In the past week, stocks in China saw the largest weekly net buy since records began. According to Goldman Sachs, the rise was driven almost entirely by bullish buying, with a single stock accounting for 71% of the nominal net buy. Trading volume in Hong Kong stocks hit a historic high, mainly driven by overseas macro hedge funds buying in.

Since the "924" new policy, the Chinese stock market has experienced an epic surge.

On September 30, the last trading day before the National Day holiday, the two major A-share benchmark indices achieved the largest increase in sixteen years, with a total turnover of nearly 2.6 trillion, setting a historical record.

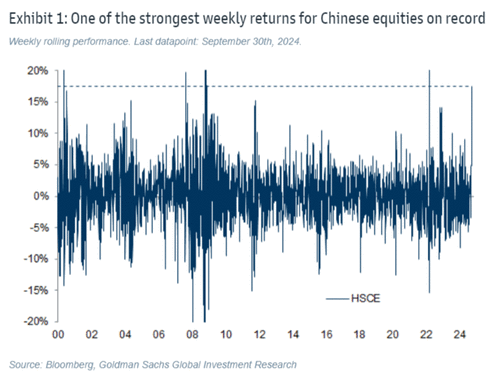

In September, the SSE Composite Index rose by 17.39%; the Shenzhen Component Index rose by 26.13%; the ChiNext Index rose by 37.62%, setting a historical record for single-month increase; the CSI 300 Index rose by 23.06% this month. As for Hong Kong stocks, the Hang Seng Index rose by 17.48% this month; the Hang Seng Tech Index rose by 33.45%; the Hang Seng China Enterprises Index rose by 18.62%.

In September, the SSE Composite Index rose by 17.39%; the Shenzhen Component Index rose by 26.13%; the ChiNext Index rose by 37.62%, setting a historical record for single-month increase; the CSI 300 Index rose by 23.06% this month. As for Hong Kong stocks, the Hang Seng Index rose by 17.48% this month; the Hang Seng Tech Index rose by 33.45%; the Hang Seng China Enterprises Index rose by 18.62%.

Goldman Sachs's latest nine charts, helping you understand this record-breaking rebound in Chinese stocks!

From last week to the 30th, the Chinese stock market saw one of the strongest weekly returns ever.

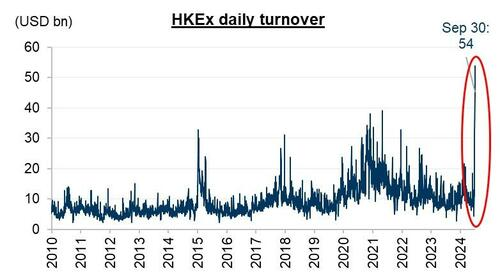

Trading volume in Hong Kong stocks soared to $54 billion, reaching a new historical high.

On September 30, the trading volume of Hong Kong stocks was 4.7 times the 52-week average.

On September 30, the A-share turnover reached 2.6 trillion yuan, hitting the highest turnover ever recorded.

Last week, A-share margin purchases surged, and retail participation is on the rise.

Southbound funds poured into Hong Kong stocks, with new capital inflow of 1.56 billion US dollars, making it the second largest capital inflow of the year.

Hong Kong stock trading volume hit a historical high, mainly driven by overseas macro hedge funds.

In the past week, Chinese stocks saw the largest weekly net inflow on record.

Goldman Sachs pointed out that this market rally is almost entirely driven by bullish buying, with individual stocks accounting for 71% of the nominal net inflow.

Driven by the Chinese market, the most significant net inflow ever also occurred in the broader Asian markets.

The MSCI China Index outperformed the MSCI World Index.

With continuous bullish policies, have the multiple large green candles in the A-share market changed your perspective? It may be troublesome to access A-shares in Hong Kong, but you can trade in just 3 steps on Futu>>

Related recommendations: How can Hong Kong investors trade A-shares?

Editor/ping

9月整月,上证指数累计上涨17.39%;深证成指涨26.13%;创业板涨37.62%,创单月涨幅历史纪录;沪深300指数本月上涨了23.06%。港股方面,恒生指数本月累计上涨17.48%;恒生科技指数涨33.45%;恒生国企指数涨18.62%。

9月整月,上证指数累计上涨17.39%;深证成指涨26.13%;创业板涨37.62%,创单月涨幅历史纪录;沪深300指数本月上涨了23.06%。港股方面,恒生指数本月累计上涨17.48%;恒生科技指数涨33.45%;恒生国企指数涨18.62%。