Whales with a lot of money to spend have taken a noticeably bullish stance on Microsoft.

Looking at options history for Microsoft (NASDAQ:MSFT) we detected 71 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 38% with bearish.

From the overall spotted trades, 31 are puts, for a total amount of $2,005,638 and 40, calls, for a total amount of $2,078,899.

From the overall spotted trades, 31 are puts, for a total amount of $2,005,638 and 40, calls, for a total amount of $2,078,899.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $475.0 for Microsoft over the last 3 months.

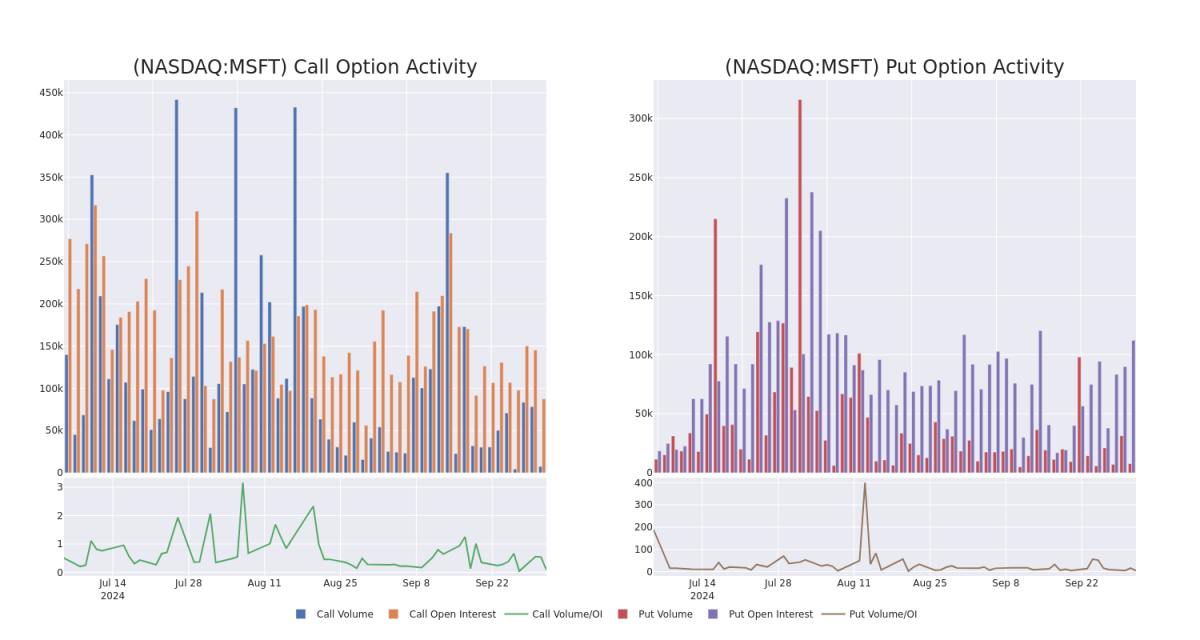

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Microsoft's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Microsoft's whale trades within a strike price range from $150.0 to $475.0 in the last 30 days.

Microsoft Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSFT | PUT | TRADE | BULLISH | 11/15/24 | $2.29 | $2.24 | $2.25 | $365.00 | $225.0K | 1.4K | 1.0K |

| MSFT | CALL | SWEEP | NEUTRAL | 03/21/25 | $21.25 | $21.1 | $21.1 | $440.00 | $198.2K | 1.8K | 109 |

| MSFT | PUT | TRADE | BULLISH | 06/20/25 | $46.75 | $46.35 | $46.35 | $450.00 | $162.2K | 952 | 37 |

| MSFT | PUT | TRADE | BULLISH | 06/20/25 | $46.8 | $46.5 | $46.5 | $450.00 | $139.5K | 952 | 103 |

| MSFT | PUT | TRADE | BEARISH | 08/15/25 | $38.15 | $37.8 | $38.15 | $430.00 | $110.6K | 78 | 33 |

About Microsoft

Microsoft develops and licenses consumer and enterprise software. It is known for its Windows operating systems and Office productivity suite. The company is organized into three equally sized broad segments: productivity and business processes (legacy Microsoft Office, cloud-based Office 365, Exchange, SharePoint, Skype, LinkedIn, Dynamics), intelligence cloud (infrastructure- and platform-as-a-service offerings Azure, Windows Server OS, SQL Server), and more personal computing (Windows Client, Xbox, Bing search, display advertising, and Surface laptops, tablets, and desktops).

In light of the recent options history for Microsoft, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Microsoft

- With a trading volume of 6,217,284, the price of MSFT is down by -0.52%, reaching $418.51.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 20 days from now.

Professional Analyst Ratings for Microsoft

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $485.3333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Consistent in their evaluation, an analyst from DA Davidson keeps a Neutral rating on Microsoft with a target price of $475. * Reflecting concerns, an analyst from DA Davidson lowers its rating to Neutral with a new price target of $475.* An analyst from Morgan Stanley persists with their Overweight rating on Microsoft, maintaining a target price of $506.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.