Source: Zhitong Finance

Berkshire Hathaway is planning to issue yen bonds for the second time this year, triggering market speculation that the company is seeking to increase investment in Japan, and Japanese trading company stocks are rising in response.

Owned by “Stock God” Warren Buffett $Berkshire Hathaway-A (BRK.A.US)$ /$Berkshire Hathaway-B (BRK.B.US)$ Plans are under way to issue yen bonds for the second time this year, triggering market speculation that the company is seeking to increase investment in Japan, and Japanese trading company stocks rose in response.

According to reports, Berkshire Hathaway hired Bank of America Securities and Mizuho Securities to issue priority unsecured bonds denominated in Japanese yen. The company has been a regular issuer of yen notes since 2019, and the last time it issued such bonds was in April.

According to reports, Berkshire Hathaway hired Bank of America Securities and Mizuho Securities to issue priority unsecured bonds denominated in Japanese yen. The company has been a regular issuer of yen notes since 2019, and the last time it issued such bonds was in April.

Berkshire Hathaway's funding plan has received close attention from stock market investors because Buffett previously bought shares in a Japanese trading company and promoted$Nikkei 225 (.N225.JP)$The index hit a record high. Buffett said in his annual letter to shareholders in February of this year that most of Berkshire Hathaway's investments in Japanese companies were funded by issuing Japanese yen bonds.

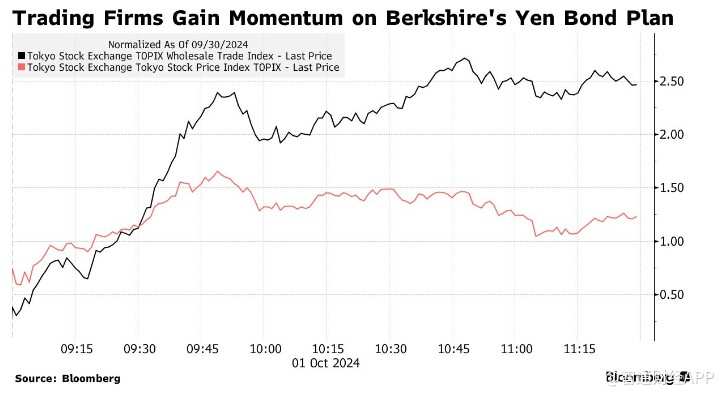

On Tuesday, Japanese trading company stocks continued their gains in the Tokyo market, tracking the sector's index increase as high as 2.8%. In contrast, the Nikkei 225 index rose 1.87%.$ITOCHU (8001.JP)$rose 3.8%,$Mitsui (8031.JP)$It rose 4.2%.

According to reports, Buffett's favorite Japanese trading companies include ITOCHU Corporation,$Marubeni (8002.JP)$,$Mitsubishi (8058.JP)$, Mitsui & Co., and$Sumitomo (8053.JP)$. In February of this year, Buffett revealed in a shareholder letter that Berkshire's shareholding ratio in these trading companies had increased to about 9%. He has revealed that these investments are long-term investments of 10 to 20 years.

Editor/jayden

据悉,伯克希尔哈撒韦聘请美国银行证券和瑞穗证券发行以日元计价的优先无担保债券。该公司自2019年以来一直是日元票据的定期发行人,上一次发行此类债券是在4月份。

据悉,伯克希尔哈撒韦聘请美国银行证券和瑞穗证券发行以日元计价的优先无担保债券。该公司自2019年以来一直是日元票据的定期发行人,上一次发行此类债券是在4月份。