Barclays stated that as of the quarter ending in December, a major Taiwan supplier's order for key semiconductors for Apple iPhones may be reduced by 3 million units, along with a global shortened delivery time for the iPhone 16, indicating weak demand; the delayed launch of Apple Intelligence in Chinese may also impact users' early enthusiasm for the new device. Apple fell by nearly 3%.

There are still divergent views on the demand outlook for Apple's new generation of iPhones on Wall Street; some analysts are bullish on the new AI features provided by Apple Intelligence AI system, expecting them to drive the upgrade cycle, while others are cautious about the weakening demand for new devices, with Barclays recently issuing a warning.

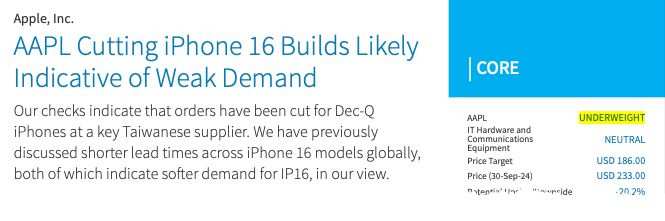

Barclays analysts led by Tim Long and George Wang revealed in a report released this Tuesday that they conducted an investigation into the iPhone supply chain and found that due to lower-than-expected demand, Apple may have cut production of the iPhone 16 for the quarter ending in December of this year, leading to significant cuts in orders for key components from suppliers.

The report stated that an investigation of the supply chain found that a top **** supplier may have been significantly cut by Apple as a result.

The report stated that an investigation of the supply chain found that a top **** supplier may have been significantly cut by Apple as a result.

"We believe that Apple may have just cut the production of key semiconductor components for iPhones by about 3 million units (as of this quarter ending in December)."

In addition to the **** supplier mentioned above being cut, the report also mentioned that the shortened delivery time for the new iPhone is used as an indicator of demand, indicating lackluster demand. The report states:

"Our investigation indicates that orders for iPhones for the quarter ending in December from a major **** supplier have been cut. We previously discussed that the shortened delivery time for the global iPhone 16 model, and we believe that both indicate weaker demand for the iPhone 16."

Barclays analysts explained in the report that if the investigation is correct and Apple's related order cuts are confirmed, it means that this is the earliest order cut in recent cycles, as Apple typically adjusts orders for the first time in early or mid-October.

The report summarises that the initial sales of the iPhone 16 were weak, partly due to the Apple Intelligence feature not launching in China and Europe this year.

"Overall, iPhone production may decline, weak sales, and shortened delivery times all indicate a softer start to the iPhone 16 cycle, with negative changes in the product mix due to weak consumer spending, macro pressures, and competition. The Chinese version of Apple Intelligence will not be launched until 2025, which may weaken the early enthusiasm for the iPhone 16 in this important market. Europe may also gradually introduce AI features in 2025, which could limit people's enthusiasm for new devices."

After the release of the Barclays report, Apple's stock price, which had just surged by 10.6% in the third quarter, had a "black start" to the fourth quarter. On Tuesday, October 1st, Eastern Time, Apple's stock price opened lower and continued to decline, opening down by about 1.5%, falling by over 3% in the morning session, dropping nearly 4% at noon, narrowing the decline afterwards, eventually closing down by almost 3%, erasing all gains from the rebound on Monday, falling from the closing high reached on July 16, the last of three consecutive trading days of gains since Monday.

Barclays maintains its underweight rating on Apple and lowers Apple's target price to $186, one of the lowest target prices given by analysts, slashing it by about 20.2% from the previous target price of $233, equivalent to an expected drop of about 20% from Monday's closing price.

Also on Tuesday, Citigroup lowered its iPhone sales expectations for the quarters ending in September and December, but raised expectations for the quarters ending in March and June 2025.

Citigroup stated that with the release of Apple Intelligence in late October in the U.S. and the possible major update of Siri next year, Citigroup still believes that by 2025, with the launch of the iPhone 17, consumers will start renewing their iPhones. Consumers may wait to upgrade their iPhone to see how Apple Intelligence affects their daily interactions with the phone.

Before Citigroup and Barclays released their reports, recent reports from Morgan Stanley and JPMorgan also helped drive Apple's stock price up on Monday.

Among them, analysts at Morgan Stanley stated that delivery times for the iPhone 16 Pro and Pro Max models are stabilizing, which is an unexpected positive development. JPMorgan analysts stated that the demand trend for the iPhone is improving.

Editor/Lambor

报告称,调查供应链发现,一家台湾的顶级供应商可能已因此被苹果大幅砍单,

报告称,调查供应链发现,一家台湾的顶级供应商可能已因此被苹果大幅砍单,