High-rolling investors have positioned themselves bullish on Carnival (NYSE:CCL), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in CCL often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Carnival. This is not a typical pattern.

The sentiment among these major traders is split, with 50% bullish and 50% bearish. Among all the options we identified, there was one put, amounting to $33,000, and 7 calls, totaling $518,532.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.5 to $19.0 for Carnival during the past quarter.

Insights into Volume & Open Interest

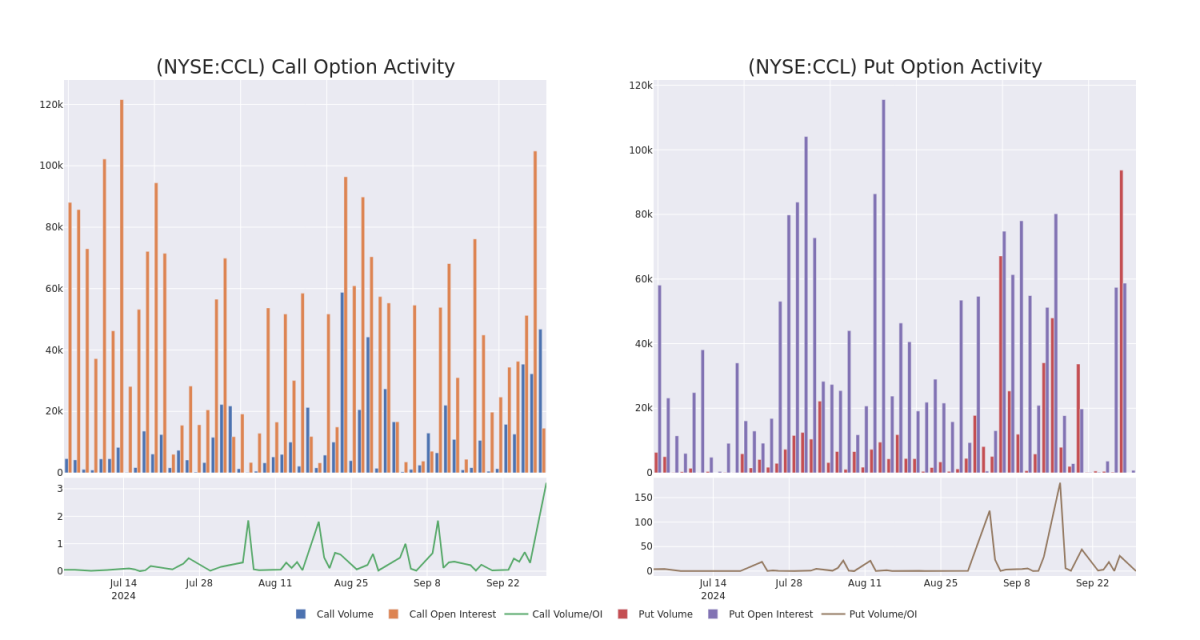

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Carnival's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Carnival's significant trades, within a strike price range of $12.5 to $19.0, over the past month.

Carnival Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CCL | CALL | TRADE | BEARISH | 10/04/24 | $0.75 | $0.73 | $0.73 | $17.50 | $242.1K | 1.6K | 8.3K |

| CCL | CALL | SWEEP | BULLISH | 10/04/24 | $0.86 | $0.83 | $0.85 | $17.50 | $65.3K | 1.6K | 11.9K |

| CCL | CALL | SWEEP | BULLISH | 01/17/25 | $1.52 | $1.5 | $1.52 | $19.00 | $64.6K | 9.3K | 569 |

| CCL | CALL | TRADE | BULLISH | 10/04/24 | $1.01 | $0.98 | $1.01 | $17.50 | $50.5K | 1.6K | 12.8K |

| CCL | CALL | SWEEP | BEARISH | 10/11/24 | $4.95 | $4.85 | $4.95 | $12.50 | $34.1K | 1 | 86 |

About Carnival

Carnival is the largest global cruise company, with 92 ships in service at the end of fiscal 2023. Its portfolio of brands includes Carnival Cruise Lines, Holland America, Princess Cruises, and Seabourn in North America; P&O Cruises and Cunard Line in the United Kingdom; Aida in Germany; Costa Cruises in Southern Europe. It's currently folding its P&O Australia brand into Carnival. The firm also owns Holland America Princess Alaska Tours in Alaska and the Canadian Yukon. Carnival's brands attracted nearly 13 million guests in 2019, prior to covid-19, a level it reached again in 2023.

Where Is Carnival Standing Right Now?

- With a trading volume of 21,317,495, the price of CCL is down by -3.86%, reaching $17.82.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

What Analysts Are Saying About Carnival

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $26.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Stifel persists with their Buy rating on Carnival, maintaining a target price of $27. * Consistent in their evaluation, an analyst from Mizuho keeps a Outperform rating on Carnival with a target price of $25.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Carnival options trades with real-time alerts from Benzinga Pro.