Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Nano Dimension (NASDAQ:NNDM) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). Let's start with an examination of the business' cash, relative to its cash burn.

How Long Is Nano Dimension's Cash Runway?

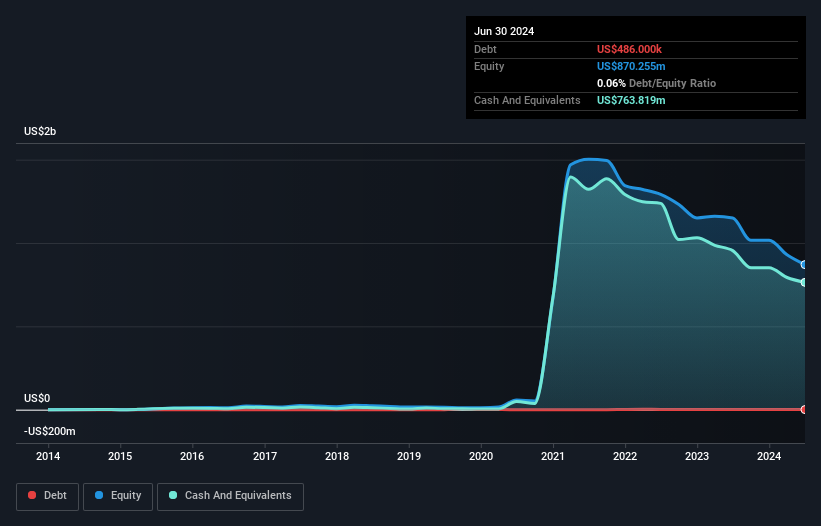

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2024, Nano Dimension had cash of US$764m and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through US$85m. That means it had a cash runway of about 9.0 years as of June 2024. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Well Is Nano Dimension Growing?

It was fairly positive to see that Nano Dimension reduced its cash burn by 27% during the last year. Revenue also improved during the period, increasing by 6.1%. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

It was fairly positive to see that Nano Dimension reduced its cash burn by 27% during the last year. Revenue also improved during the period, increasing by 6.1%. On balance, we'd say the company is improving over time. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Nano Dimension Raise More Cash Easily?

There's no doubt Nano Dimension seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$555m, Nano Dimension's US$85m in cash burn equates to about 15% of its market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

Is Nano Dimension's Cash Burn A Worry?

Nano Dimension appears to be in pretty good health when it comes to its cash burn situation. Not only was its cash burn reduction quite good, but its cash runway was a real positive. Considering all the factors discussed in this article, we're not overly concerned about the company's cash burn, although we do think shareholders should keep an eye on how it develops. Readers need to have a sound understanding of business risks before investing in a stock, and we've spotted 1 warning sign for Nano Dimension that potential shareholders should take into account before putting money into a stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies with significant insider holdings, and this list of stocks growth stocks (according to analyst forecasts)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.