1) the fuel consumption of traditional fuel vehicles is becoming more strict, and the development of low fuel consumption models is encouraged. The new "integral method" adjusts the traditional fuel vehicle testing method from NEDC to WLTC, and CNAC data show that its fuel consumption will be 10.6% worse than that of NEDC. In addition, the target value of fuel consumption has been lowered by about 10%.

2) the NEV score is decreased and the proportion is required to be increased. The new "points method" requires that the proportion of new energy points from 2021 to 2023 will be 14%, 16% and 18% respectively, an increase of 2% year by year. In addition, with the change of bicycle integral formula, the integral of pure electric and fuel cell vehicles is halved under the same technical conditions. The upper limit of points is adjusted, and the upper limits of points for pure electric, fuel cell and plug-in hybrid are adjusted to 3.4, 6 and 1.6 points respectively, which is-32%, + 20% and-20% higher than the current method.

3) NEV points are allowed to be carried forward to extend the assessment benefits for small and medium-sized enterprises. Previously, because the NEV points could not be carried forward, it weakened the enthusiasm of developing new energy vehicles. The new "points method" allows 19 years of NEV positive integrals to be transferred in equal amounts, and 20 years of positive integrals to be carried forward by 50%, which to a certain extent increases the flexibility of NEV points carry-over and transaction, and promotes the simultaneous development of traditional cars and new energy vehicles.

The new method will push up the integral value of new energy, support the growth rate of new energy vehicles, and protect the long-term development of the industry. Under reasonable assumptions, the new NEV points policy can increase the output of new energy passenger vehicles by about 70, 75 and 800000 in 2021, 2022 and 2023.

2.3 EU: the most stringent carbon emission standards in history, electrification becomes the only way out

In the first half of 2019, the total sales of passenger cars in the EU are 8.1836 million, second only to China; the sales of new energy passenger vehicles are 197800, accounting for 20.10% of the world; and the mainstream car companies Volkswagen, BMW, Mercedes-Benz and Audi are all in the European Union. The European Union plays an important role in the world automobile industry.

2.3.1 interpretation of carbon emissions: large reduction, short buffer, strict testing and heavy fines

In April 2019, the European Union issued document 2019, which stipulates that CO2 emissions from newly registered passenger cars in 2025 and 2030 will be reduced by 15% (81g/km) and 37.5% (59g/km) respectively on the basis of 2021 (95g/km). Compared with the previous standards, the new policy is more stringent, reflected in the following four points:

1) A large reduction in the target value: the new test standard WLTP will be adopted in 2021, and the emissions of passenger vehicles shall not be higher than 95g/km, and will be reduced by 15% and 37.5% respectively on the basis of 2021 in 2025 and 2030. According to the International Clean Transport Committee (ICCT), the actual carbon emissions of EU passenger car companies fell from 169g/km in 2001 to 121g/km in 2018, with an average annual decline of only 1.9 per cent.

2) the buffer period is shorter: the new rule has only an one-year buffer period and needs to reach 95% of the 2021 target by 2020. The previous 2015 target was first set in 2009, with a gradual introduction system, with 65%, 75% and 80% of new cars reaching the target in 2012, 2013 and 2014, respectively.

3) the test standard is more stringent: the WLTP test standard will be implemented from 2021. Compared with the NEDC test standard, the WLTP test standard has longer testing distance, more cycles, faster speed, and is closer to the reality. According to the 2018 EU passenger car test data released by EEA, the average carbon emission of passenger cars under the WLTP standard is about 21% higher than that of NEDC, while the test results of mainstream car companies show that it is 15% 24% higher.

4) the fine is even heavier: in 2018, it will be punished in stages according to the specific value of carbon emissions, but from 2019, all will be punished in accordance with the highest standard, with a fine of 95 euros per 1g/km exceeding the standard. The average carbon emissions of new passenger vehicles registered in the EU in 2018 are 121g/km, with sales of 15.62 million vehicles; assuming that carbon emissions and sales remain unchanged in 2020, there will be a fine of (12195) × 1562 × 95 = 38.58 billion euros.

2.3.2 Automobile companies should deal with it: electrification becomes the only way out

Supply side: in the face of such a high fine, the effect of improving energy-saving technology is limited, the development of new energy vehicles is the only choice. Newly registered passenger cars within the EU in 2018, of which gasoline vehicles, diesel vehicles, light mixers, HEV, PHEV and BEV accounted for 57%, 36%, 0.4%, 3.3%, 1.0% and 1.0%, respectively, and carbon emissions decreased in turn. According to EEA, the average CO2 emissions of EU-registered HEV passenger vehicles in 2018 only meet the requirements of 2020, but not the standards of 2025 and 2030. Therefore, the mainstream car companies will increase the layout of HEV in the short term, and the only choice is to develop PHEV and BEV in the medium and long term.

Demand side: Europeans are more receptive to new energy vehicles and have better fuel economy. Compared with China, the European Union has several advantages in developing new energy vehicles: 1) Europeans have strong environmental awareness, prefer compact cars, and have high acceptance of new energy vehicles. In 2018, EU A00, A0 and A cars accounted for 41% of the total. 2) the promotion of electric vehicles in Europe is more economical. According to the electricity consumption of pure electric passenger vehicles per 100km, industrial / residential electricity consumption is 50%, passenger cars gasoline cars and diesel vehicles account for 60% and 40%, and fuel consumption per 100km is 7.5L, using pure electric vehicles can save US $4.04,5.97,5.61,6.83,9.93,9.03 respectively per 100km.

2.4 US: demand-side tax relief, supply-side credit-driven

There are five main policies to promote new energy vehicles in the United States: tax relief, CAFE (CorporateAverage Fuel Economy) standard, GHG (Greenhouse Gas Emissions) standard, advanced vehicle loan support program, and ZEV (Zero-Emission Vehicle) Act; the first four are implemented at the federal level, and ZEV is at the state level; ZEV was first formulated and implemented by California, and then adopted by nine states, including Connecticut, Massachusetts and Maryland.

The Advanced vehicle loan support Program aims to provide low-interest loans to car companies that develop new technologies. In 2007, the US Department of Energy issued Article 136 of "Energy Independence and Security Act of 2007", announcing the implementation of "AdvancedTechnology Vehicles Manufacturing (ATVM) direct loan program" in the United States to provide low-interest loans to companies that develop new technology cars. According to the DOE of the US Department of Energy, the project has recently issued 8 billion US dollars in low-interest loans to US auto companies, of which Tesla, Inc., Ford and Nissan received 4.65,59.0 and 1.45 billion US dollars in low-interest loans in 2010, 2009 and 2010, respectively.

2.4.1 demand side: tax relief is linked to battery capacity, and the cumulative sales of electric vehicles by car companies will be halved every six months after the cumulative sales of electric vehicles exceed 200000.

The "Energy Improvement and Extension Act" was passed by the United States Congress in 2008 and has been implemented since it was amended by "The American Recovery and Reinvestment Act" in 2009 and "American Taxpayer Relief Act" in 2013.

According to the tax law, newly purchased PHEV and EV cars after December 31, 2009 can enjoy the corresponding tax return amount: 1) the power battery capacity 05kWh part, each additional 1kwh tax return will increase by US $417, up to a maximum of US $7500. 3) for companies with cumulative sales of more than 200000 new energy vehicles in the United States, the new car tax credit will be reduced by 50% in the next two quarters, followed by a further 50% in the next two quarters, and then cancelled. ≤ 5kwh, tax rebate of $2500; 2) Power battery capacity x >

In order to resist the impact of tax breaks, Tesla, Inc. cut prices four times from January to July 2019. Tesla, Inc., for example, sold more than 200000 electric vehicles in the United States at the end of 2018. Since 2019Q1, his bicycle tax credit has been reduced from 7500 US dollars to 3750 US dollars; since 2019Q3, his bicycle tax deduction has been reduced from 3750 US dollars to 1875 US dollars; and 2020Q1 tax relief has been abolished. In order to resist the increase in purchase costs caused by the reduction in tax breaks, Tesla, Inc. cut prices four times in January 2019, February 2019, May 2019 and July 2019, respectively.

According to Tesla, Inc. 's financial report, 2019Q3's gross profit margin on car sales is 21.78%, gross profit on bicycles is US $11525.77, and tax breaks account for 16.27% of gross profits. after the tax relief is cancelled, the gross profit margin is expected to be reduced by 3.54 percentage points.

2.4.2 supply side: multiple points system drives the electrified Transformation of Automobile Enterprises

On the supply side, there are mainly two kinds of national new energy vehicle promotion policies: CAFE standard and GHG standard; at the state level, there are mainly the ZEV Act formulated and promoted by California.

1) CAFE and GHG standards: in May 2010, Obama asked the US Environmental Protection Agency (EPA) and the US Highway Safety Administration (NHTSA) to implement a national 2017-2025 light vehicle program based on "Clean Air Act" and "Energy Independence and Security Act of 2007" to increase CAFE and reduce GHG emissions. Among them, EPA is responsible for formulating the GHG standard from 2017 to 2025, and NHTSA is responsible for formulating the CAFE standard from 2017 to 2025.

The first phase of the GHG policy "2017-2021" standard has been issued, and the second phase "2022-2025" standard, because on April 2, 2018, the Trump administration accused it of being too harsh and affecting employment, which needs to be revised, and the new version has not yet been released. The first phase of CAFE policy "2017-2021" standard has been promulgated, but the second stage "2022-2025" mid-term evaluation has not been published yet. There are many similarities between CAFE and GHG: 1) the integral system is adopted, and the positive integral can be obtained if the GHG emission is lower than the target value, and vice versa; 2) the standard values are classified by vehicle type and refer to the car occupation area "Footprint" as a reference. Take the GHG standard as an example, its target value curve for passenger cars from 2017 to 2021 is as follows. For car companies that do not meet the GHG standard, according to Article 205 of Clean Air Act, the maximum fine for bicycles is $37500.

The GHG standard is managed by the integral system. EPA publishes annual GHG reports of car companies to publicize the points of each car company. Companies that produce negative points need to buy positive points of GHG to offset. GHG score = (GHG target value-GHG actual value) × output × whole life cycle mileage / 1000000. Among them, the total life cycle mileage is 195264 miles for passenger cars, and the integral unit is Mg (megagrams Meg). Suppose: automobile company A produces 50000 passenger cars a year, and the output distribution of each model is as follows, then the actual score for that year can be calculated as: 478396.8Mg.

2) ZEV Act: in the 1860s, the United States promulgated "Clean Air Act" and gave California the right to set emission standards. Since then, the California Air Commission (CARB) first published the "Zero-EmissionVehicle" (ZEV) Act in 1990, which set the target of no less than 2% of zero-emission vehicles by 1998 and no less than 5% by 2001 and no less than 10% in 2003. After that, it was revised many times in 1996, 2001, 2003, 2008, 2013, and revised again in 2016 to become the latest version, which is as follows:

(1) minimum proportion: enterprises that sell more than a certain number of cars in California must produce at least a certain number of ZEV models every year according to the total number of cars they produce in California, and the number of ZEV models = reference car production x minimum ratio requirements. Reference car production: the average of all passenger cars and light trucks produced by the automaker in California in the previous 2-4 years. For example, the reference output in 2019 is the average of 2015, 2016 and 2017. 2018, 2019, 2020, 2021, 2022, 2023, 2024, 2025 and later, the minimum ratio requirements are 4.5%, 7.0%, 9.5%, 12.0%, 14.5%, 17.0%, 19.5%, 22.0%.

(2) ZEV integral formula: CARB calculates the ZEV integral of each enterprise according to the integral formula shown in the table below and makes an annual public announcement. According to the "Health and Safety Codesection 43211 civil penalty" regulations, companies that do not meet the ZEV points requirements will be fined $5000 per ZEV points.

According to Tesla, Inc., Tesla, Inc. 's cumulative points sales income from 2010-2019Q3 was US $2.168 billion, of which in 2016, 2017 and 2018, ZEV and non-ZEV points earned US $2.15,0.87, 1.03 and 315 million respectively.

2.5 Japan: dual-core promotion of financial subsidies and tax breaks

As a country lacking resources and highly dependent on energy, Japan has long attached importance to the development and application of new energy vehicles. In 2009, the Ministry of economy, Trade and Industry of Japan put forward the "EV/PHV City" initiative to build electric vehicle demonstration zones in 18 regions to promote the comprehensive popularization of EV/PHV. In this regard, a series of policies have been issued, focusing on strategic planning, financial subsidies and tax relief.

2.5.1 Master Plan: new energy vehicles account for 20-30% in 2030

New energy vehicles accounted for 15-20% and 20-30% in 2020 and 2030 respectively. The next Generation vehicle Strategy 2010 issued by the Ministry of economy, Trade and Industry of Japan in April 2010 defines the next generation of vehicles as: non-plug-in hybrid vehicle (HEV), pure electric vehicle (BEV), plug-in hybrid vehicle (PHEV), fuel cell vehicle (FCV), clean diesel vehicle (CDV) and so on. And announced for the first time the development goal: by 2020, the next generation of cars will strive to reach 20% to 50% of new car sales; by 2030, the next generation of cars will strive to reach 50% to 70% of new car sales, and will continue to be used today.

2.5.2 Financial subsidy: CEV subsidy for electric vehicles is linked to pure electric mileage

Financial subsidies for new energy are led by the Ministry of economy, Industry and Industry and are divided into four categories: 1) subsidies for energy-efficient vehicles; 2) subsidies for CEV (CleanEnergy Vehicle) introduction; 3) subsidies for charging facilities; and 4) subsidies for hydrogenation equipment. Among them, the subsidy for energy-efficient vehicles was abolished in September 2012 and replaced by CEV subsidies; the subsidies for hydrogenation equipment are mainly for hydrogen fuel cells, and the subsidies for charging facilities are mainly for charging piles. At present, the main driving force of new energy vehicles is the "CEV import subsidy".

In June 2012, an administrative council was held in Japan to consider the "CEV introduction subsidy" and draw up a specific roadmap. The implementing agency is the "New Generation Automobile Revitalization Center" under the Ministry of economy, Trade and Industry. As shown in the table below, the subsidy for electric vehicles is positively related to pure electric mileage. And requirements: 1) consumers must hold the car for 3-4 years after obtaining the CEV vehicle subsidy, and if they have no choice but to sell it, they must apply to the center in advance; 2) if the subsidy is less than 15,000 yen, the subsidy will not be given; 3) when the price difference between EV/PHV and gasoline vehicles narrows to 500000 yen, and annual sales increase to 10-150000 vehicles, it will no longer be used as a subsidy object.

2.5.3 tax relief: all new energy vehicles are exempted from purchase tax and heavy vehicle tax, and the green tax for newly registered new energy passenger vehicles is reduced by 75%.

The Ministry of Land and Transport has made efforts from the tax side, and in order to promote the popularization of energy-efficient and environmentally friendly vehicles, Japan has implemented the policy of "tax reduction for environmentally friendly vehicles" and "green tax system" since April 2009. The "tax reduction for environmentally friendly vehicles" is mainly divided into two types: purchase tax and heavy vehicle tax. the standard is slightly adjusted every year. The latest regulations: all new generation vehicles, including HEV, BEV, PHEV, FCV and CDV, are exempted from vehicle purchase tax and heavy vehicle tax, regardless of whether they are passenger vehicles, light commercial vehicles, medium commercial vehicles and heavy commercial vehicles. Compared with the tax system of "tax reduction for environmentally friendly vehicles", the "green tax system" is taxed according to vehicle emission standards, reducing taxes on vehicles with low fuel consumption and increasing taxes on vehicles with high fuel consumption. The latest "green tax system" stipulates that all new-generation cars include: HEV, BEV, PHEV, FCV, CDV, and green tax relief for newly registered passenger cars by 75%.

3 demand side: China is the world's largest market for new energy vehicles

3.1 Sub-regions: China accounts for more than half, EU accounts for 20%, and the United States ranks third

The global share of 2019H1 new energy passenger vehicles is 50% in China, 20% in the European Union and 20% in the United States and Japan. According to the China Automobile Association, 2018 and 2019H1 China New Energy passenger vehicles sold 105.3 and 563000 respectively; according to IEA and Markline, 2018 and 2019H1 US New Energy passenger vehicles sold 36.1 and 137000 respectively; according to ACEA, 2018 and 2019H1 EU New Energy passenger vehicles sold 30.2 and 198000 respectively; according to the Ministry of economy, Trade and Industry and Markline, 2018 and 2019H1 Japan New Energy passenger vehicles sold 18.4 and 74000 vehicles respectively According to IEA and Markline, 2018 and 2019H1 sold 18.4 and 74000 new energy passenger vehicles in other areas respectively. According to the above statistics, the market share of new energy passenger vehicles in 2019H1 China, the United States, the European Union, Japan and other regions is 56.9%, 13.8%, 20.0%, 1.8% and 7.5% respectively.

The growth rate of the European Union has remained stable, the growth rate of China and the United States has declined, and Japan continues to have negative growth. According to statistics from the China Automobile Association, IEA, ACEA and other institutions, in 2018, the year-on-year growth rates in China, the United States, the European Union, Japan and other regions were 81.9%, 82.2%, 42.2%,-34.4% and 40.6% respectively. The year-on-year growth rates in China, the United States, the European Union, Japan and other regions were 58.6%, 27.9%, 37.9%,-29.1% and 23.1%, respectively.

3.2Technology: global EV market share continues to increase

2019H1 global new energy passenger car market EV accounts for 3. 4%, the share continues to increase. In the 2019H1 new energy passenger car market, according to the China Automobile Association, China EV and PHEV sold 44.0 and 123000 vehicles respectively; according to ACEA, EU EV and PHEV sold 12.5 and 72000 vehicles respectively; according to Markline, US EV and PHEV sold 10.6 and 31000 vehicles respectively, Japan EV and PHEV sold 1.1 and 7000 vehicles respectively, and EV and PHEV sold 6.2 and 12000 vehicles respectively in other regions. According to the above statistics, 2019H1 global new energy passenger car market, EV and PHEV sold 74.4 and 246000 vehicles respectively, and EV's market share increased from 58.4% in 2014 to 75.2% in the first half of 2019.

2019H1 global market PHEV growth decline, Europe and the United States EV, PHEV growth differentiation is serious. In the 2019H1 new energy passenger car market, according to the China Automobile Association, China's EV and PHEV grew by 69.9% and 28.0% respectively; according to ACEA, EU EV and PHEV grew by 90.9% and-6.9%; according to Markline, Japan's EV and PHEV grew by-27.7% and-31.1%, the US EV and PHEV grew by 68.0% and-29.5%, and EV and PHEV grew by 52.7% and-37.6% in other regions. According to the above statistics, EV and PHEV in the 2019H1 global new energy passenger car market grew by 68.7% and-0.8% respectively compared with the same period last year.

4 supply side: central and European markets are dominated by local brands, Tesla, Inc. of the United States accelerates globalization

10 TOP20 auto companies in China, Tesla, Inc. expanding the leading edge

Tesla, Inc. and BYD (01211) all have a market share of more than 10%, while BAIC, SAIC and BMW all have a market share of more than 5%. According to EV Sales, the global sales of new energy passenger vehicles TOP20 from January to November 2019 are: Tesla, Inc., BYD, BAIC, SAIC, BMW, Nissan, Geely, Volkswagen, Hyundai, Toyota, Kia, Mitsubishi, Renault, Chery, Great Wall (02333), Volvo, Guangzhou Automobile, Changan, Jianghuai and Chevrolet, including 10 in China, 2 in the United States, 3 in Japan, 3 in the European Union and 2 in South Korea. The corresponding sales of TOP20 are 755100 in China, 336500 in the United States, 175000 in Japan, 232600 in the European Union and 116500 in South Korea. The corresponding market share of TOP20 is 38.88% in China, 17.32% in the United States, 9.01% in Japan, 11.97% in EU and 5.96% in South Korea.

Car model with 4.2 points: Tesla, Inc. Model 3 outshines others.

China occupies 9 seats of TOP20 model, EU occupies 5 seats, Tesla, Inc. is on the list of all departments, and Model 3 stands out. According to EV Sales statistics, the global sales of new energy passenger cars TOP20 from January to September 2019 are: Model 3, EU series, Yuan / S2 EV, Leaf, Outlander PHEV, Baojun E series, 530e/Le, Zoe, Kona EV, BMW i3, Tang PHEV, eQ EV, PriusPHEV, Model X, BYD E5, Dihao EV, e-Golf, Roewe Ei5 EV, Euler R1 EV, Model S The corresponding sales volume is 20.80,7.43,6.08,5.38,3.86,3.73,3.68,3.52,3.30,3.06,3.00,2.96,2.87,2.86,2.84,2.73,2.54,2.35,2.26 and 20500, including 9 in China, 3 in the United States, 2 in Japan, 5 in the European Union and 1 in South Korea.

The Chinese and European markets are dominated by local brands, while the American and Japanese markets are dominated by local brands, supplemented by German. From a regional point of view, in the new energy passenger car market, Chinese local brands occupy an absolute position, TOP10 occupies 9 seats; American local brands mainly occupy 6 seats and Japanese brands are supplemented by Japanese brands, respectively, Tesla, Inc. Model 3 outshines others, with a market share of 46.52%; European local brands occupy an absolute position, TOP10 occupies 7 places; Japanese local brands and German brands are comparable, TOP5 occupies 2 and 3 places respectively.

4.3Technical reserve: the United States, Japan and South Korea together account for 90% of BEV patents, while HEV and FCV patents are dominated by Japan.

Patent is not only a symbol of technological strength, but also the embodiment of the forward-looking layout of enterprises. In October 2019, the Global Industrial Research Institute of Tsinghua University released the report "Global Patent observation of New Energy vehicles". It was pointed out that by July 2019, the number of patents for BEV models accounted for 26% in Japan, 25% in China, 20% in South Korea, 18% in the United States, 4% in Germany and 1% in France. The proportion of patented HEV models is 52% in Japan, 4% in China, 6% in South Korea, 16% in the United States, 12% in Germany and 4% in France.

The new generation of Japanese car HEV dominates. Because of the leading engine technology, Japan has a natural advantage in developing HEV, so it brings HEV into the new generation of automobile system and develops together with EV and PHEV. According to the Japan Automobile sales Association (JAMA), the sales of new HEV, EV, PHEV, FCV and traditional cars in Japan in 2018 were 92.18,1.46,1.88,0.06 and 1.9397 million respectively, accounting for 66.99%, 31.84%, 0.65%, 0.5% and 0.02%, respectively.

5 supporting industrial chain: Japan is the most complete, China relies on imports of some key parts, and the battery links of the European Union and the United States are missing.

Japan is complete, China's electronic control IGBT is heavily dependent on imports, and there is a lack of power battery enterprises in Europe and the United States.

Battery, motor and electric control are the core technologies of new energy vehicles.

1) batteries: according to SNE Research, the number of power batteries installed by global TOP10 companies in 2018, CATL, Panasonic, BYD, LG Chemical, AESC, Samsung SDI, Farasis, Guoxuan, Lishen and Yiwei are 21.3,20.7,11.6,7.4,3.7,3.3,3.2,2.8 and 1.9GWh respectively. Among them, China, Japan and South Korea accounted for 49.2%, 21.4% and 10.7% respectively, totaling 81.3%.

2) Motor: according to the prospective Industrial Research Institute, the United States, Japan and Germany accounted for 34%, 16% and 13% of the global new energy vehicle motor market in 2018, respectively, and China's new energy vehicle motor basically realized domestic substitution. 3) electronically controlled IGBT:IGBT is the core component of the electronic control system of new energy vehicles. According to the Infineon Annual report, Infineon, Mitsubishi, Fuji Motor, on and Semix accounted for 28.6%, 15.2%, 9.7%, 7.2% and 5.7% respectively in the global IGBT field in 2018; according to nationality, Germany 34.3%, the United States 7.2%, Japan 24.9%; and China's IGBT import dependence in 2018 is about 90%.

5.2 charging piles: car piles are closer than those in China, Japan and Europe, and lower in the United States.

As of November 2019, according to the statistics of the China Automobile Association and the China charging Union, the number of new energy vehicles and public charging piles in China was 3.855 million and 496000 respectively, with a corresponding pile ratio of 7.77 to 1.According to the statistics of ACEA and the EU alternative fuel Observatory, the number of EU new energy vehicles and public charging piles was 1.35 million and 173000 respectively. According to the statistics of Markline and the US alternative fuel data Center, the number of new energy vehicles and public charging piles in the United States is 1.412 million and 75000 respectively, with a ratio of 18.88 to 18.88. As of December 2018, according to the Ministry of economy, Trade and Industry, there are 236000 new energy vehicles in Japan; according to the New Generation Automobile Revitalization Center, there are 38000 charging piles, with a ratio of 6.15 to 6.15.

6 Prospect: a hundred years of great changes in the automobile, keep the cloud open and see the moon bright

At present, the century-old automobile industry is at the confluence of three transformative forces:

One of the changes: the rise of new forces such as Tesla, Inc., the cross-border entry of Internet, semiconductor and other technology giants, the reshaping of the competition pattern of the automobile industry, the reconstruction of the core value chain, and some OEM may become contract factories in the future.

1) pattern reshaping: the new car-building forces represented by Tesla, Inc. are constantly grabbing the market share of traditional car companies by making use of their first-mover advantages and Internet genes. From January to November 2019, sales of the Tesla, Inc. Model 3 in North America reached 128000, exceeding the sum of the same class of BMW 2Accord 4 / 5 Series (104000), Mercedes-Benz C/CLA/CLS/ E-Series (95000) and Audi A3 / A4/A5/A6 (70, 000). On the other hand, traditional car companies such as GM and Ford are laying off staff one after another, and FCA (Fiat Chrysler) and PSA (Peugeot Citroen) merged to form the fourth largest car company in the world.

2) value chain reconstruction: in the future, the core value of the automobile industry will no longer be the engine, body and chassis, but batteries, chips, on-board systems and data. Cake making may be a traditional car company, while cake eaters may be new forces. Volkswagen, the world's largest carmaker, has announced that it will become a software-driven company and has set up a "Digital Car&Service" division to vigorously promote the digital transformation. Toyota announced that Toyota will transform from a car company to a mobile travel company, and their competitors are no longer Mercedes-Benz, BMW and Volkswagen, but Apple Inc, Alphabet Inc-CL C and others. Giants such as Alphabet Inc-CL C, Qualcomm Inc, NVIDIA Corp, Huawei, BABA and Baidu, Inc. have embedded intelligent driving segments through cooperation, authorization or supplier identity, which may occupy an important value point in the industry in the future. Some car companies that are unable to master the core technology can only be gradually marginalized and even become contract manufacturers.

The second change: the governments of Europe, Japan and South Korea have accelerated the electrification transformation one after another, verifying the forward-looking strategy of China's development of new energy vehicles ten years ago.

After ten years of planning and cultivation, China's new energy automobile industry has a certain first-mover advantage and scale advantage. Chinese Autobots have never been so close to the dream of an automobile power. However, Tesla, Inc. set up a wholly-owned factory in Shanghai in 2019 and delivered it on December 30th. The price of Model 3 is less than 300000 after subsidy. In the face of this "catfish", can China's own car brands keep the first-mover advantage?

1) Europe, the United States, Japan and South Korea promote the transformation of electrification through top-level design and car companies from the bottom up: in April 2019, the European Union released the most stringent carbon emission standard in history. Norway, the Netherlands, the United Kingdom, France and Portugal set the ban on the sale of fuel vehicles at 2025, 2030, 2040, 2040 and 2040 respectively. The development of new energy vehicles is the only way out. Germany has enacted legislation to confirm that subsidies for domestic electric vehicles have risen instead of falling. Subsidies for pure electric vehicles selling for less than 40, 000 euros have been increased from 4000 euros to 6000 euros. Car companies have increased their investment. Volkswagen will increase the number of electric vehicles it originally planned to produce from 15 million to 22 million by 2030.

2) China's new energy vehicle industry urgently needs to make up for its shortcomings and turn its first-mover and scale advantages into technology and brand advantages: 563000 new energy passenger vehicles were sold in China in the first half of 2019, with a global market share of 56.9%, much higher than that of the European Union (20%). Industrial chains such as three power systems and charging infrastructure have initially taken shape. From January to November, independent brands accounted for 4 of the top 10 new energy passenger car companies in the world (BYD, BAIC, SAIC, Geely). However, China's new energy vehicles basically rely on domestic sales, and there are no Chinese brands of best-selling electric models in the United States, the European Union and Japan from January to September 2019. Some core components are highly dependent on imports, such as electronic control core components IGBT devices and image processing chips. Germany, Japan and the United States accounted for 34.3%, 7.2% and 24.9% of the global IGBT market in 2018, respectively; image processing chips were basically monopolized by NVIDIA Corp and Mobileye (acquired by Intel Corp).

The third change: the attributes of automobile products are more diverse, and the automobile will become a software-defined intelligent mobile terminal.

1) hardware reform: on the one hand, batteries, motors and electronic controls will replace engines, and automobile powertrain will face the biggest change in a century; on the other hand, Intelligent Network will enhance the demand for vehicle perception, interaction and decision-making. sensors, central control screens and chips will become the core components of the automobile.

2) Software change: automotive electronic and electrical architecture will evolve from distributed to centralized architecture similar to smartphone (underlying operating system, chip SOC). The decoupling of software and hardware not only realizes the standardization of hardware, but also realizes the repeated development and utilization of software, and greatly reduces the internal redundancy. In the future, there will be a dispute between iOS and Android in the automobile industry.

3) Service and ecological change: intelligent Networked vehicles can continuously update their applications through OTA air upgrades during their life cycle, and interface interaction will give cars more application scenarios-drivers will have more free time in the case of self-driving, while car networking technology enables cars to connect with offices, homes and public facilities at any time to achieve remote control. Cars will be the entrance to a variety of services and applications.

After experiencing the throes of subsidy decline, China's new energy vehicle industry is about to usher in positive competition from overseas giants. It took less than 14 months for Tesla, Inc. to deliver the first batch of products from Oct. 17,2018 to Dec.30,2019, and the pace of localization was rapid.

According to the 299000 price of the latest domestic version of Model 3 after subsidy, taking into account the decline in financial subsidies in 2020 and the scale effect after capacity increase, it is expected that the large-scale delivery price of domestic Model 3 in 2020 will be around 26-280000, which will put huge competitive pressure on local brands in the high-end market. In the face of the great changes in the automobile industry in the past hundred years, the road of China's automobile power is facing unprecedented opportunities and challenges. "changing lanes and overtaking" needs the full cooperation of policy and the whole industry chain. We suggest that:

1) to further guide the electric transformation: we should first ban the sale of fuel vehicles in public transport, logistics, rental and other official fields, encourage some key areas for air pollution control and cities with high popularization rate of new energy vehicles to ban the sale of fuel vehicles, and clarify the requirements for the proportion of new energy vehicles in online car-hailing.

2) encourage and support the research and development of core technologies: increase tax breaks for enterprises with high R & D investment, and set up a national new energy vehicle industry fund to support the weak links of the industrial chain; coordinate the efforts of the government, enterprises and universities to tackle key common technologies such as battery materials and core chips.

3) strengthen the construction of battery safety system: using big data platform to establish early warning mechanism, strengthen prior supervision; establish power battery life cycle safety test, strengthen in-process supervision; establish accountability system, strengthen ex post supervision. According to the report on the Safety Supervision results of big data, the national supervision platform for new energy vehicles, of the 79 safety accidents of new energy vehicles discovered from May to August in 2019, 47 were connected to the supervision platform, and 28 accidents occurred within 10 days before the occurrence. Has been warned by the regulatory platform.

4) develop and support the new energy used car market: car owners generally change cars for 3-5 years due to changes in social relations, economic conditions and family population. The three-year residual value rate of traditional fuel vehicles is about 70%, and that of new energy vehicles is about 30%. The depreciation is too fast, and the cost of trial and error is too high. Many consumers dare not buy new energy vehicles and have a strong wait-and-see mood.

5) accelerate the construction of private charging piles and encourage the promotion of community smart charging: the difficulty of charging is an important factor restricting the development of new energy vehicles. As of November 2019, China's public charging pile 496000, private charging pile 678000, compared with the 2020 target completion rate of 99.2% and 15.8% respectively, the construction of private charging pile is far from the expected. The great impact on the power grid load of the residential area is an important factor for the slow construction of private charging piles, and the promotion of community intelligent charging can effectively realize peak cutting and valley filling and reduce the load of power grid.

Edit / Iris ray