Before the IPO, Carlote introduced two cornerstone investors, Wei Capital and Yuansheng Capital, with a total investment of $40 million. Previously, Carlote had been independently developing without introducing investment institutions. In overseas channels, Amazon and Walmart's revenue growth has been rapid, reaching 2.35 billion yuan in the first quarter of this year, accounting for 52.2%, indicating that overseas has become their main sales channel.

"Star Market Daily" reported on October 3rd (Reporter Xu Cihao) The 'Pot Factory' of Zhejiang's post-85s second-generation factory has gone public.

Recently, the kitchenware brand Carlote (Commercial) Co., Ltd. (referred to as 'Carlote') was listed on the Hong Kong Stock Exchange. In this IPO, Carlote was priced at 5.78 Hong Kong dollars per share, issuing a total of 0.1299 billion shares, with net proceeds of approximately 0.693 billion Hong Kong dollars.

On the first day of listing, Carlote's stock price performed strongly, opening at 9.5 Hong Kong dollars per share, a significant increase of 64% over the issue price. As of the close on October 2nd, the stock price steadily settled at 9.15 Hong Kong dollars per share, still showing a high increase of 58.3%, and the company's market cap subsequently soared to 4.9 billion Hong Kong dollars.

On the first day of listing, Carlote's stock price performed strongly, opening at 9.5 Hong Kong dollars per share, a significant increase of 64% over the issue price. As of the close on October 2nd, the stock price steadily settled at 9.15 Hong Kong dollars per share, still showing a high increase of 58.3%, and the company's market cap subsequently soared to 4.9 billion Hong Kong dollars.

It is worth noting that Carlote had always maintained an independent and autonomous stance before the IPO, never introducing external investors. In this listing, Wei Capital and Yuansheng Capital, as cornerstone investors, each invested $20 million and respectively hold 5.06% of the shares.

The founders saw a surge to 3.674 billion.

The origin of Carlote started with the transformation of a second-generation factory.

According to the prospectus, the controlling rights of Carlote are in the hands of the young couple Zhang Guodong and Lv Yili. Both were born in zhejiang in 1988 and have had an inseparable bond with the kitchenware manufacturing industry since childhood. In 1992, their parents - Li Huiping and Zhang Zhihui, founded Yongkang Special Electric Appliance Co., Ltd., which was the predecessor of Carlote.

Li Huiping's daughter Lv Yili and Zhang Zhihui's son Zhang Guodong both studied abroad at Griffith University in Australia, one studying accounting and the other studying marketing. After graduating in 2010, they both joined Carote.

Later, Zhang Guodong and Lv Yili got married and took over together, becoming the actual controllers and core executives of Carote. Zhang Guodong served as the chairman and CEO, while Lv Yili was an executive director and chief product officer.

Carote was established in 2007 and initially provided OEM services to the international market before focusing on branding. In 2013, Carote underwent its first transformation to ODM, established its own R&D team, and shifted its business from OEM manufacturing to designing and developing new products for international brands, including customized services. This marked the initial accumulation of brand influence.

During the fastest-growing phase of e-commerce development, Zhang Guodong and his wife launched their own brand, Carote (CAROTE), in 2016, venturing into online retail and emphasizing direct-to-consumer sales to build the brand.

In early 2022, Carote divested its production operations and shifted to a fully outsourced and asset-light model.

Since then, Carote has transformed from a traditional manufacturing factory at the bottom of the industry chain to a brand company at the top of the industry chain, integrating industry resources.

Prior to the IPO, Carote brought in two cornerstone investors, Weiying Venture Capital and Yuansheng Capital, with a total investment of $40 million (approximately 0.312 billion Hong Kong dollars), each subscribing to $20 million, accounting for about 42% of the highest fundraising amount in this round.

According to the prospectus, Zhang Guodong and Lv Yili hold 98.60% of Carote's equity before listing, making them the largest shareholders. The remaining stakeholders include Denk Trade, holding 1%, and Carote CM holding 0.4%. Denk Trade is a customer of Carote's OEM services.

After listing, Zhang Guodong and Lv Yifeng hold 74.99% of the shares, while the two cornerstone investors each hold 5.06% of the shares. The lock-up period for cornerstone investors is 6 months. Based on this calculation, Zhang Guodong and Lv Yifeng have earned a fortune of 3.674 billion following the successful listing of Carolot.

Mainly focusing on overseas channels.

The prospectus shows that in 2021, 2022, 2023, and the first quarter of 2024, Carolot introduced 520, 1305, 1374, and 361 SKUs of its own brand products, continuously expanding its product range.

Today, Carolot's product portfolio includes over 2200 SKUs covering different categories of kitchenware, mainly including non-stick cookware, cast iron pots and selected cooking utensil sets, kitchen storage boxes, containers, knives, cutting boards, spatulas, ladles, drinking containers, mugs, glassware, air fryers, electric cookers, and other cooking, kitchen, and drinking utensils.

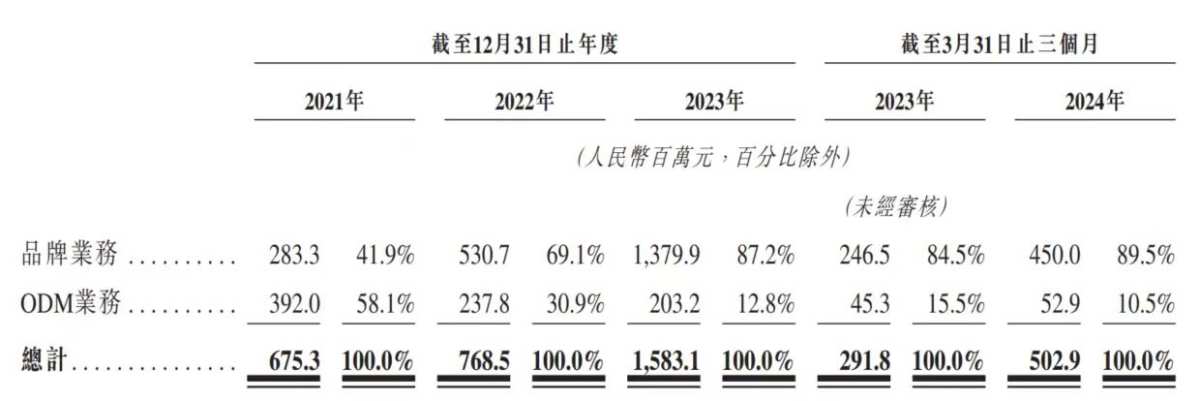

The prospectus shows that in 2021, 2022, 2023, and the first quarter of 2024, Carolot achieved revenues of 0.675 billion yuan, 0.769 billion yuan, 1.583 billion yuan, and 0.503 billion yuan respectively, with profits of approximately 0.032 billion yuan, 0.109 billion yuan, 0.237 billion yuan, and 0.089 billion yuan during the period.

After 8 years, the own-brand business (referred to as Carolot below) has become Carolot's most important source of revenue.

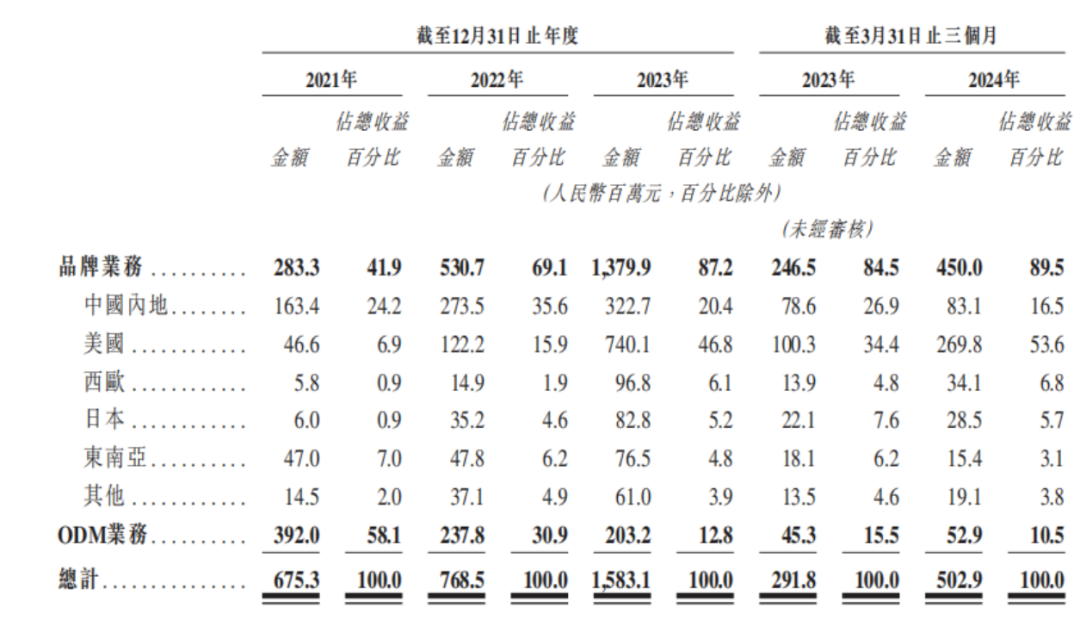

The prospectus shows that in recent years, Carolot's self-operated business has grown rapidly, with revenue starting at 0.283 billion yuan in 2021 and reaching 0.531 billion yuan in 2022, 1.38 billion yuan in 2023, and a compound annual growth rate of 120.7%; the percentage of total revenue has also increased from 41.9% to 69.1%, 87.2%. In the first quarter of 2024, revenue reached 0.45 billion yuan, accounting for an increased share of total income at 89.5%.

While the revenue of the ODM business has been declining year by year, from 0.392 billion yuan in 2021 to 0.238 billion yuan and 0.203 billion yuan in 2023, with the first quarter of 2024 at 0.053 billion yuan, accounting for 10.5% of total revenue.

From a channel perspective, although Karott also sells domestically through platforms such as Tmall and JD.com, most of its revenue comes from overseas markets. Last year, due to strong sales performance in the USA and Western European markets, as well as an increase in brand awareness, Karott's overseas revenue growth exceeded double.

According to the prospectus, the revenue from mainland China in 2021, 2022, 2023, and the first quarter of 2024 was 0.163 billion yuan, 0.274 billion yuan, 0.323 billion yuan, and 0.083 billion yuan, accounting for 24.2%, 35.6%, 20.4%, and 16.5% of total revenue, respectively.

In overseas channels, the revenue growth of Amazon and Walmart has been rapid, with Amazon's revenue reaching 0.67 billion yuan in 2023, accounting for 48.8%; in the first quarter of this year, it reached 0.235 billion yuan, accounting for 52.2%.

上市首日,卡罗特股价势头强劲,开盘即报9.5港元/股,较发行价大幅飙升64%。截至10月2日收盘,股价稳稳收于9.15港元/股,涨幅依然高达58.3%,公司市值随之跃升至49亿港元。

上市首日,卡罗特股价势头强劲,开盘即报9.5港元/股,较发行价大幅飙升64%。截至10月2日收盘,股价稳稳收于9.15港元/股,涨幅依然高达58.3%,公司市值随之跃升至49亿港元。