Whales with a lot of money to spend have taken a noticeably bullish stance on Marvell Tech.

Looking at options history for Marvell Tech (NASDAQ:MRVL) we detected 9 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $239,185 and 5, calls, for a total amount of $370,011.

From the overall spotted trades, 4 are puts, for a total amount of $239,185 and 5, calls, for a total amount of $370,011.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $65.0 to $85.0 for Marvell Tech over the recent three months.

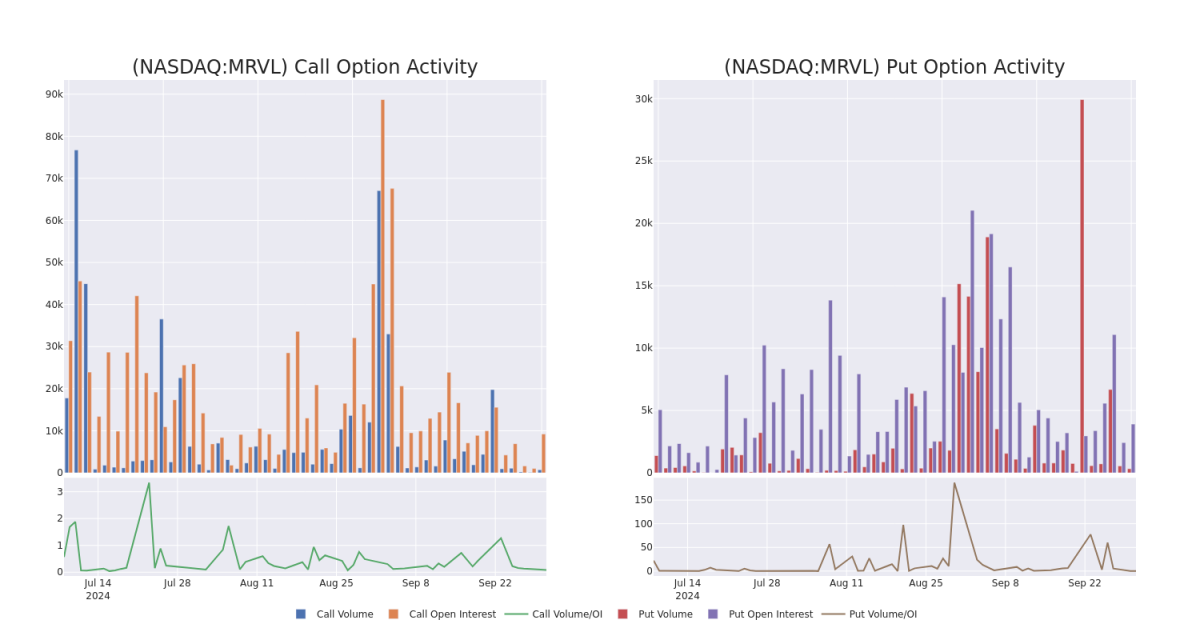

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Marvell Tech's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Marvell Tech's substantial trades, within a strike price spectrum from $65.0 to $85.0 over the preceding 30 days.

Marvell Tech Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $11.2 | $11.05 | $11.2 | $65.00 | $224.0K | 3.0K | 200 |

| MRVL | PUT | SWEEP | BEARISH | 11/15/24 | $7.8 | $7.7 | $7.8 | $77.50 | $103.7K | 697 | 133 |

| MRVL | PUT | SWEEP | BULLISH | 10/18/24 | $1.64 | $1.59 | $1.59 | $67.50 | $54.8K | 1.9K | 116 |

| MRVL | PUT | SWEEP | BEARISH | 11/15/24 | $6.4 | $6.3 | $6.4 | $75.00 | $50.5K | 936 | 79 |

| MRVL | CALL | SWEEP | NEUTRAL | 01/17/25 | $2.94 | $2.87 | $2.89 | $85.00 | $39.3K | 4.2K | 272 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Following our analysis of the options activities associated with Marvell Tech, we pivot to a closer look at the company's own performance.

Where Is Marvell Tech Standing Right Now?

- Currently trading with a volume of 3,079,868, the MRVL's price is down by -1.66%, now at $70.92.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 59 days.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.